By Sera

Marketing

Credit Card Application Declined? Here Are 7 Possible Reasons Why

We all have experienced getting rejected before, after a job interview, by someone we admire…but getting rejected by a bank whether for personal loan or other application, can truly hurt!

If you have ever had your credit card application declined by a bank before, don’t be so quick to give up. Getting rejected once does not mean you are entirely not eligible. There might have been an overlooked mistake or a criterion that you missed while applying.

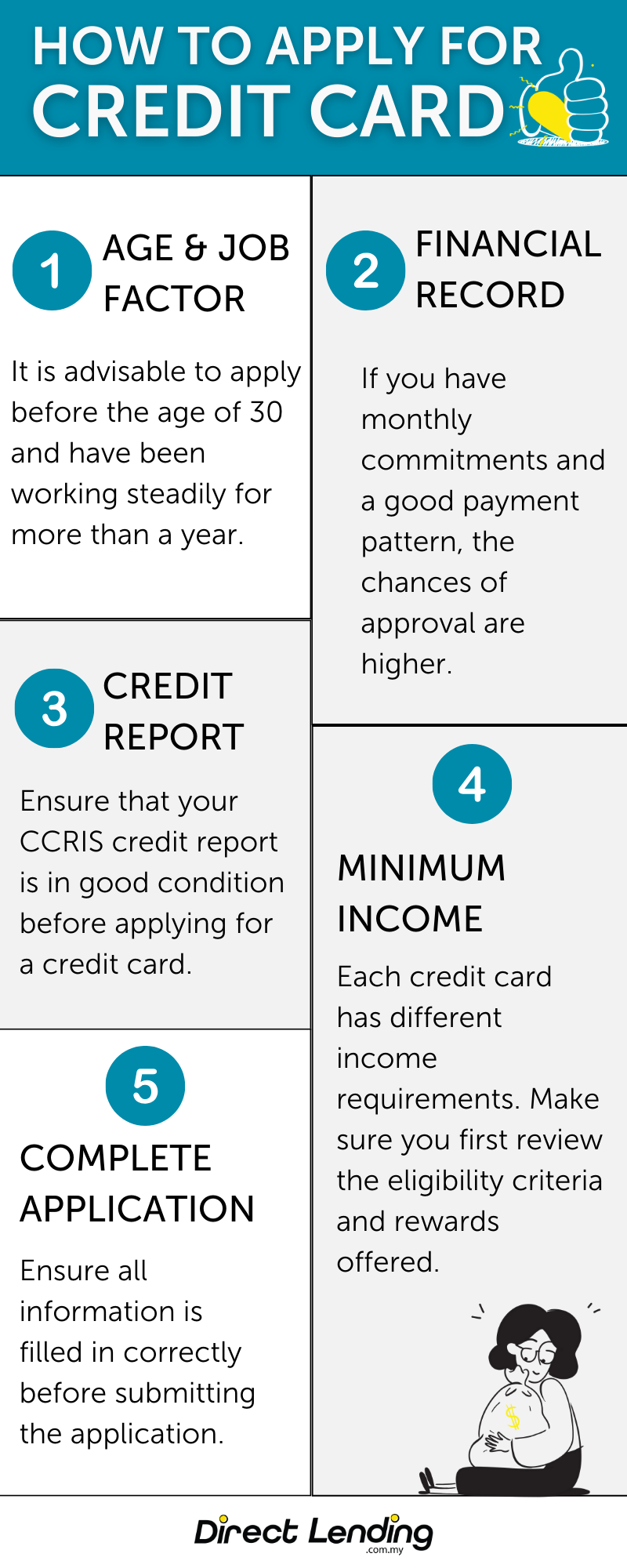

To avoid you credit card application being rejected, these are 5 conditions that you need to know before applying.

Requirement for Applying Credit Card

1. Age and Employment History

Age and employment history play a role in determining whether a credit card application will be accepted or rejected by the bank. For employment factors, individuals who have just entered the workforce may face difficulties obtaining credit card approval. Therefore, make sure you have been employed for at least a year to ensure your application is approved. Additionally, if you are a contract worker, you may also face challenges getting credit card approval as banks are less inclined to approve credit card applications for individuals with contract employment due to the higher risk associated with their employment status. Regarding age, if you are 30 years or older and have never owned a credit card, you may encounter some difficulty getting approval for your first credit card. Our advice is to get a credit card before reaching the age of 30.

2. Financial Commitments

If you have monthly commitments such as car loans, home loans, or personal loans, you may find it easier to get credit card approval. This is because the bank can assess your payment pattern to meet these financial commitments. Conversely, if you have no financial commitments, the bank cannot assess your payment pattern, and banks typically hesitate to approve credit card applications in such situations.

3. Credit Report

When the bank processes a credit card application, they will analyze your credit report through the Central Credit Reference Information System (CCRIS). Therefore, before applying for a credit card, obtain a copy of your CCRIS credit report to ensure it is in good condition. You can obtain your CCRIS credit report from Bank Negara Malaysia (BNM). Additionally, to improve your credit report status, ensure you pay all your bills and financial loans consistently, as frequent payment delays will be reflected in your credit report as a poor payment pattern.

4. Minimum Income

You might be interested in a credit card that offers a lot of Air Miles rewards, and you immediately click the button to apply. Wait! Have you checked the minimum income requirements for that card? According to BNM guidelines, the minimum income for first-time applicants is RM24,000 per year. The bank will require proof of income to qualify you as a credit cardholder. Typically, credit cards that offer substantial rewards often set a high minimum income as a qualification requirement.

5. Complete Application

Sometimes, credit card applications are rejected because of mistakes made while filling out the application form. Although it may seem straightforward, many make mistakes when providing their personal information on the application form. Scrutinize your application form to ensure all information is filled out correctly before submitting it, especially if you are applying for a credit card online. You must also have a valid identification card, employer confirmation letter, and other documents to support your application.

7 Ways to Apply for Credit Card and Get Quick Approval

1. Fulfil the Credit Card Requirements

Banks are becoming more creative with their credit card rewards. Once tempted by all the free gifts, cashbacks, rebates, etc., an applicant may sign up without carefully checking the eligibility requirements. You need to properly ensure you meet the criteria such as minimum wage, age, employment status to ease the following processes.

2. Prepare All Documents and Information Needed

It is not uncommon to make mistakes in application forms, even for adults. Especially when dealing with banks and government agencies, you will be asked for various documentations to support your application. For a credit card, you will usually be asked to attach your most recent EPF statement along with a copy of your IC. Be sure to prepare all necessary documents accordingly.

3. Stable Income

Earning a steady income is one of the most essential requirements for a bank’s approval. Banks will make sure the applicant is able to consistently repay their debts before approving their applications. If you have only started working, or have been unemployed for a while, it is wise to wait at least 6 months into the new job to prove a consistent income flow before applying for a credit card.

4. Do Not Own Too Many Cards

Bank Negara Malaysia has set a limit for individuals earning below RM36,000 annually to own only 2 credit cards maximum. If you have reached this limit, you will need to cancel 1 first before applying for another.

5. Calculate DSR (Debt Service Ratio)

If you already have too many commitments on your hand, that will be reflected in your Debt Service Ratio (DSR). Besides credit scores, banks also rely on DSRs to decide whether or not to approve or reject an application. The recommended DSR to get easier credit approval is not more than 70% (for net income of RM3k and above) 0r 60% (for net income of RM3k and below). You can refer to this to calculate your DSR.

6. Do Not Apply for Multiple Credit Card at the Same Time

Perhaps one may assume that applying for multiple cards at the same time increases your chance of getting approved, almost as if one gets rejected, there will be another as backup. This is a misconception as every application is recorded in your CCRIS report. If you have made many applications, and many of them also get rejected, it might seem as if you have a bad credit score. Therefore, it is better to wait around 3 to 6 months to apply for a credit card again if your recent application gets rejected.

7. Check Credit Score Before Applying

Lastly, even if you have met and double-checked all requirements and documents, this is still no guarantee for an approval. The most important criterion for approval is the evidence that you will repay the debt consistently, and this is proven by what is reported in your CCRIS & CTOS report. Having some credit score imperfections in your credit report puts you at high risk of getting rejected. There should not be any outstanding debt repayments or bills within 6 months before applying.

Video: How to Apply for Credit Card With Quick Approval

Did your credit card application just get rejected? If 3 to 6 months is too long a wait for you, may we suggest you to apply for a personal loan with Direct Lending. Get lower interest rates as low as 2.95% and fast approval. Our trained consultants are ready to help you find, compare and apply for personal loans that suit you. Our service is 100% free, no down payment, no processing fees.

Infographic: How to Apply for Credit Card (Fast Approval)

If you have to wait for another 3 to 6 months to apply for a new credit card, you can consider other financing alternatives. As such, you may apply for personal financing.

Other than faster approval rate, the financing amount is larger compared to credit card. Direct Lending can help you to find, compare, and apply for personal financing suitable to financial needs and criteria

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.