By Mandy

Marketing

Credit Score Malaysia: All You Need to Know Before Applying for Loans

Do you know what a credit score is, and why is it so important when it comes to applying for loans and credit cards? How, then, do these scores affect CTOS and CCRIS reports, sometimes to the point of causing borrowers to be ‘blacklisted’? If you would like to learn more on credit scores, how to improve credit score and how they work in Malaysia, this article is for you.

Table of contents

- What is a credit score?

- Functions of a credit score

- Calculating credit score

- Factors affecting credit scores

- Consequences of a low credit score

- Video: 8 Ways to Clear Your Negative CTOS & CCRIS Record

- If I do not yet have a credit record, what should I do?

- Applying for loans with a low credit score

- Conclusion

What is a credit score?

A credit score is a system for grading an individual’s credit worthiness, which is defined as the extent to which a person or company is considered suitable to receive financial credit, often based on their reliability in paying money back in the past. It is used to evaluate an individual’s credit history, which is an important piece of information needed by banks in choosing the clients that they would like to lend to.

Each of your loans, be it credit cards, monthly instalments or other financial commitments, is recorded and will subsequently appear in your credit report.

A good credit score can leave you with more financing options as banks deem you to be a trustworthy client. On the contrary, a low credit score may deter financial institutions from lending you money.

Essentially, it is a measure of how well can a borrower repay the loans granted to them within the loan term. Therefore, it is very important to always maintain a reasonable credit score because they can affect your financial decisions and to some extent, your livelihood.

Functions of a credit score

A credit score is useful in grading an individual’s creditworthiness based on the total amount of loans and credit cards they have taken and how much they need to consistently pay for. It shows the amount of debt that an individual holds each month.

Regardless of whether you always make payments on time or never on time, or if you have some outstanding payments, they are all recorded and will influence your credit score.

It can also help you gauge a possible repayment habit and check if you have missed any payments, both of which can impact your credit score. If there is any legal action being taken against you with regards to your financial commitments, that too will be reflected in your credit score.

Financial institutions will refer to your credit score when determining the approval of your loan applications, this includes personal loans, mortgage loans, car loans, student loans and credit cards.

Your credit history is stored and tracked by Bank Negara Malaysia (BNM)’s database known as The Central Credit Reference Information System (CCRIS), and they can be accessed by Credit Reporting Agencies (CRA) like Experian Credit & Information Services (formerly RAM Credit Information (RAMCI)), CTOS and Credit Bureau Malaysia to generate your credit score.

Calculating credit score

Simply put, there is no actual formula in calculating credit scores and you cannot easily calculate your own. Instead, you will need the service of Credit Reporting Agencies (CRA) such as Credit Bureau Malaysia, CTOS or Experian.

These agencies have their respective methods of calculating credit scores, but their differences are negligible. Certain banks also have their own calculation methods.

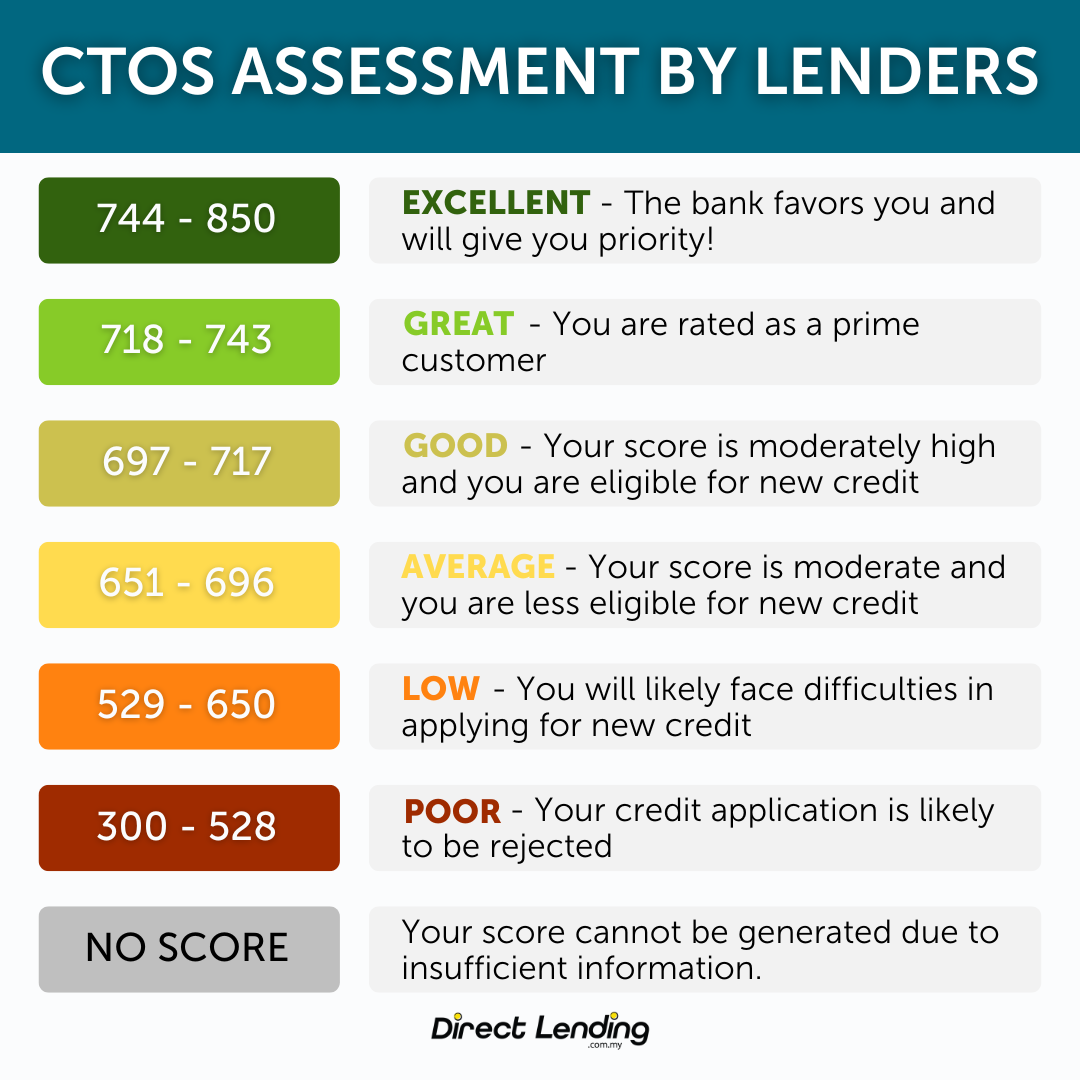

According to CTOS, a good credit score is 697 and above whereas a low credit score is 528 and below.

Factors affecting credit scores

| Factor | Weightage |

| Payment History Record | 45% |

| Total Debt/Credit | 20% |

| Credit Facility Term | 7% |

| Credit Account Type | 14% |

| New Credit | 14% |

The schedule above shows the credit calculations adopted by CTOS. Bear in mind that most financial institutions or credit providers have their own methods of calculating applicants’ credit scores.

As we have seen, the credit score itself is formulated based on a number of factors. In the process of credit score calculation, the component that is most important would be your payment history record.

Repaying an instalment late for a month is not as harmful to your credit score. Being late every month, however, will take a toll on your credit score as well as your outstanding balance.

Besides that, another component that is important in credit score calculation is the Debt Service Ratio (DSR), which is the ratio of an individual’s total debt to their household income.

Debt here refers to monthly commitments which may include credit community loans, credit card debts, mortgage and other commitments that are tracked in the CCRIS report. The total of these commitments will then be divided by the individual’s household income to obtain the DSR.

If one’s DSR is high, financial institutions may deem that they owe more than they can pay for, thus causing a lower credit score.

Your overall credit history is also taken into account for assigning you a credit score, such as how long have you owned a credit record for, or when did you start having a credit record. This will then be compared to your age at the time of the loan or credit card application.

The types of debt or credit that you own matter too. Whether you own secured debts (e.g. mortgage, vehicle hire purchase) or unsecured debts (licensed moneylenders, bank or cooperatives personal loans, credit cards, etc.), they affect how your credit score is evaluated.

Perhaps surprisingly, having absolutely no monthly commitment or no credit record is quite a common reason for financial institutions to reject loan applications, especially for unsecured loans. Having no credit record on CCRIS and CTOS means that you have never held any prior commitment such as loans, credit cards, etc.

Lastly, having legal action taken against you, including penalties or any form of court case, is also a factor that can influence your credit score.

Consequences of a low credit score

Image Source: Forbes

Image Source: Forbes

As mentioned above, a low credit score can, to some extent, affect your livelihood, whether you realise it or not.

For instance, a low credit score can prevent you from buying a comfortable home, or it can also prevent you from getting employed.

This is because some employers do background checks on their potential employees’ financial records as part of the hiring process, especially if the job is within the financial sector.

At the same time, having a low credit score reflects a degree of debt mismanagement on the part of an individual, and this in itself is a cause for family issues like divorces and feuds.

Video: 8 Ways to Clear Your Negative CTOS & CCRIS Record

If I do not yet have a credit record, what should I do?

Not having a credit record, and subsequently not having a credit score does not completely block out your chances of applying for a loan.

But, certain institutions may not be keen on lending big sums to an applicant with no prior commitment. This is because without a credit record, financial institutions are not able to assess the loan applicant’s repayment habits, and therefore may not want to bear the risk of loan defaults.

One of the easiest ways to build a credit history is to start using a credit card. A useful rule of thumb is to always limit your credit card usage to 30% of the credit limit. Abiding by this will help you maintain a healthy ownership of the credit card and simultaneously demonstrate a good credit score to financial institutions.

Applying for loans with a low credit score

The best way to get approval on loans if you have a low credit score is to first improve the score itself. Another way that we suggest is through debt consolidation. This is a method where all separate outstanding debts are replaced by a single new personal loan account.

This is an effective way to clear CCRIS and CTOS records and can help borrowers that are already burdened with debts to steadily realign their financial commitments. If you are a civil servant, it is more advisable for you to apply for debt consolidation with conventional banks or apply for bank and cooperative loans.

Conclusion

A credit score is essential in determining the approval of your loan applications, especially for big purchases like a first home or a first car.

Essentially, if you are not disciplined in repaying monthly instalments on existing commitments, they will cause you difficulties in acquiring loans in the future.

Therefore, always strive towards maintaining a good credit score so that your future self will thank you.

This article is prepared by Direct Lending. A digital platform that helps you to find, make comparisons and apply for the cheapest and most suitable personal loan for you. Our smart eligibility checking system is able to suggest the best personal loan from Bank and Cooperatives for you. Our service is 100% free, no upfront fees or processing charges.

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.