By Mandy

Marketing

Credit Card Vs Personal Loan – Which One Should You Get?

There comes a time where we may find ourselves in need of a huge sum of money whether it is to foot the bill of unforeseen business expenses or for emergency purposes like paying the medical fees of a vital surgery. These are best funded by one’s own emergency funds, but what if this is still not enough?

Often, the solution comes down to two options; credit card or personal loans. Besides emergencies, these two financing options can also help fund major purchases like buying a car, home deposits, home renovations, etc.

Before we dive into which option you should go for to fund your financial needs, this article will first give you a closer look at what a credit card is, its usage benefits and disadvantages, plus how it differs from a personal loan.

Table of contents

- What is a Credit Card?

- Advantages

- Disadvantages

- Advantage and Disadvantage of Credit Card

- Video: Credit Card vs Personal Loan – Which One Should I Choose?

- Comparison Between Credit Card vs Personal Loan

- Paying Off Credit Card Debts Using a Personal Loan

- Flat Interest Rate vs. Fixed Interest Rate

- Advantages & Disadvantages of Paying Off Credit Cards With a Personal Loan

- Credit Card Balance Transfer

- Control Your Expenses

What is a Credit Card?

Usually, you will be required to pay your credit card bill at the end of every month, specifically 20 days after the bill has been issued according to your bank/financial institution’s regulations. Some of the well-known credit card issuers in Malaysia are Maybank, AEON, CitiBank, BSN, Bank Rakyat etc. Some best credit card also offer unique benefits such as zero annual fees, cashback rebates, travel rewards, Islamic banking properties and many more.

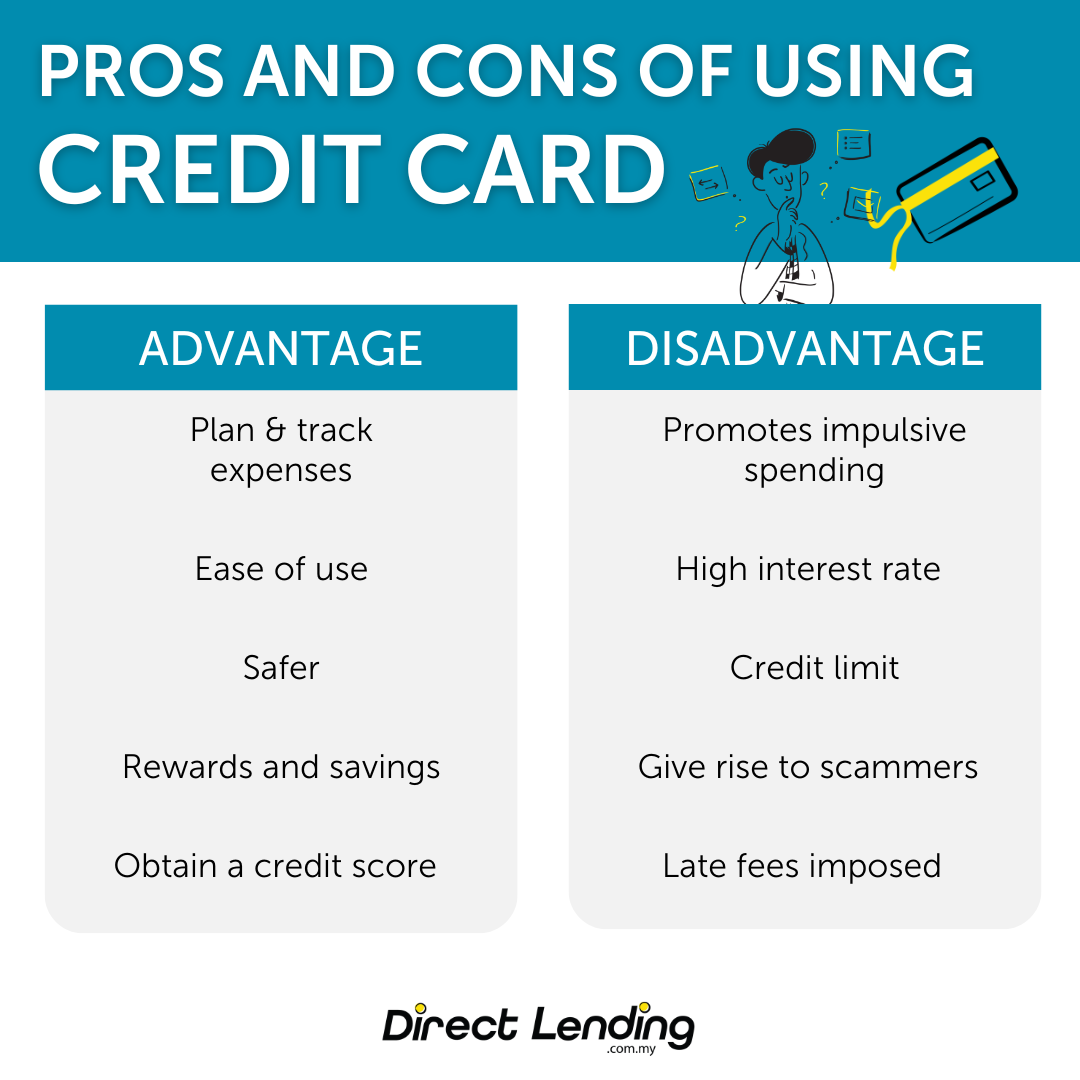

Advantages

1. Ease of Use

Many would prefer using credit cards to cash due to their convenience. Your transactions can be completed literally within seconds. They are also very easy to carry as compared to cash, which makes most sense when you are making large purchases. You just need to ensure that the place at which you are shopping in accepts credit card payments.

Besides that, another huge advantage to credit cards is the ability to split your payments into instalments. This saves you from having to pay large sums in one go, and helps you to maintain a positive cash flow in your savings account.

2. Plan and Track Expenses

Through using credit cards, you also get the flexibility to plan and track your spending. Each transaction gets automatically recorded, and you can check them in your monthly statements. This can help you plan your monthly commitments and prevent impulse purchases.

3. Safety

This is one of the main advantages of credit cards. When you carry a lot of cash and they get stolen, it becomes very difficult to track them, let alone have them returned to you. With a credit card, if you notice that you have lost it or if it gets stolen, you can immediately take action by calling the issuer bank to block the card and then you can lodge a police report. This prevents further usage of the card by other people. Most banks also provide free travel insurance when you use their credit cards. And more recently with the COVID-19 pandemic, using a credit card reduces human contact thus preventing the spread of the disease.

4. Rewards and Savings

Another benefit to using credit cards is the rewards system, where consumers accumulate points with each usage which, after a certain threshold, can be redeemed for goods and services, such as for hotels, retailers and restaurants. For instance, travel credit cards offer access to lounge services at airports, and their points can be exchanged for free or cheaper flight tickets. The more points you collect, the better the rewards. You can redeem the rewards as you go making everyday transactions or collect them for bigger rewards later.

5. Obtain a Credit Score

If you have a good payment record, you will obtain high credit score ratings which will be useful when applying for loans in the future. They will allow you to get lower interest rates and ease borrowing for vehicles and mortgages overall.

Disadvantages

1. High Interest Rates

The most important factor to consider when it comes to borrowing money is undoubtedly the interest rate. Many people think that interest is only charged when the credit card is being used, but actually, you will be charged up to 18% interest per annum or 1.5% per month if you only make minimum payments instead of full payments within the time given. If you mange to pay your credit card bill in full when it is due, only then will you not be charged any interest.

Therefore, if you make late payments or only pay minimum amounts per month, your credit card debt balance will be charged with interest ranging from 13% to 18% per annum. This is higher than bank and koperasi personal loans where their interest rates range between 8% to 11% per annum.

2. Credit Limit

For credit cards, according to Bank Negara Malaysia’s guidelines, those earning under RM36,000 per annum will have a credit limit of two times their monthly salary with a maximum of two issuers. Therefore, if you are earning a monthly salary of RM3,000 your maximum limit will only be RM6,000. This might serve as a limitation towards funding larger financial expenses.

3. Late Fees Imposed

Most banks charge their customers with late fees if they fail to pay their credit card bills after they are due. Usually late fees are calculated as 1% of outstanding balance or RM10, whichever is higher. So, the more the outstanding balance, the higher the charge. Remember point number 1 about high interest rates? As long as you pay your outstanding balance later than the due date, you will continue to be charged with 13 to 18% interest rates and a late fee of 1%.

Therefore, a credit card may lead you to overspend and accumulate bad debts (i.e. interest buildup on monthly outstanding debt) if you choose to only pay minimum amounts each month.

4. Gives Rise to Scammers

If you misplace your credit card, it can easily be used by whomever finds it. This is because no signatures are required to make payments.

5. Promotes Impulsive Spending

A credit card adds one’s spending power and may create the illusion that they can afford more things. An uncontrolled usage will bring more serious debt and financial problems. It can also add to the country’s bankrupt citizens statistics. All you need to bear in mind when using credit cards is to not let it control you.

Advantage and Disadvantage of Credit Card

Video: Credit Card vs Personal Loan – Which One Should I Choose?

Comparison Between Credit Card vs Personal Loan

We have also compiled a few general comparisons between them in the table below.

| Credit Card | Differences | Personal Loan |

| Between 15% – 18% p.a. | Interest Rate | Between 8% – 11% p.a. |

|

Those earning under RM36,000 per annum will have a credit limit of two times their monthly salary with a maximum of two issuers. Those earning above RM36,00, the credit limit depends on the respective financial institution. |

Credit Limit | Minimum loan of RM3,000 and maximum of RM250,000 (if eligible). |

| Can be used anywhere, anytime according to respective credit limits. | Convenience |

Loan application needs to be approved by banks, with several more processes required before cash is received. The approval process can take from days up to weeks. |

| Many banks offer interest-free instalment plans for 12 to 36 months. Therefore, consumers will only have to pay monthly instalments within the agreed time period and payment will not be deducted in one go. | Repayment | Personal loan interest rates, such as that for licensed moneylenders are fixed throughout the agreed upon loan tenure. |

| Offers rewards such as cash rebates and points with every usage. | Rewards & Savings | Some banks offer special rates if borrowers use auto debit to repay their loans. |

Paying Off Credit Card Debts Using a Personal Loan

One trusty solution to pay off credit card debts is by doing a personal loan overlap. You must know that this method is for solving your credit card debts, not to have spare cash for spending.

Flat Interest Rate vs. Fixed Interest Rate

Before making a personal loan, first do some research. Make sure that the loan you are applying for suits your financial situation well. One of the areas that need extra attention when applying for a loan is the interest rate.

A personal loan carries a FLAT interest rate

- A personal loan has a flat interest rate that is calculated on the principal.

- This means that you will be paying a uniform amount for your instalments throughout the loan tenure.

A credit card carries a FIXED interest rate

- Interest is charged on a daily basis.

- This means that interest is added to the outstanding balance. This process will continue repeating until the balance is completely paid off.

Sample Calculation of Flat vs. Fixed Interest Rates

Say you have allocated 2 years for paying off a credit card debt of RM10,000 and you can afford to pay RM500 monthly.

The usual interest rate charged on a credit card is between 15% to 18% per annum, or up to 1.5% per month. Some government employees are entitled to co-operative loans (koperasi loan) with a lower interest rate. For example, Co-Op Bank Pertama offers koperasi loan for civil servants with interest rates as low as 2.95% p.a.(accurate at the time of writing). Does this mean a personal loan is better?

| Credit Card | Personal Loan | |

| Credit Amount | RM10,000 | RM10,000 |

| Interest Rate | 18% p.a. (Fixed) | 2.95% p.a. (Flat) |

| Tenure | 24 months | 24 months |

Based on the given example, compare the minimum amount that you can pay for the credit card monthly with the personal loan instalment.

| Credit Card | Personal Loan | |

| Minimum monthly payment | RM500 | RM441 |

| Total payment over entire tenure | RM500 x 24 months = RM12,000 |

RM441 x 24 months = RM10,584 |

| Total interest (total payment – principal) | RM2,000 | RM584 |

| Savings | RM1,416 |

From this example, it is clear that the personal loan is indeed the better choice. The starkest reason is the interest rate. Do not ever choose a personal loan that bears higher interest rate than the credit card; that just defeats the purpose of a personal loan overlap.

Here, you can save on monthly instalments by only paying RM441 instead of RM500. That is a total RM1,416 saved!

Advantages & Disadvantages of Paying Off Credit Cards With a Personal Loan

Advantages

1. Debt consolidation

Consolidating all your debts into a single personal loan is a smart move if you choose a lower interest rate. This solution is an effective way to pay off car loans fast. The credit balance that you clear off will remove the credit limit, and you will be able to use your credit card for other purposes.

2. Debts become easier to track & monitor

Monitoring your debts will become much easier as the interest on a personal loan is uniform throughout the loan tenure. This prevents borrowers from overlooking or missing payments as they only need to repay their debt on one single loan account.

3. Potential for savings

Another benefit to taking a new personal loan is the opportunity for saving. You can gain an effective saving of RM1,014, about 10% from the loan balance or principal of RM10,000. This is a good opportunity to boost your savings.

Disadvantages

1. Outstanding Balance

The real test is after you finish paying off your credit card debts; which is whether or not you can use your credit card with great discipline. It is not reasonable to get a personal loan unless you are truly confident that you can start being disciplined with your credit card usage. Otherwise, it will just add to your financial burdens.

2. High Interest Rate

As specified before, it is not worth taking a new personal loan if its interest rate is just as high. Maintain your financial position by making sure repayments are made on time.

3. Hidden Charges

Get information on any processing fees from your credit provider. Be sure to check if there are any hidden charges behind a low interest rate promised.

Credit Card Balance Transfer

Another alternative to solving credit card debts is through balance transfer. This is best for those that are about to max out on their credit card. You will need to find a credit card company that offers low interest alongside a low balance transfer cost.

However, this balance transfer is subject to a time limit. A low interest rate may only be offered temporarily. Once this period is over, the interest will bounce back to a higher rate.

Control Your Expenses

Shopping using a credit card is exciting, but be careful to not let the excitement drive you to bankruptcy. Malaysia is starting to experience a rise in bankruptcy cases that are attributed to uncontrolled credit card usage. If you catch yourself starting to develop an unhealthy credit card spending habit, take careful steps to correct them before it gets too late.

Generally, credit cards are convenient but its limited credit is only suitable for smaller purchases whereas personal loans are better for larger purchases and for consumers who prefer a fixed and predictable monthly repayment. Regardless of whether you choose to use your credit card or apply for a personal loan, always remember to do your research and only sign up with reputable financial institutions or loan agencies. Shield yourself from scammers by identifying these warning signs that the loan you are getting is a scam.

If you are ever in need of personal financing, Direct Lending is ready to help. Let us help you to solve your financial struggles by offering 100% free consultation service. No hidden cost or upfront payment needed. We can help you to source the best personal loan deals in town. Loan approval as fast as 2 working days.

(This article was originally published on the 25th of March 2018 and updated on the 2nd of April 2024).

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.