By Mandy

Marketing

What is Koperasi Loan & 7 Tips To Apply for Koperasi Loan

A personal loan is a type of credit facility offered by financial institutions to help fulfill your financial needs. In general, many borrowers apply for a personal loan based on various reasons such as settling overdue debts, tackling emergency needs, wedding costs, home renovation, and many more.

So, what is a personal loan and the differences with a koperasi loan? Why does civil servants choose government loan instead applying for a personal loan from license money lender? We are going to discuss all about koperasi loan in this article.

What is a Koperasi Loan?

Koperasi loan is a type of personal financing offered to civil servants working in a federal or state government, municipal councils, statutory bodies as well as employees of selected government-linked entities. Koperasi loan is a popular choice among civil servants because of its leniency and flexibility in terms of application as compared to commercial bank personal loans. One of the reasons for this flexibility is because the repayment of koperasi loan is done through a salary deduction repayment scheme via Biro ANGKASA. Most of the koperasi loans are Syariah compliance, often called as Islamic personal loan.

The cooperatives that offer koperasi loan to civil servants are registered under the Co-operatives Societies Act 1993. Besides cooperatives, there are also ‘Yayasan’ or foundation and also selected banks that offer personal loans to civil servants. Although Yayasan is not exactly a koperasi; but the personal loan offered by Yayasan and also banks have the same features as koperasi loan in many aspects. This includes the repayment method through salary deduction.

Key Features of Koperasi Loan

- Loan repayment is conducted through direct salary deduction via Biro ANGKASA or Accountant General. These two agencies have the mandate from the government to be able to make deduction from the civil servants’ salary income. This is the reason why koperasi loan is offered to civil servants only.

- The total financing amount ranges from RM2,000 (minimum) to RM250,000 (maximum).

- The maximum financing tenure is 10 years or until retirement, whichever is shorter.

- Most of the koperasi loan offers Takaful insurance protection. The Takaful premium would be deducted directly from the loan principle. So, you don’t have to worry what happens to your debts after you die or involved in an accident.

- Koperasi loan is an unsecured loan. This means that it is a type of loan that does not require any loan guarantor or collateral.

- Most of the koperasi loan is offered to civil servants with full time permanent job status. Only a few co-operative that offers personal loan to contract status workers.

- The salary deduction allowed for koperasi loan should not exceed 60% of the gross income. This means that in the salary slip of the civil servants, the percentage of net income should be at least 40%.

3 Reasons To Apply For Koperasi Loan

Here we would like to highlight the benefits of using koperasi loan or the 3 main reasons why you might want to consider getting a koperasi loan.

1. An alternative for unsuccessful applications from a commercial bank loan

Generally, a koperasi loan is more lenient in its approval process as compared to a commercial bank. This is mainly because of the repayment which is made via salary deduction (through Angkatan Koperasi Kebangsaan Malaysia Berhad (Biro ANGKASA) or the Accountant General’s (AG) Department). Many koperasi (Co-operatives) accept borrowers with no credit history or with a negative CCRIS or CTOS record (e.g. Special Attention Account or more than 3 months overdue loan payments).

Koperasi loan will also approve loans to those with a relatively high financial commitment. However, to ensure responsible lending, koperasi loan can only be extended where the salary deduction in the payslip is not more than 60% of the borrower’s gross income.

2. Removing negative CCRIS / CTOS records by settling overdue loans

Source: Doucefleur

Source: Doucefleur

Poor repayment history of your loan or any loan guaranteed by you will result in a negative credit record. If this happens, it is highly unlikely that a bank will approve your home loan, car loan, or credit card application.

In this case, it makes sense to apply for a koperasi loan and use the proceeds to settle any overdue debts. This will get rid of your negative CCRIS / CTOS records and provide the financial flexibility that you need. Of course, ideally, it is always better to stay disciplined and pay off all your commitments and loans on time to maintain a good credit record.

3. Consolidate credit card debts with low interest koperasi loan

Even with a good credit history, a koperasi loan might benefit you in terms of reducing your debt burden. If you have any outstanding credit card debts with an interest of 15% to 18% per annum or a personal loan with a high interest rate, you can consider using a lower interest rate koperasi loan to consolidate debt and pay off these expensive debts.

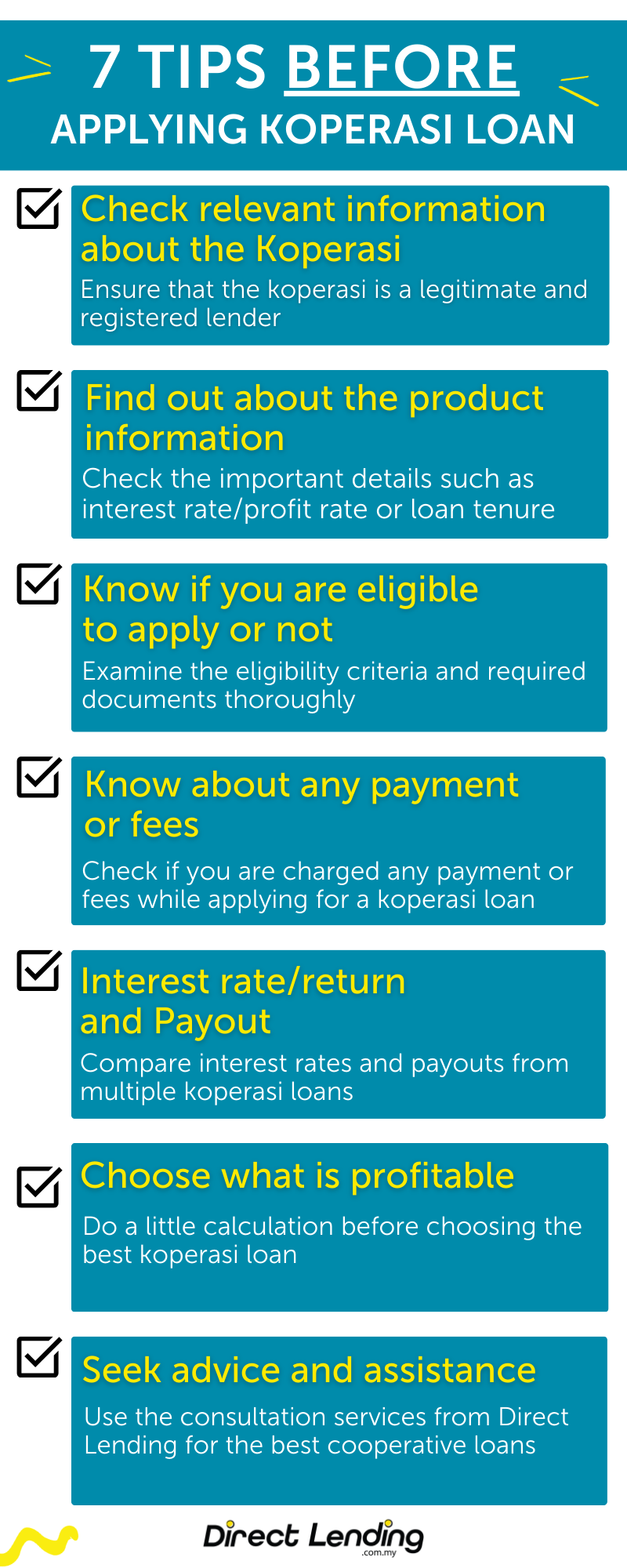

Know These 7 Tips Before Applying for Koperasi Loan

1. Check relevant information about the koperasi

The first step is to ensure that the koperasi that you are dealing with is a legitimate and registered lender. There are many cases out there of scammers trying to pretend to be koperasi representatives or even from the koperasi itself to take advantage of desperate victims. To safeguard yourself in dealing with the right koperasi party, it is highly advisable for you to conduct a simple search through this portal Malaysia Co-operative Societies Commision.

Key in the full name of the koperasi that you intend to check and click ‘Find’. If the name of the koperasi and its registered state are shown, then it is legal and registered. Otherwise, do check again if you entered the correct name of the koperasi. If there is still no information displayed, then it might be that the koperasi does not exist, or perhaps it is a scammer.

2. Find out about the product information

Spend some time to check on the details of the financial product. For instance like interest rate or profit rate, loan tenure, payout amount (the amount to be received in your account), and monthly repayment. For koperasi loan in Malaysia, it offers a fixed interest rate. This means that the rate would not change throughout the tenure of the loan. So, your monthly repayment would stay the same until your loan contract ends.

Tip: Do your research and obtain information about the koperasi loan. This would give you the choice to compare which option is suitable for your financing needs. Or you can check your eligibility for free with Direct Lending. Our smart eligibility system can assist you in selecting the best financing solution.

3. Know if you are eligible to apply or not

Just like the requirements for bank loans, eligibility criteria for applying for a cooperative loan vary depending on the type of financing plan offered. Similarly, the required documents for application differ. Some cooperatives may require documents with employer verification, and vice versa.

You need to carefully examine the eligibility criteria and required documents for applying for the cooperative loan. Make sure you are eligible to apply and can provide the requested documents.

For example, here is a brief comparison of three popular cooperative loans on this website. Note how the eligibility criteria vary significantly among the three cooperative financing plans offered.

| FINANCING PLAN | INCOME (GROSS SALARY) | CTOS/CCRIS/AKPK |

| Public Bank BAE Personal Financing-i (MCCM) | RM3,000 | CTOS - No record CCRIS - No Special Attention Account (SAA) AKPK - Not listed |

| KOPUTRI Pembiayaan Tawarruq. | RM1,800 | CTOS - Not exceeding RM5,000 CCRIS - Arrears must be settled with a loan AKPK - Not listed |

| Yayasan Dewan Perniagaan Melayu Perlis Pembiayaan Peribadi. | RM1,500 | CTOS - Not exceeding RM30,000 CCRIS - Arrears/SAA can be applied AKPK - Listed can apply |

4. Know about any payment or fees

Check if you are charged any payment or fees while applying for a loan koperasi. Usually, the charges involved are stamp duty, Takaful insurance, membership fees, and other charges. Always remember, a legitimate lender would never ask a borrower to pay any upfront payment before receiving financing. So if there are any charges or fees involved, it would be directly deducted from your loan amount and you would not need to pay anything upfront at all. So, usually, you will receive about 80% to 98% from your loan after deduction of any payment or fees.

In summary, there are several cooperative financing fees that will be charged if your application is approved. These include:

- Stamp Duty: A tax imposed on loan agreement documents. The charge is 0.5% of the approved loan amount or RM5 for every RM1,000.

- Insurance Protection: This is mandatory or optional depending on the type of loan offered.

- Advance Payment: Depending on the type of loan, some loans may require you to make an advance payment in the form of a monthly deposit. Do not confuse this with the deposit/payment requested by scammers. Refer to the advance payment section below for a more detailed explanation.

- Membership Fee: This is also one of the fees that some cooperatives will charge. Some cooperatives do not charge a membership fee if the loan is approved, and vice versa. The membership fee for cooperatives is usually in the range of RM30 and will be deducted directly from the monthly payment deduction.

- Late Payment Fee: This fee is rarely charged because most cooperative loans use the Angkasa Salary Deduction Scheme (SPGA) or deductions through employers for installment payments. However, some cooperatives charge a late payment fee if you fail to make installment payments on the agreed-upon date.

- Early Termination Fee: For Islamic loans, no early termination fee will be charged if you intend to settle your loan debt earlier. In fact, some loans will provide a rebate or Ibra' for early settlement.

5. Interest rate/return and Payout

The best or perfect cooperative loan is a loan with a low interest rate/return and a high payout, as well as loose eligibility criteria. Unfortunately, such loans do not exist.

You must choose two out of three factors above. Loans with low interest rates/returns and high payouts will impose strict eligibility requirements, and loans with loose eligibility requirements come with higher interest rates/returns and lower payouts.

The most straightforward example is from the table below for a comparison of interest rates and payouts for three types of cooperative loans:

| FINANCING PLAN | INTEREST RATE (% P.A) | PAYOUT AMOUNT |

| Public Bank BAE Personal Financing-i (MCCM) | Starts from 3.99% | Up to 98% |

| KOPUTRI Pembiayaan Tawarruq | 5.99% | Up to 95% |

| Yayasan Dewan Perniagaan Melayu Perlis Pembiayaan Peribadi | Starts from 6.50% | Up to 90% |

From the above table, although the Public Bank MCCM financing plan imposes somewhat strict eligibility criteria, this loan offers the lowest interest rate and a very high payout.

On the other hand, the YYP financing plan, which requires very loose eligibility criteria but imposes a relatively high interest rate, offers a slightly lower payout.

6. Choose What is Profitable

Referring to the payout amount or the net amount of money you will receive, many will undoubtedly choose a cooperative loan with a high payout. However, you should do a little calculation before making your choice.

A high payout does not necessarily mean that the loan is the best.

The simplest example is from the table below.

| LOAN SHARK / AH LONG | LOAN PLAN A | LOAN PLAN B |

| Loan amount | RM10,000 | RM10,000 |

| Profit / Interest rate | 5% p.a | 5.5% p.a |

| Loan period | 10 years | 10 years |

| % Payout | 90% | 98% |

| Cash in hand | RM9,000 | RM9,800 |

| Monthly installment | RM125 | RM129 |

| Total payment amount | RM15,000 | RM15,500 |

| Total loan amount | RM6,000 | RM5,700 |

Loan Plan A offers a low payout of 90% compared to Loan B with a payout of up to 98%. However, the annual interest/return rate charged by Loan B is higher than Loan A.

Although the difference in the annual interest/return rate between Loan A and Loan B is only 0.5% p.a, the total loan cost you need to pay is more than RM500 if you choose Loan B. This makes Loan A more advantageous even though it offers a lower payout than Loan B.

7. Seek Advice and Assistance

Because there are many cooperative loans available now, you definitely need to spend some time choosing a cooperative loan that suits your eligibility and preferences. If you want advice to help you make a more accurate choice, you can use the consultation services from Direct Lending, which manages the best cooperative loans.

How to Apply for the Best Koperasi Loan

Watch this video for an easy explanation of how to check your eligibility for free.

1. Check your eligibility

Click on the button below to check your eligibility for free. Type in the amount and financing period that you need.

2. Compare and choose the product that best suits you

You will receive results almost instantly based on the results that you have typed in. Compare and choose from the list of koperasi loan that suits your financial situation whether it is to apply for a low interest rate loan or loan with fast approval.

3. Prepare your documents

To complete your loan application, please ensure that you prepare the full set of documents as follows:

- IC copy (MyKad) (front and back)

- Latest 3 months paylips

- Confirmation letter of employment

- A copy of bank statement that credit your monthly salary

Our friendly loan consultants would then contact you to proceed with the loan application.

Summary

Koperasi loan is not only suitable for huge purchases like home renovation, medical expenses, and many others but it can also help you to solve your other overdue debts more effectively. We hope that this article would provide some useful information about koperasi loan in Malaysia. Make sure to follow the tips provided to receive easy and safe financing solutions.

This article is prepared by Direct Lending, an online personal lending platform that offers bank & koperasi personal loans, especially for the civil servant. We help can help you to find, compare and apply financing that best suit your financial needs.

(This article was originally published on the 17th of September 2017 and updated on the 20th of March 2024).

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.