By Yik Seong

Director

5 Things to Watch Out for as a Loan Guarantor

Have you ever been approached by a relative or close friend and asked to act as a loan guarantor? The scenario is typical for would-be borrowers that are required by lending institutions to have a loan guarantor. That is a pre-condition for their loan application to be approved. Your natural instinct would be to agree as a gesture of support. However, you should give it a serious thought before signing any loan contract. There are dire consequences to being a loan guarantor in the event of non-payment of the debt. Hence, some borrowers chose to apply for personal loan due to the flexibility of no guarantor needed.

Responsibilities of a Loan Guarantor

Firstly, a loan guarantor is not a co-borrower. As a co-borrower, you share equal responsibility with the principal borrower in the payment of the loan. As for loan guarantors, they are legally bound to pay back the loan if the borrower is unable to pay.

Types Of Loan Guarantor

Loan Guarantor can be divided into two categories, which are social guarantor and non-social guarantor. Lets take a deeper look on these two categories.

Social Guarantor

Social guarantor is an individual that give guarantee to the borrower without getting any benefits or commercial. For example, they become a guarantor to help their family members or friends to buy a car, house or scholarship without any financial importance or financial benefits.

Non-Social Guarantor

For non-social guarantor types or also known as normal guarantor, they are the people that does not fall into social guarantor like personal loan guarantor, commercial loan or guarantor for business loan.

Difference Between Nominee and Guarantor

Most people are still confused about the difference between nominee and guarantor and how do they work.

Nominee is a condition when a separate individual use or borrow another person’s name to apply for loan. For example, you have a close friend or family member that have been ‘blacklisted’ by bank or any Malaysia monetary institute and they are no longer eligible for any types of loan.

Thus, they ask request others for help with using their name as a nominee in the loan agreement and they will pay for the loaned amount directly to the nominee every month.

As soon as your write down your signature on the contract agreement, you will be the one officially responsible or being called as a nominee for any matter regarding the loan like monthly payment, document write- up and more even though the individual that is borrowing your name is the one who fails to payback the money monthly.

As for loan guarantor, it is like what is mentioned in the first half of the article. From here, you can see the stark different between nominee and guarantor.

Banks or financiers would require a guarantor if the amount of loan applied for by the borrower is above the prescribed limit. However, some of the loans in Malaysia do not require the borrower to include a guarantor as part of the application. For instance, koperasi loan is one of the Islamic personal loan for civil servants which does not involve the need to include a guarantor in the application.

In some cases, there is misgiving on the ability of the borrower to sustain payments. Hence, another person is needed to guarantee the payment of the loan should the borrower default in paying the loan obligation. In essence, you become the fallback or second way out of the lender.

Requirement Of A Guarantor

To qualify as a loan guarantor, below are the legal requirements required:

- Aged 18 years old and above

- Not bankrupt

- Must be of sound mind and have the mental capacity to understand the guarantee document, obligations, and responsibilities of a guarantor

- Must be freely consented to act as a guarantor

Some of the plus points of a preferable loan guarantor are individuals with a stable income and good credit standing.

The issue of bankruptcy is prevalent in Malaysia. The number of delinquent borrowers below the age of 40 has grown over years. The failure to settle their auto loans, home mortgages, and even personal loan are the principal reasons for the alarming trend. Unfortunately, some of those ‘blacklisted’ or who belong to the delinquency bucket list are mere loan guarantors.

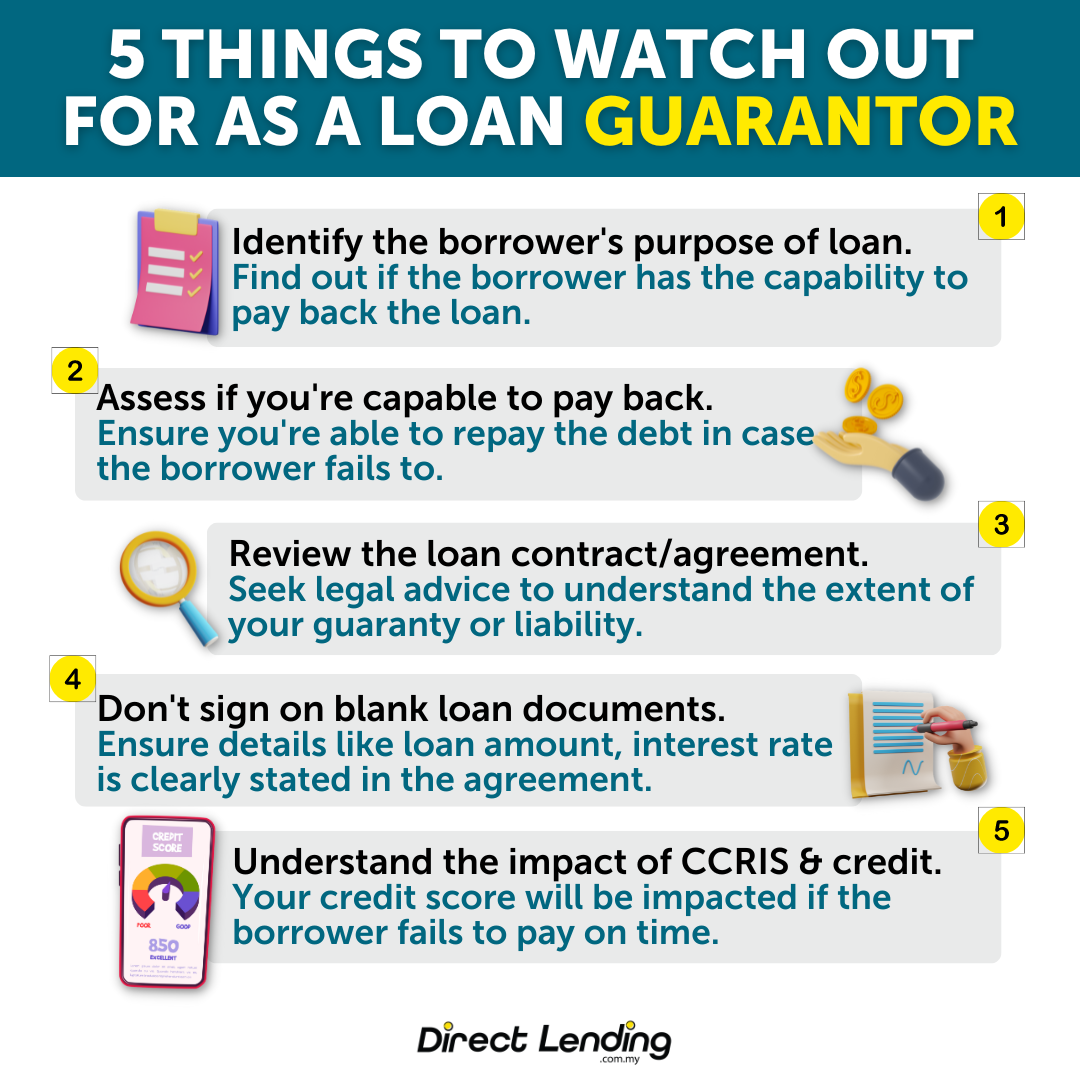

Thus, it is important to be aware of the negative implications before you extend help to relatives or friends. One shouldn’t feel honored or obligated when asked to act as a loan guarantor. Instead, you have to think twice if you’re willing to assume the responsibility of paying for a debt that is not yours in the first place. Here are 5 things to watch out for before agreeing to act as a loan guarantor.

5 Things To Consider Before Becoming A Loan Guarantor

1. Ask the requesting party the purpose of the loan

Through these information you can identify whether the borrower has the mean to payback and afford the loan. If you feel like there is something that is not right with the loan, do not be afraid to speak up and kindly decline their request to become their guarantor. If your close friend of relatives are in need of loan because you cannot afford to pay car service, you can choose loan that does not require guarantor like Auto Service Financing by Direct Lending.

2. Assess if you have the capacity to repay the loan in case of default

If you feel comfortable that the risk of default is negligible, assess your own financial position. Be certain you have the capacity to repay the debt should the requesting party, in the remote possibility, default in the payment. Keep in mind that it will be an added expense on your part to pay for someone else’s loan.

3. Review the loan contract or agreement

Source: Freepik (@M. Teerapat)

Source: Freepik (@M. Teerapat)

The most crucial mistake done by guarantor is the failure to analyse and read the agreement document that is given to them. As a guarantor, you are supposed to read though the whole agreement document and comprehend the content before any further action. Get a lawyer to better help you understand your risk and rights as a guarantor. Do not rush things and sign the agreement document unless you fully understand the details written in the agreement. Make sure that you know these 8 important things before you sign a personal loan agreement.

Prepare a damage compensation agreement for the borrower to sign as your security asset. With the damage compensation agreement, you can legally take action towards the borrower for the loss that you have to face as a guarantor if the borrower decides to be irresponsible of their own loan. If the borrower does not want to sign the agreement, that mean that they have an ill-intention.

4. Do not sign blank loan documents

The amount of loan, interest rate and tenure period has to be written clearly in the agreement. If not, you might have the shock of your life not knowing that you have sign and agreed to a completely different terms and conditions from what was informed by the borrower.

5. Find out the impact on your CCRIS record or credit standing

While it may be heart-breaking to reject a relative’s or friend’s request, it would be more agonizing to you if it impacts your credit record like CCRIS and CTOS. Keep in mind that the granting of the loan is anchored on your signature.

So what is CCRIS? It is a record that is supervised by Bank Negara Malaysia (BNM)’s Credit Bureau which aims to track an individual’s loan repayment behaviour. One might think that serving as a guarantor will not affect their own credit record, but in the event that a borrower defaults on his/her loan, their creditors will transfer the responsibility of repaying the loan to the guarantor. If you as a guarantor also fail to repay, then your name will be listed in CCRIS’s negative list.

When you already signed the agreement, you are stuck for life. You have to go foward being responsible and shoulder the burden of paying of others debt if the borrower does not carry out their responsibility.

Video: Understand These 5 Thing Before Becoming A Guarantor

Summary

The greatest setback of being a loan guarantor is that you are liable to repay the loan in case of default. But that would also tarnish your creditworthiness. You run the risk of forfeiting your own credit privileges. Hence, do not let your emotions influence your decision. Be level-headed and protect yourself. It can’t be in hindsight later on.

Do you know that every government loan listed on Direct Lending platform does not require a loan guarantor to be included in the application? Save your hassle and apply with us today without needing to worry about asking your family or friends to act as your loan guarantor.

This article is written by Direct Lending – An online personal lending platform that provides bank and koperasi personal loan as well as licensed moneylenders personal loan. For car owner, check out our car repair instalment plan- Repair car now, Pay later. We can help you find, compare and apply personal loan that best suits your financial needs. Check your eligibility for free, no upfront payment or processing fees and get a loan rates from 2.95% p.a. or 2 working days.

(This article was originally published on the 23rd November 2018 and updated on the 25th March 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.