By Yik Seong

Director

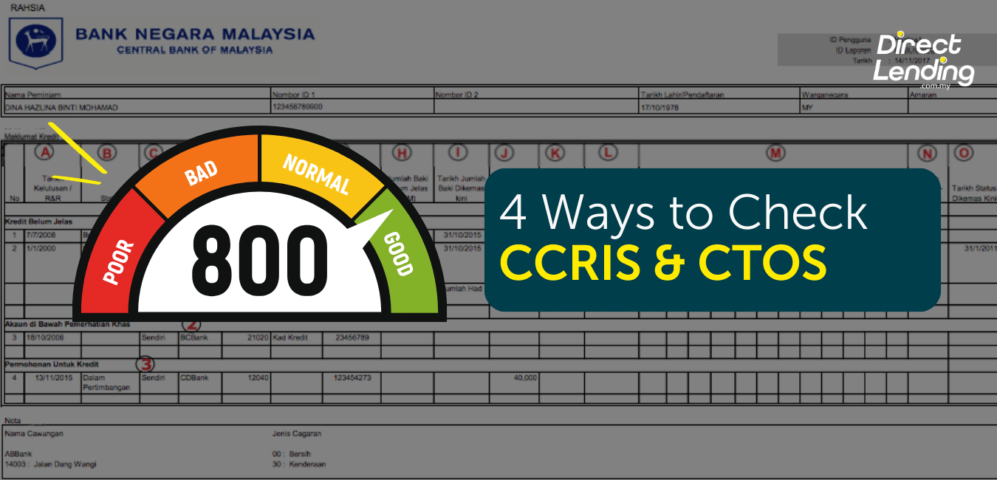

What is CCRIS and CTOS & How to Read Your CCRIS Report?

“Your loan is rejected because you have a bad CCRIS or CTOS record”. Have you been told this before by a bank officer? And you are wondering, “What is CCRIS and CTOS?”.

To answer these questions, let’s first understand how banks or financial institutions decide whether to give you a loan or not. One of the main areas they look at is your credit history, i.e. your previous loan repayment record – have you been paying on time? Or have there has been a delay or even default in loan repayment? Of course, as you can guess, the better you are at paying your personal loan on time, the better your credit history, and hence the higher chance you can get your loan approved!

Table of contents

- What is CCRIS?

- Who have access to CCRIS Report?

- 4 ways to check CCRIS for free

- Video: How To Register & Check eCCRIS For Free (Less Than 10 Minutes)

- What is CTOS?

- Video: What is CCRIS & CTOS?

- What are the differences between CCRIS, CTOS & Experian?

- Will CCRIS or CTOS ‘blacklist’ me?

- Why do I need to maintain a good CCRIS and CTOS record?

- What should I do if I have a bad CCRIS or CTOS record?

How do the banks or financial institutions obtain your credit history then? They obtain this information from your credit report. In Malaysia, there are a few authorised agencies that produce credit report, this includes;

- Bank Negara Malaysia’s Credit Bureau who produce CCRIS

- CTOS and RAM Credit Information (regulated under Credit Reporting Agencies Act 2010)

What is CCRIS?

CCRIS (Central Credit Reference Information System) is a record maintained by Bank Negara Malaysia that collects and tracks your loan repayment behavior.

The CCRIS report includes:

- Details of all the loans you have with every financial institution in Malaysia (this covers all the banks and non-bank financial institutions like AEON Credit or PTPTN)

- Your loan repayment history over the past 12 months including any overdue

- Any ‘Special Attention’ loan or loan under close monitoring by the banks

- Any loan that has been rescheduled or restructured

Who have access to CCRIS Report?

- The borrower or the lender

- The borrower for CCRIS report on sole proprietorship partnership and corporations.

- Financial institution for any credit application and to check the borrower’s credit eligibility

- Credit Reporting Agency that is approved by BNM with the consent of the borrower.

4 ways to check CCRIS for free

You can get and check your CCRIS report using these channels for free!

NEW! Free eCCRIS Online Portal

If you are in urgent need of the CCRIS report, you can now check your CCRIS via online and free at eCCRIS portal. If you are an Malaysian citizen that have online banking and have not register as eCCRIS user, you can register via online through the eCCRIS portal.

How to Register eCCRIS Online for New User

Step 1: browse eccriss.bnm.gov.my and click ‘Register Now’

Step 2: Fill in Personal Details

a. Fill in your personal details

Full name, MyKad, birth date, phone number dan e-mail.

b. Next, confirm the given details and Terms & Conditions

Step 3: Select bank and transfer RM1

Complete the registry and digital confirmation through one time transaction, RM1 to the Bank Negara Malaysia account. RM 1 wilk e refunded automatically in the period of 2 working days after the registration.

Step 4: eCCRIS account is successfully registered! First time log in.

When you successfully register eCCRIS account, click ‘Continue to First Time Log In Page’ that is displayed on the screen or browse eccris.bnm.gov.my and click ‘First Time Log In’

Step 5: Fill in your MyKad and 6 digit OTP

6 digit OTP is only eligible for 7 days. Please log in before the expiry date of the OTP.

Step 6: Set your user ID and password

Step 7: Set image, phrase, security question and answer

Step 8: Log in to eCCRIS using user ID to get your CCRIS report.

For other user, other method that is still used is registering through kiosk at AKPK or online via BNMTELELINK.

Walk-In Kiosk Bank Negara Malaysia (BNM)

You can get your CCRIS report from Kiosk at any Bank Negara Malaysia branches. The report is free. you only need to walk in and bring along your MyKad or any related documents that can help identify your identity like driving license or passport (if you are not a citizen of Malaysia). Your CCRIS report will be give to you instantly.

Letter/Fax/E-mail

If you are applying for CCRIS credit report via letter/fax/e-mail, here are some of the documents that you need to prepare and attach along:

- Credit Report Request, CRR

- Loan Declaration Form

- Clear Copy of MyKad (front & back)

- Any two of these documents (with clear full name & address on each document;

- Water Bill;

- Electrical Bill;

- Phone Bill;

- Bank Account Statement;

- Credit Card Statement or;

- EPF Statement

- Credit Report Application form and Loan Declaration Form can be obtain through CCRIS portal.

You can post the letter, e-mail or fax to BNM TELELINK Bank Negara Malaysia.

Credit Management And Counselling Agency (AKPK)

You can get your CCRIS report at any AKPK branches for free. Application needs to be done at the office only. You have to walk in and make a self identification- MyKad.

Video: How To Register & Check eCCRIS For Free (Less Than 10 Minutes)

How To Read CCRIS Report?

Think of your CCRIS report as your credit health report card. The information stated in that report determines your eligibility to apply for credit facilities such as personal loan, credit card, housing loan, car loan, etc. Let us take you through this example together. The information provided in this credit report is solely for illustration purposes and does not represent any individual.

Dina Hazlina has 2 outstanding credit facilities as shown in the outstanding credit – one credit card and one hire purchase (vehicle). The hire purchase loan was applied during January 2000 with the loan amount of RM35,000. From the report, it shows that she has an outstanding balance of RM8,500. Then in July 2008, she received a credit card facility with the credit limit of RM5,000 and as of now, her total outstanding balance is RM3,000.

For her hire purchase loan, Dina probably had difficulties in paying her car loan promptly. Due to the inconsistent payments for a few months, she has received a summon on 31 January 2011 (as shown in the column “N” – Legal Status). So, she has decided to restructure her payments again to extend the length of her loan tenure (as shown in “B” – Status).

Referring to the table, we can observe that Dina has been paying her car loan consistently from December 2016 to August 2017. How do we know that? It is because “0” means no missed payments/ arrears. Then from September 2017 onwards, Dina did not pay 3 months of instalments as shown in the November column.

Here’s a reference tip:

0 – No missed payments / arrears

1 – Late payment for 1 month

2 – Late payment for 2 months

3 – Late payment for 3 months

So when we look at her credit card record, she was paying her monthly instalments consistently except for some months. She did not pay for 3 months from March 2017 – May 2017. Dina was also 2 months late during September and October 2017.

The credit card that Dina applied on October 2006 is listed under the “Special Attention Account” (SAA). So you may ask why is her credit card categorised under SAA? Dina probably missed her monthly payments for more than 3 months on her credit card which led her to be listed under SAA.

So, you may notice that Dina has applied for a credit card facility on November 2015 and it is currently pending.

In your opinion, do you think Dina’s credit card would be approved?

Below is the explanatory description for each credit information label:

(1) Outstanding Credit – This section displays the facilities that the borrower has taken.

(2) Special Attention Account (SAA) – Those that fall under this category shows outstanding credit facility under close supervision by the financial institution.

(3) Application for Credit – This section displays the approved or pending credit applications that are made over the last 12 months.

A – Approval Date / R&R – The application date when the credit facility has been approved

B – Status – This indicates the credit status for applications. For example: Outstanding (All outstanding credits obtained by the borrower), Rescheduled Credit Facility (The original payment schedule of the credit facility has been rescheduled), Facility restructured under AKPK

C – Capacity – Description of the credit facility obtained by the borrower is under his own name, joint name with another individual, name under sole proprietorship and partnership or professional body

D – Lender – Financial institution that disbursed the credit facility

E – Branch – The credit facility that was applied at

F – Facility – The type of credit facility i.e. personal loan, credit card, housing loan, etc.

G – Account/ Application Number – The reference number assigned by the financial institution for the credit facility

H – Total Outstanding Balance – The reference outstanding amount of the credit facility

I – Date Balanced Updated – The total outstanding amount of the facility

J – Limit/ Instalment Amount – The total amount approved by the financial institution or contractual obligation amount to be repaid by borrower until the total amount is settled

K – Collateral – The type of collateral or security for the credit facility

L – Principal Repayment Term – The frequency of each credit facility’s payment

M – Instalment in Arrears for Last 12 months – Refers to payment records of the credit facility. Example: 0 (no late payment), 1 (1 month in arrears), 2 (2 months in arrears) and so on

N – Legal Status – The legal action taken against the borrower because of defaulted payments

O – Date Status Updated – The latest date of the legal action status

So, when you apply for a bank loan (whether it is a mortgage or personal loan), the bank will obtain and go through your CCRIS record to assess your past repayment behavior. Although each bank practices different credit criteria, they will likely consider it as a bad CCRIS record if you have not been paying your loan for 2-3 months within the past 6 months or if you have a loan under ‘Special Attention’, it may affect the approval of your loan application.

There are some cases where, the applicant is a guarantor for their family or partner which make their credit report affected. One of the risk that you have to be prepared for if you a loan guarantor, your CCRIS and CTOS record will also be affected if the loan applicant have unsettled debt or irresponsible in their payback period.

For Co-operative or koperasi loan (pinjaman koperasi), given the repayments is via direct salary deduction, the chances of your application being approved is higher although you may be 2-3 months overdue on your outstanding payments. Other than that, approval rate for Buy Now Pay Later is also high and easier to get because mostly they do not check your credit score. With that said, if you are in need of instalment payment with 0% interest, you may consider BNPL payment.

What is CTOS?

CTOS is a credit reporting agency that is permitted by Bank Negara Malaysia to record your credit report. One of the difference between CCRIS and CTOS is that CTOS gives you score based on your credit record health. CTOS Score is a credit score for individual to asses the user credit risk value. Score will be given in the form of 3 digit in the range of 300 to 850. The higher the score, the lower your credit risk value; which mean easier it is for your loan to be approved.

Some of the functions of CTOS credit Report:

- Increase an individual chances to secure loan

- Help an individual to be more aware of the signs of identity theft or fraudulence

- Able to check court record and bankruptcy status

- Able to check unsettled debt record

- Help keep your information in credit report updated

- Able to observe your credit report health

- Personal financial management will be easier

In simpler terms, CTOS is your credit health report card.

CTOS collects information from the Malaysia Insolvency Department, National Registration Department, Companies Commission Malaysia (CCM), Registrar of Societies, publications of legal proceedings and etc. The CTOS report includes the bankruptcy status, legal action and case statuses, business ownership and etc.

Any poor repayment conduct on your loans, utility bills or phone bills, any litigation action against you including bankruptcy will be shown in the CTOS report. As you can expect, situations as such will reduce your chances to successfully obtain a bank loan.

To obtain free CTOS Basic Credit Report, you only have to apply for CTOS user ID. Next, you will get CTOS report through CTOS web page. However, you have to pay RM26.50 for full report. The process of this purchase is similar to the process of getting the basic CTOS report. The only difference is, at the registry page, choose “MyCTOS Score Report (RM 26.50)” for full access (CTOS & CCRIS)

Video: What is CCRIS & CTOS?

What is Experian?

Similar to CTOS, RAM Credit Information (RAMCI) (now known as Experian) is also a credit reporting agency that provides credit information and credit score.

It also includes information such as legal and bankruptcy information, trade reference and most importantly it also informs you if a third party enquired information about your credit history. This might be beneficial in terms of early fraud detection.

There are three (3) types of Personal Credit Report (PCR) that is in RAMCI. All the price for the report includes 6% service tax.

- Personal Credit Report Basic- FREE for new registration

- Personal Credit Report PLUS – RM 19.50 per report

- JagaMyID Subscription

- RM53.00 (1 year subscription + free 4 PCRP)

- JagaMyID Plus Subscription

- RM99.00 (free 4 PCRP + MySecure Protection Plan)

Personal Credit Report (PCR) contain your credit information in the credit file that is used by prospect financial institution, professional bodies and credit lender from various industry for credit assessment or for upgrading and credibility analysis and your financial position, giving you credit advantage, information and profession.

PCR usually show your name, MyKad, address, business features, share holder/director(if any), litigation record (if any), Bancruptcy record(if any), Central Credit Reference Information System(CCRIS) and Dishonoured Cheque Information System(DCHEQS) from Bank Negara Malaysia(if any) as well as bank credit payment record and non-bank(if any)

Some of the information that is used by RAMCI to count your credit score:

- Current loan (credit card, housing loan, car loan, personal loan and more);

- Whether you are a punctual in payment;

- Current and used credit amount;

- The amount of unsettled debt;

- Whether you are actively applying for new credit;

- Whether there is a legal action against you;

- The age of your account

What are the differences between CCRIS, CTOS & Experian?

Generally, CCRIS, CTOS, and Experian are similar whereby these reports show the individual’s credit history. Banks will go through not just your CCRIS record, but also CTOS or Experian record in their credit assessment.

Having said that, CCRIS is not the same as CTOS or Experian. The main difference is that CCRIS is managed by Bank Negara whereas CTOS and Experian are managed by a private company. Besides that, CCRIS obtains information from financial institutions whereas CTOS and Experian obtain information from public sources and also have records of default from utility companies, telco, money lenders, or other consumer installment loan providers (e.g. Courts, Singer, Coway).

Will CCRIS or CTOS ‘blacklist’ me?

No, neither CCRIS nor CTOS will blacklist you. They simply provide your credit records to financial institutions, including Co-operative (Koperasi) for the purpose of credit assessment before approving your loan application. So, CCRIS or CTOS record is purely an input for financial institutions to assess your creditworthiness and to decide whether to give you a loan or not.

Why do I need to maintain a good CCRIS and CTOS record?

Your CCRIS and CTOS credit record will be used by financial institutions to justify your credit character when you apply for a credit facility such as credit card, personal loan, housing loan, car loan, etc. Your repayment behaviour would help banks to decide on whether to approve or reject your loan, interest rate, loan tenure, loan amount and so on. If you have been paying your loan commitments on time, there should not be a problem for your loan to be approved.

Plus, banks will also look into your CCRIS and CTOS report to calculate your Debt Service Ratio (DSR) before deciding on the approval of your loan. For instance, if your DSR exceeds 60%; chances are your loan might either get rejected or it would be approved at a lower loan amount.

What should I do if I have a bad CCRIS or CTOS record?

No worries, it is still not too late to act on improving your CCRIS or CTOS record. Read our article on 7 ways to clean your negative CCRIS record and ways to improve your credit score.

For those who have a bad CCRIS, CTOS record or listed under SAA and AKPK and is in urgent need of fund, there are certain koperasi loans that will accept such application especially for those who work in the government sector. Koperasi loans are less stringent because the repayment is processed through direct salary deduction and hence, the risk of repayment is lower. This is still a safe and legal way to obtain some emergency funding. While there are some moneylenders out there who claim to accept borrowers who have bad CCRIS and CTOS, please be aware of the terms of the loan!

The best way is still to maintain a good CCRIS and CTOS so that you can get any financing when you need to. Follow us on the blog or our Facebook as we share more tips on how to maintain a good CCRIS and CTOS record.

In case you want to apply for a personal loan to do renovation, wedding, consolidate debt, overlap and etc; Direct Lending is ready to help. Let us help you to solve your financial struggles by offering 100% free consultation service. No hidden cost or upfront payment needed. We can help you to source the best personal loan deals in town. Loan approval as fast as 2 working days.

This article is written by Direct Lending – An online personal lending platform that provides bank and koperasi loans as well as licensed moneylenders personal loan. We can help you find, compare and apply personal loan that best suits your financial needs. Check your eligibility for free, no upfront payment or processing fees and get a loan rates from 2.95% p.a. or 2 working days.

(This article was originally published on the 25th April 2023 and updated on the 5th January 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.