By Khairina

8 Ways to Apply for Business Loans (Easy Approval)

Is a business loan essential for every entrepreneur? How do you go about applying for such a loan?

A business loan is a specialized financial product for business owners. The amount you can borrow depends on the size of your company, annual turnover, business classification, and the bank's assessment criteria.

In this article, we will share information about several ways to apply for business loans in Malaysia.

Why Apply for a Business Loan?

Is taking on debt for your business good or bad for your future? Many entrepreneurs may still be wondering or in a dilemma about choosing between borrowing money or continuing their business with their own capital or a small business fund.

The best reason to apply for a business loan is when the business is ready to expand, and you believe that with the help of this loan, the business will achieve more profits than before.

For example, you want to open a new branch from a single restaurant to multiple branches in different locations. You can already estimate how much sales you will make per day at the store, monthly costs, and how much profit you will gain.

With increasing demand from existing customers and a well-known brand, there is no issue if you decide to apply for a loan from the bank.

Additionally, you should apply for this loan to improve equipment and hire more employees.

The Differences Between Personal Loan & Business Loan

Personal loans are given to individuals and can basically be used for any purpose. They are normally unsecured loan (called ‘clean loan’), meaning that the lender does not require any form of security (collateral) for the loan. Instead, a personal loan is given based on the borrower’s creditworthiness. Usually loan providers would look at the borrower’s credit history through their CCRIS/ CTOS credit record, earning potential and repayment ability.

On the other hand, a business loan is designed for business use, and is given to companies or business entities, not individuals. A business loan can be used to buy business premises, equipment or help with funding working capital.

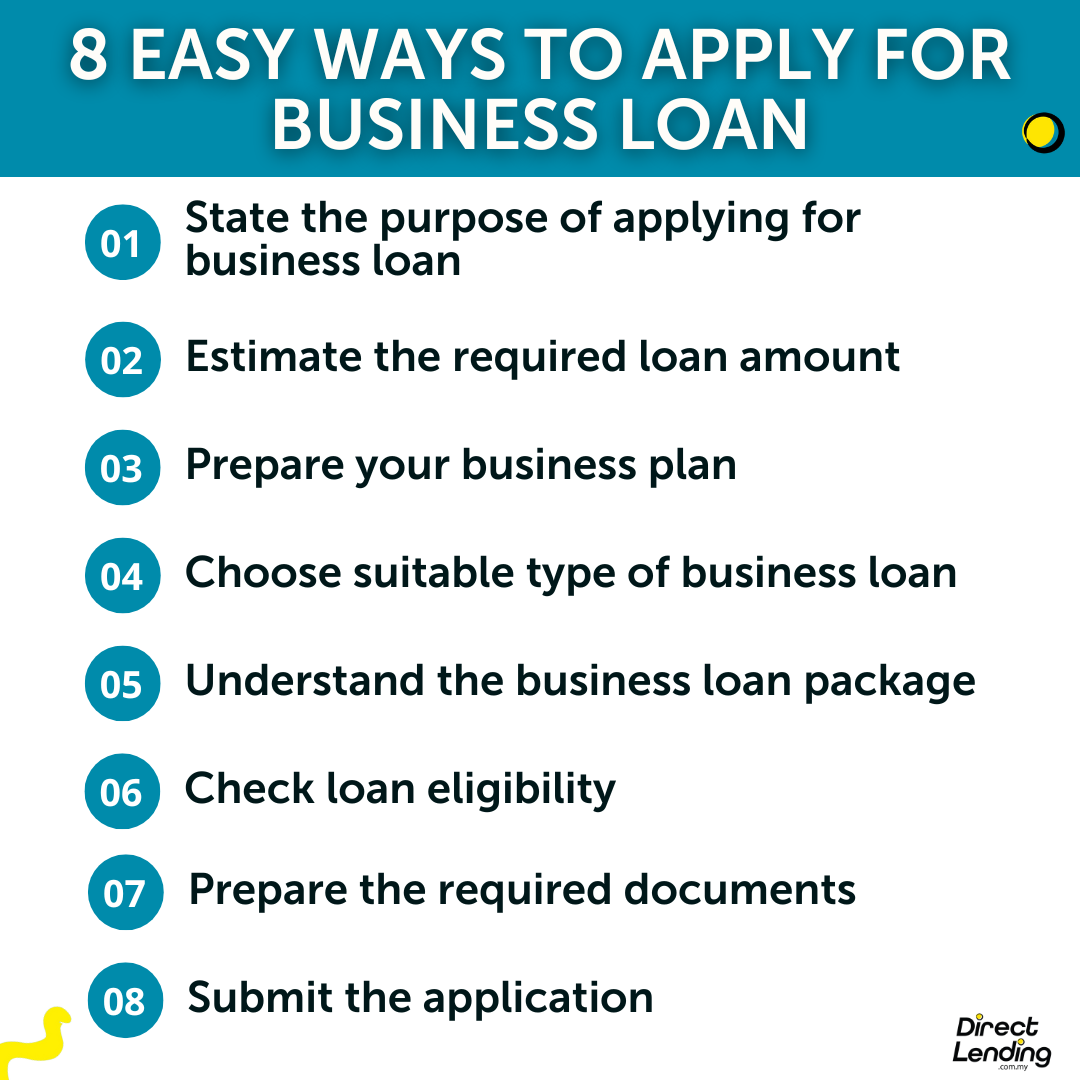

8 Easy Ways to Apply for a Business Loan

For your information, applying for a business loan is slightly different from applying for personal loans, car loans, and the like. Generally, applications for business loans take several days before they are approved.

Therefore, taking early steps is better for your preparation. Here are some easy steps to follow when applying for a loan:

1. Define the purpose of applying for a business loan:

The first thing you need to do before applying for a loan is to identify the purpose of your loan application. Every business surely has specific reasons why it needs the assistance of a loan.

For example, it could be for renovations, expanding job opportunities, increasing production of goods, and so on. What's certain is that entrepreneurs seek loans to streamline their business operations and processes.

This indirectly saves time and energy for small business owners who work tirelessly to ensure that their business runs smoothly as planned.

Once your business has clear and realistic goals, it can significantly help you determine what you truly want to achieve. Your focus on the business won't easily waver. If you succeed in the loan application, you'll know how to manage the funds wisely.

2. Estimate the required loan amount

Even though the amount of money you can borrow depends on the agency or institution involved, it's still crucial for you to make your own estimate of the required loan amount.

Applying for the right amount can increase your chances of approval. You can use a loan calculator to get an estimate.

3. Prepare your business plan

If possible, include a detailed business plan in your loan application to improve your chances of approval. This is because the bank can make a better assessment.

Imagine an applicant with concrete evidence in a written plan; they are more credible and believable compared to those who only talk and dream in their heads.

Moreover, if you have no record of running a business, obtaining a business loan can be quite challenging, whether it's for an online business or otherwise.

As a result, entrepreneurs might resort to personal loans, which often come with higher interest rates.

Some key things to do before preparing a business plan include:

- Outline every process in running the business.

- Outline the necessary expenses.

- Identify the skills needed and who is required.

- Identify a suitable market.

- Identify competitors in the market.

Once you've identified all these elements, it becomes easier to create an effective business plan.

Additionally, essential information that should be included in this plan consists of business information, market analysis, your business competitors, operational strategies, and financial plans involving cash flow statements, profit and loss statements, and key calculations.

4. Choose the appropriate type of business loan

Next, you need to choose the type of loan that suits the goals of your business. You can borrow from any selected bank or business loan agencies such as:

- TEKUN Nasional

- Majlis Amanah Rakyat (MARA)

- Perbadanan Usahawan Nasional Berhad (PUNB)

- Program Syarikat Bumiputera Berprestasi Tinggi (TERAS)

- Business grants in Malaysia, and so on.

Each loan has its own advantages and disadvantages based on the suitability of your business.

5. Understand the business loan package

This is perhaps one aspect that many people don't take too seriously when taking out a loan. To ensure that your loan doesn't become a burden in the future, you need to understand the terms and conditions that have been set. You need to know your business's ability to repay the loan amount.

The terms and conditions of loans vary from one bank to another. Therefore, it is crucial to ensure that you truly understand these terms before deciding on the best bank.

Factors determining monthly payments include:

- Type of loan

- Business profit

- Type of business

- Operating period of the business

- Owner's business income

- Credit history

You also need to know that the interest rate applied is proportional to the profile of your business. For example, a higher business risk will result in a higher interest rate.

6. Check loan eligibility

Eligibility criteria for different loan schemes require you to be more aware and clear about the set conditions. It's like an initial filter that determines whether the application is approved or not.

Usually, eligibility involves elements such as:

- Citizenship status.

- Applicant's age limit.

- Type of business.

- The operating period of the business.

- Annual sales of the business.

- Statements from the bank, and so on.

For example, if you want to borrow from RHB Bank under RHB SME, eligibility criteria set for applicants are:

- Applicants must be between 18 to 60 years old.

- No specific minimum monthly salary.

- Must have a bank statement for the latest 6 months.

For more detailed information, you can visit the official website of the bank or selected loan institutions.

7. Prepare the required documents

Every bank or loan institution you apply to usually requires different documents. However, the purpose of these documents is the same: to help them assess whether your business meets all the criteria and conditions set or not.

So, preparing comprehensive documents that contain all the financial activities of your company is crucial to give them confidence in approving your application.

Some documents commonly requested by the bank include:

- Business details (business plan, name, address, tax, etc.).

- Personal financial statements related to the business (tax statements, bank statements, credit card bills, key calculations, tax agreements, a list of business assets, and other related files).

- Information about the business owner (personal details for anyone who owns more than 20 to 25 percent of the company).

8. Submit the application

Once you have prepared the documents and filled out the required form, you can submit the application to the bank. Usually, you will go through an interview process conducted by the bank as a standard procedure for anyone applying for a loan.

During the interview, the bank will ask you everything important related to your business to help them make a good assessment and decision.

Don't forget to ask the bank whether the interview is conducted online or physically to make it easier for you to prepare.

Once this process is completed, you will need to wait for a certain period to find out whether your application has been successful or not.

Applying for Business Loans for Micro SMEs

If you are looking for additional capital for your business, Direct Lending provides Micro SME loans in both Shariah and conventional finance. You can apply for this business loan online with no hidden fees, no upfront fees, or required deposits. Here are the eligibility criteria and required documents:

Eligibility criteria:

- Sole proprietorship, partnership, or private limited company (Sdn. Bhd.).

- Business has been operating for a minimum of 6 months.

- Minimum business income of RM5,000 per month.

- No pending legal actions.

- No bankruptcy status.

Required documents:

- Identification card (front and back).

- The latest 6-month bank statement.

Offers are given up to RM200,000 with an interest rate between 0.8% to 1.5% per month over an 18-month financing period.

Video: How to Apply for SME Business Loans (100% Online)

In conclusion, it's not wrong for you to apply for a business loan, especially if the business is well-established. However, for those of you who are still crawling to start a business, the best way to start a business is with minimal capital that you own.

This is because the risk of business failure in the early stages is higher. As Datuk Wira Dr. Azizan Osman said,

"It's very easy to start a business, just go to the Companies Commission of Malaysia, and you can register your business, but the difficult part is to sustain the business, especially to go through the first phase, and you don't have enough knowledge."

It is hoped that our sharing about how to apply for a business loan can provide you with useful information and knowledge to advance your business in the future.

This article is written by Direct Lending – a personal loan platform from trustworthy bank & koperasi and licensed moneylender. Let us help you find, compare and apply for the personal loan that best suits you. Check your eligibility for free and receive affordable rates as low as 2.95% or as fast as 2 working days.

About the writer

Khairina

Khairina is an English graduate who is chronically online consuming various forms of literature. She finds passion in simplifying complex ideas into chunks of words and love finding out fascinating random facts of the day.