By Yik Seong

Director

Should You Rent or Buy? Financial and Real Estate Insights to Help You Decide

“Should I rent or buy house?” is probably a question that gets pondered a lot by Malaysians, especially now that property prices have been consistently rising. Owning a house may start becoming more of a lofty dream to some, causing them to prefer renting to purchasing.

If you are in two minds on this matter, we have put together a guide containing some things you should ponder in order to aid you in making a decision whether to purchase a house or stick to paying monthly rentals.

Table of contents

- Buying Cost vs Rental Cost

- Lifestyle and Financial Factors

- Renting Insights

- Buying Insights

- Market Analysis

- Financial Tools and Strategies

- FAQ or Practical Guidance

- The Pros And Cons Of Buying vs Renting

- Buying Your House: From Renting to Owning

- Buying A House With An Under RM3k Salary

- So What Is The Bottom Line?

- Video: Is it Better to Buy Or Rent a House?

Buying Cost vs Rental Cost

The situation below depicts the differences between buying and renting a house:

Summary: Starting from the 5th year, the costs borne from buying a house will be cheaper than rental costs. Based on this scenario, buying a house will give you greater value than renting especially if you are looking to reside in the property for a long period.

Disclaimer: The situation above is solely for demonstrating possible costs of buying vs renting. The values quoted are by no means predicting or depicting real market values.

Lifestyle and Financial Factors

Your lifestyle plays a significant role in determining whether you should rent or buy a home. Here are some key factors to consider:

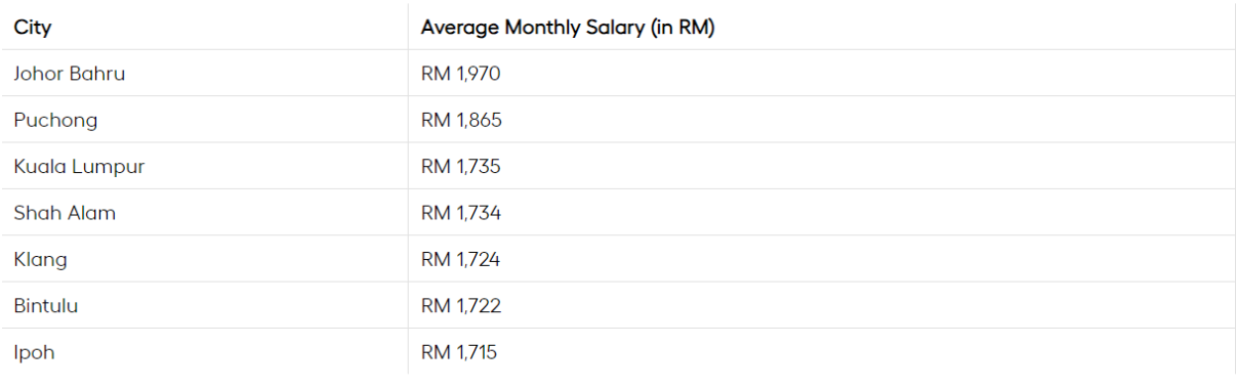

- Income Level: Your earnings can greatly influence your housing options. Higher income often means more flexibility in choosing where to live.

Source: Indeed

- Family Structure: If you're single, you might prefer a cozy apartment in the city. On the other hand, families often look for spacious homes in quieter neighborhoods.

- Career Mobility: If your job requires frequent moves, renting might be the better option for you, as it offers more flexibility without the hassle of selling a property.

- Long-term Goals: Think about what you want for your future. Are you planning to settle down, start a family, or travel? Your goals can guide your housing decision.

By reflecting on these factors, you can align your housing choice with both your financial situation and personal aspirations.

Renting Insights

Renting can be an excellent choice for many people, offering several advantages:

- Flexibility: One of the biggest perks of renting is the ability to move easily. If your job or lifestyle changes, you won’t have to worry about selling a house.

- Lower Upfront Costs: Renting typically requires less money upfront compared to buying. You won’t have to save for a down payment or deal with closing costs.

- Maintenance-Free Living: Most landlords take care of maintenance and repairs, which means fewer unexpected expenses for you.

- Market Risks: While renters are less affected by market fluctuations, rising rental prices can still be a concern overtime.

Overall, renting can be a smart move if you're looking for flexibility and lower immediate financial commitments.

Buying Insights

On the flip side, buying a home is a significant investment that comes with its own set of benefits and challenges:

- Building Equity: When you own a home, you're building equity over time, which can be a great financial asset in the long run.

- Stability: Homeownership often provides more stability than renting, making it an appealing option for families looking to settle down.

- Personalization: As a homeowner, you have the freedom to customize your space however you like—no landlord approval needed! …. can help you with any renovations that you are looking for .

- Market Vulnerability: However, homeowners are exposed to market fluctuations that can affect property values. It's essential to consider this risk when deciding to buy.

Buying a house is a major milestone that requires careful planning and research. It's not just a financial transaction—it's about finding a space that fits your lifestyle and long-term goals. From setting your budget to securing financing and navigating legal requirements, every step is crucial. Ready to start? Explore IQI Global’s comprehensive guide to buying property in Malaysia.

Market Analysis

Understanding the housing market is crucial for making informed decisions:

- Interest Rates: When interest rates are low, borrowing becomes cheaper, which can encourage more people to buy homes.

Source: IQI

- Supply and Demand: A limited supply of homes often drives prices up. In competitive markets, being prepared to act quickly is key.

- Economic Conditions: A strong economy typically boosts consumer confidence and increases buying activity in the housing market.

Staying informed about these trends can help you navigate the complexities of renting or buying.

Financial Tools and Strategies

Managing your finances wisely is essential whether you're renting or buying:

- Budgeting is crucial for managing housing costs effectively. Consider using the 50/30/20 rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings. To help with your financial planning, explore the best free budgeting apps.

- Credit Monitoring: A good credit score plays a key role in the loan approval process. Keep an eye on your credit report and address any issues promptly. Learn more about credit scores in Malaysia by visiting this article.

- Safety Net Savings: Having savings set aside can help cover unexpected expenses related to housing or emergencies.

- Financial Planning Services: Consulting with financial advisors can provide personalized advice on mortgages and long-term strategies tailored to your situation.

- Loans: If you need financial assistance, consider exploring loan options through DirectLending. We offer flexible personal loan solutions tailored to your needs, ensuring a smooth and efficient process. Calculate your loan here: Personal Loan Calculator.

Using these tools can enhance your financial stability and empower you in your housing decisions.

FAQ or Practical Guidance

Our answer to those is simply to do what is best with your current financial situation.

- Do you need to have enough money?

Realistically speaking, yes you do. You would need to prepare a deposit of at least 10% of a house’s price and that is provided your bank approves a loan of 90% of the house price. If the bank approves less than that, you will need to prepare even more money as deposit.

This has not yet taken into account legal fees and stamp duties. Furthermore, after accounting for all the costs involved in buying a property, will you be left with enough savings for emergencies?

It is also not advised for someone to take up a personal loan to fund a property deposit because this will double your future debt commitments.

- Are you willing and able to hold a large commitment?

The loan tenure for a mortgage loan is usually long due to the big amount involved. You will need to maintain a long-term discipline in order to commit to years and years of monthly instalments.

To give you a bigger picture, a mortgage loan term may span up to 35 years. You will need to bear in mind that throughout this period, you will also be faced with some financial challenges like the loss of a job and the likes.

- Do you plan on staying there for a long time?

Before buying a property in a given location, do you actually intend to stay there for a long time, or are you planning to put it up for sales and move to a different place in future? Even though you might change your mind eventually, you should still be firm with your intention in regards to a property so that careful planning can be done in advance.

If your answer is no to all the questions above, or you cannot say yes for certain, then we recommend that you stick to paying monthly rentals, at least for the time being. If your answer is yes however, then you might be ready for your own home!

- What is the price-to-rent ratio?

The price-to-rent ratio compares the number of years of rent to be paid to cover the overall cost of a house.

Some view that tenants are placed lowest on the property market hierarchy, they pay rent year after year only for the landlords to get richer, while the former still does not have ownership to the house.

This is not true as not all house purchases are good bargains either. To gain some mathematical insight on whether owning or renting makes more economic sense, you can calculate the price-to-rent ratio.

Example calculation:

| Price-to-rent ratio = Median house price / Median annual rent |

Say the median house price in a particular location in Malaysia is RM300,000, while the median monthly rent for a house in that same location is RM1,800, making the median annual rent RM21,600.

Price-to-rent ratio = 300,000 / 21,600 = 13.88

This value shows that you would need to pay nearly 14 years of rent to afford the overall cost of owning a house.

Based on thresholds set by Trulia, the company that invented the price-to-rent ratio, a ratio of 1 to 15 indicates that it is much better to rent than buy, so from our example, you would be better off renting the house than owning it.

- What are your needs and preferences?

Knowing your own needs and preferences are also essential for you to determine whether to rent or to own.

This might not seem too obvious in the beginning, but you might want to factor in your other plans such as building your own family and your lifestyle.

For instance, you might want to live where you can have better access to a good school for your future children, or you might want to reside in an urban area where you can easily get around through public transport.

Besides that, unlike renting a house, owning one will give you the freedom to change things up at any time you want.

If you rent from a landlord, you might likely be prohibited from making any permanent changes to the interior and exterior of the house.

If you are keen on living in a home with a design that is unique to you, then buying a house would be a better idea for you.

- What is the price of renting in Malaysia?

Malaysia's home rental market grew by 2.9% in Q2 2024, fueled by stable yields and key projects like MRT 3 and the RTS link. With higher rental yields than Singapore and Thailand, the market is poised for growth, supported by government incentives. For more on purchasing property, read this guide.

- What should I know before buying a property?

Before diving into property ownership, consider your budget, preferred location, and potential future developments that could impact property values. Doing thorough research and seeking advice from a reliable real estate agent can make a significant difference. For more tips, check out this guide.

- What are the latest property trends?

Terraced houses in Malaysia are set to see a 5% price rise in 2025, driven by demand and affordability. Their strong performance makes them a top choice for buyers. Learn more about the latest trends here and explore your investment opportunities today!

- How do I calculate if I can afford to buy a home?

Buying a home requires careful planning. Calculate your loan eligibility based on income, debts, and the bank’s Debt-Service Ratio. Use mortgage calculators to estimate costs, save for a larger down payment, and consider taxes and maintenance. With proper preparation, you can find a property that fits your budget. Looking for more information? Look here

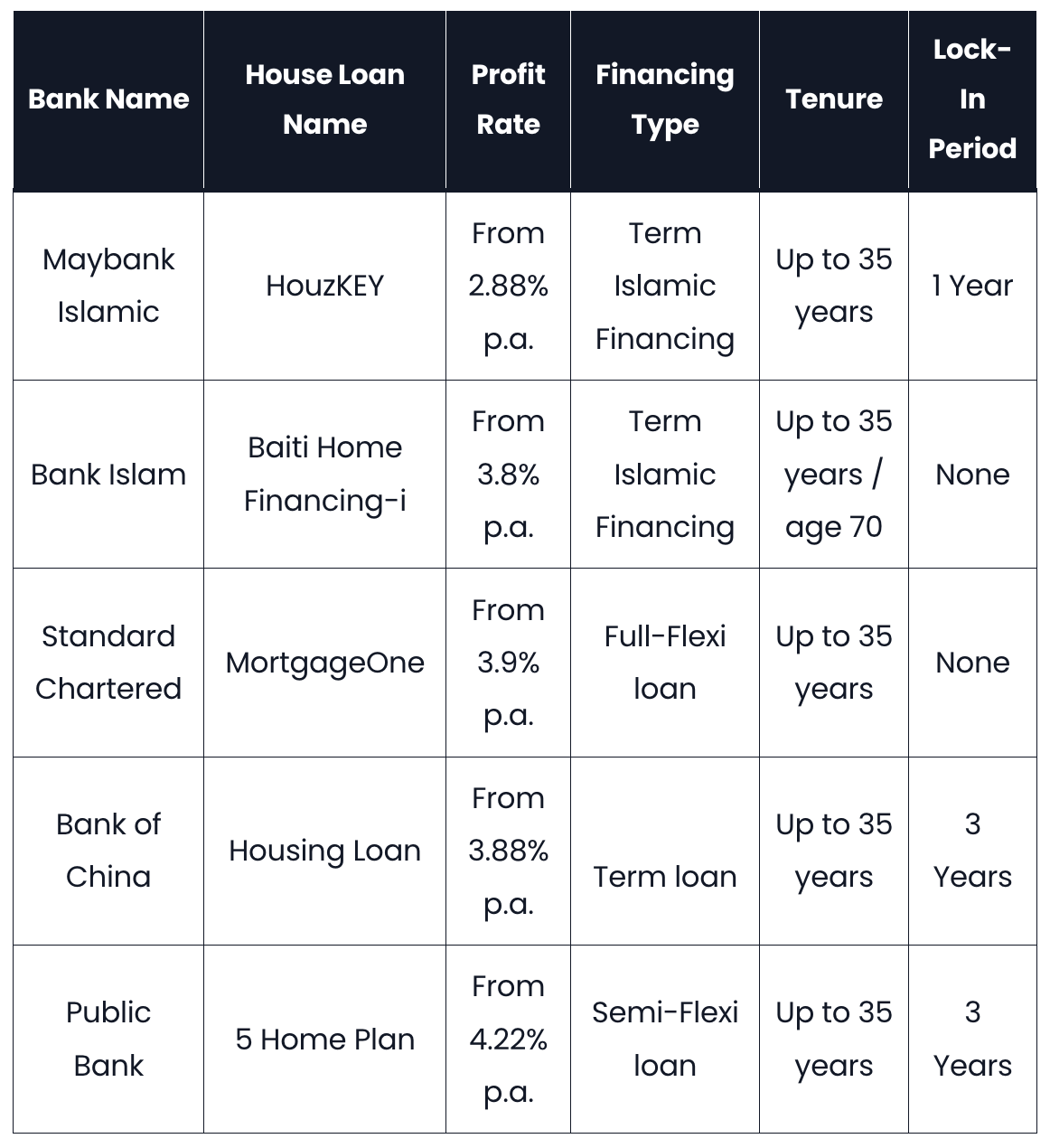

- What’s the easiest way to compare loan options?

Finding the best house loan interest rates in Malaysia can be challenging, especially with various options available. This guide of IQI Global will help you navigate the different types of loans, their interest rates, and other essential aspects to consider when looking for a dream home.

- Where can I find tips for first-time homebuyers?

IQI Global offers a wealth of resources and tips specifically designed for first-time homebuyers. These cover everything from budgeting to navigating the buying process effectively. Want to have all your questions answered as a first-time homebuyer? Read this article and you will know everything.

The Pros And Cons Of Buying vs Renting

Renting

Some people label renting with a negative connotation as if it is something to be hush about. Guess what? There is nothing to be ashamed of when it comes to renting! It is a common choice especially in more developed countries with high living costs. Here are the 3 benefits of renting a house:

- Low upfront cost and monthly commitment. Although one still needs to prepare a safety deposit in order to rent, that amount is still far lower than the upfront cost of buying a house, i.e. 10% deposit.

- Flexibility. If your job requires you to move a lot, then renting is for you, as rent contracts are usually in short terms.

Fixed commitment amount. A tenant usually does not have to worry about maintenance as this is borne by the landlord, so the former will only need to set aside pretty much the same allocation for housing every month.

Buying

Again, you should only buy a house when you can afford it, but there is no denying that owning a house is beneficial in terms of increasing your net value over time. The returns to buying a property is based on the rise in land prices and not how much you invest in at the beginning. If you can manage your finances well, you can buy a house with a salary below RM3,000 and gain positive returns over time.

- To explain this further, a house is an asset. It is a long term investment that can also be passed to your future generations. Even if you do not reside in a house you own, it can still be a source of passive income to you through renting it out. By the time you finish repaying your mortgage loan, the income you earn from rentals can be fully utilised to your own benefit.

- Land prices have been increasing as much as 9.8% over the year 2007 to 2017, and is predicted to continue in this trend. The best time to have bought a house is probably 10 years ago. The second best time is today.

- As has been shown in the diagram above, long term costs of owning a house are lower than renting over that same amount of time.

If you can afford it, buying a house is a valuable investment. The commitment that you pay in the beginning will later turn into gains for yourself. For a start, perhaps you can buy houses of the ‘sub-sale’ type or auctioned houses as they tend to be cheaper. You will need to be more mindful, however, because these houses will definitely not be ‘good as new’.

Renting a House

| Pros | Cons |

| Lower upfront cost than house purchase deposit. | Likely to encounter a bad landlord. |

| No recurring payments such as assessment rates and maintenance costs. | A drastic increase in rent may force you to move to a new place. |

Buying a House

| Pros | Cons |

| Acts as a form of investment. | High upfront cost and recurring payments. |

| Gain full ownership. | Tied to decades of financial commitment. |

Buying Your House: From Renting to Owning

Eligibility and Perks

The first step to owning a house is knowing how much you can afford based on your current income. The easiest way to do this is by using an online ‘Affordability Calculator’ or visit a local bank near you. In Malaysia, there are several government schemes aimed to improve access to more affordable housing, such as:

| Housing schemes | Household income eligibility (RM) | House price estimation (RM) |

| PPR (Program Perumahan Rakyat) | 30,000 – 35,000 | |

| SPNB (Syarikat Perumahan Negara Berhad) / RM1RM (Rumah Mesra Rakyat 1 Malaysia) | 35,000 – 250,000 | |

| PR1MA (Perumahan Rakyat 1 Malaysia) | 2,500 – 10,000 | 100,000 – 400,000 |

Civil servants are entitled to an additional housing scheme, namely PPAM (Perumahan Penjawat Awam Malaysia). Houses under the PR1MA program are specifically built in urban areas in close proximity to workplaces, amenities and attractions.

This strategically placed housing is usually in high demand and can be a form of investment with high future returns.

Saving and Buying

Banks can offer mortgage loans of up to 90% the overall price of a house, specifically for first and second homes. With this in mind, one should aim to save up for the remaining 10% that needs to be paid. One of the best ways to save up for a home deposit is by setting a 12-month target, particularly by saving 1/3 of your monthly income over this period. This practice also gets you used to putting aside a proportion of your income for the future monthly mortgage instalments.

You might also get lucky in finding developers that do not require deposits for homebuyers. In this case, you will only need to pay the monthly mortgage instalments. Be sure to also look out for other promotions offered such as Bumiputera discounts or legal fees and stamp duty exemptions because these can save you up to thousands.

Taking the steps to becoming a homeowner may take years but you should do it with a clear target in mind because it will somehow affect you and your households’ lifestyles.

Buying A House With An Under RM3k Salary

i. Set a clear target

Having a clear target is key in motivating your actions in buying a property. You can try writing down your list of targets and action plans towards achieving this goal.

Whether you are aiming to buy property for your own use or for generating income from it, you must always make decisions based on your own ability to commit financially.

For instance, with a salary below RM3000, you should properly check with a bank on how much you will have to set aside every month for the entire mortgage loan term and assess your own ability to afford it.

This is essential as, again, you will be tied to this financial commitment for probably up to decades, so you must ensure that you can afford the monthly instalments to banks. Now that you have set a goal in mind, check out the next step.

ii. Plan your expenditures

In committing to the goal you have set for yourself, you will also have to make smart decisions when it comes to spending.

The biggest chunks of your monthly pay are probably allocated to food, accommodation and entertainment. We have come up with several tips on how you can save on these categories without being too hard on yourself, because after all, you deserve some rewards too!

- Food

We understand that it can be difficult to cut down our spending on food especially if there are several mouths to feed, but try to limit food expenses by cooking at home more often and eat out less. Try setting a target of how much to spend on food every day, and if you manage to follow this consistently, reward yourself with a fancy meal at the end of the month.

- Accommodation

If possible, try to live closer to your workplace. This not only can help you save on transportation costs and time, but also allow you to get some walking exercise that is beneficial to your body and mind.

If you have no choice but to live further away from your workplace, we recommend that you take public transportation or carpool with your coworkers. This can help take away the stress from being stuck in traffic during peak hours.

- Entertainment

As mentioned, you deserve some reward for working hard, and in fact you should enjoy some entertainment every now and then. Bear in mind, though, to avoid the habit of spending too much of your pay as soon as you get them, only to be left with too little for essentials at the end of the month.

Another general tip is to always be on the lookout for special discounts, rebates or cashbacks. Sometimes, these can be very helpful for you to save some cash.

- Take up a bank housing loan

Applying for a bank loan can seem complicated, but actually, there are things that you can do to quicken the approval process. These are three pointers that are generally useful when it comes to applying for a housing loan.

- Compare among different banks

Surveying thoroughly among the housing loans offered by different banks is a smart thing to do as each bank usually has its own terms and conditions. Compare items such as loan interest rates, loan terms and loan margins offered. Do also apply from different banks and if you get approved by more than one institution, pick the one that is best to you. This can also give you several backup options in case your application gets rejected.

- It is important to have a credit record

If you have never taken any loan from any institution before, you might be surprised to find your loan application rejected. This is actually common because without a credit record, banks are not able to assess your history with debt repayments and therefore cannot judge how well can you pay this housing loan that you are applying for. Holding some debt is actually not a bad thing as long as it does not trouble you.

- Good credit score (CCRIS and CTOS)

To help you understand further how having a credit record helps in acquiring a loan, we will introduce CCRIS and CTOS. These are ‘scores’ that are given based on how well you repay your loans and debts. If you have been disciplined in paying your previous debts, your credit score will be good, and banks will use this information to determine whether or not you are trusted to repay the money that you borrow from them. If you know that your CCRIS record is negative or have been blacklisted, worry not as there are still ways to improve them.

- Stay up-to-date with financial and property knowledge

It does not harm to be consistently in the know of financial and property affairs as these knowledge evolve over time. There are a number of Malaysian resources that you can refer to for free, including the Direct Lending blog.

Learning can also solve some unhelpful misconceptions. For instance, many often see borrowing from banks as a bad thing, but in contrast, it can be good for building your assets and of course for helping you live a more comfortable life. Loans are only bad if you take more than you can manage.

So What Is The Bottom Line?

As you have learned, there are equal numbers of arguments for and against renting and buying property. Generally, these are only things that have been observed and the final choice is for you to make.

You will need to weigh up the costs and benefits of renting versus buying based on your own needs, and then move to assessing your own finances. Do not worry about what people say is right, just do whatever that benefits you most.

Video: Is it Better to Buy Or Rent a House?

This article is a collaboration between Direct Lending, a platform that helps you find the best personal loans from trusted financial institutions. IQI Global, a trusted real estate partner offering expert insights and property options for renting or buying. Together, they provide solutions to meet your financial and property needs.

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.