By Krystal

Ultimate Guide to Car Refinance in Malaysia

If you’re too tied up by your car monthly installment, or you would like to clear your car debts sooner, car refinance is the best debt management solution for you. The refinance technique may have the same characteristics as how you do debt consolidation for your personal loan. However, there are pros and cons and slight differences in the process of car refinance.

Table of contents

- What is Car Refinance?

- Can Loan Refinancing Tips

- Video: How to Reduce Monthly Commitment as Much as RM500

- How to Refinance a Car Loan in Malaysia

- Benefits of Refinance Car Loan

- Disadvantages of Refinance Car Loan

- Video: 6 Ways to Refinance a Car Loan Before it is Fully Paid Off

- Banks that Offer Car Refinancing Loan

- Conclusion

What is Car Refinance?

Car refinance is a loan repayment or a new loan applied from a bank or financial institution to settle the remaining balance of your initial car loan. If you are in a difficult financial situation due to different economic conditions such as high commitment, loss of income sources or your full-time job, a pay cut, or inflation, getting a refinance car loan is one of the alternatives to reduce your burden in paying the installment.

Loan repayment or refinancing always involves 2 types of loans: car loans and house loans. Technically, the term refinance in this context means to reduce your financial burden by reducing the amount of your monthly installment loan with a lower interest rate from your new loan repayment as compared to your existing loan.

There are many factors why people do car or house refinance other than having financial difficulties. Some people refinance to consolidate all their car loans or extend the loan tenure to improve monthly cash flow, making it more manageable for them financially while saving on monthly expenses.

If you are experiencing the above, regardless of the factors driving you to refinance your car loan, or considering whether to proceed, we have a checklist for you to refer to make a smart and informed decision.

Can Loan Refinancing Tips

1. Understand the Eligibility Requirements

Every bank or financial institution has its terms for car refinancing. As a smart borrower, you must always ensure that you ask for all the details of your car loan repayment because there are banks that instill penalty fees if you apply for loan repayment.

Moreover, different bank has different calculation method. If refinancing your car with a particular bank can help you save money and achieve your financing goals, you can proceed without a doubt. However, if getting a car refinancing is not beneficial for you, then maybe it is not the right time for you now to move forward with it.

2. Check the interest rate

If the interest rate that you are getting today is lower than your existing interest rate, then it is the best time for you to do car refinancing. If the interest rate is the same or higher, borrowers can wait for a more suitable time before refinancing because interest rates usually will drop or rise depending on the current economic situation.

How to Calculate Car Loan Interest

Before you decide to refinance your car, you need to know how to calculate your car loan interest so that you can compare your existing loan with the new loan offer. Car loan interest is usually calculated based on the loan principal, loan tenure and annual interest rate. The formula to calculate car loan interest is as below:

Total Interest = (Loan amount x Annual Interest Rate x Loan Tenure) / 100

However, you may also take advantage of any tech tools on the Internet such as the car refinance calculator or auto financing calculator that is available on any trusted financial websites. By using the auto loan refinance calculator, you can get an estimation of your monthly installment, total interest payable and the overall repayment amount over the loan tenure.

With the car refinance calculator, you can now make a better decision after knowing the total amount that you are required to pay from the new loan and also an estimation of how much you can save from refinancing your car.

Even a slight reduction in loan interest rates, such as 2 to 3 percent, can lead to significant savings on your loan. Be sure to calculate carefully before proceeding with your car refinance.

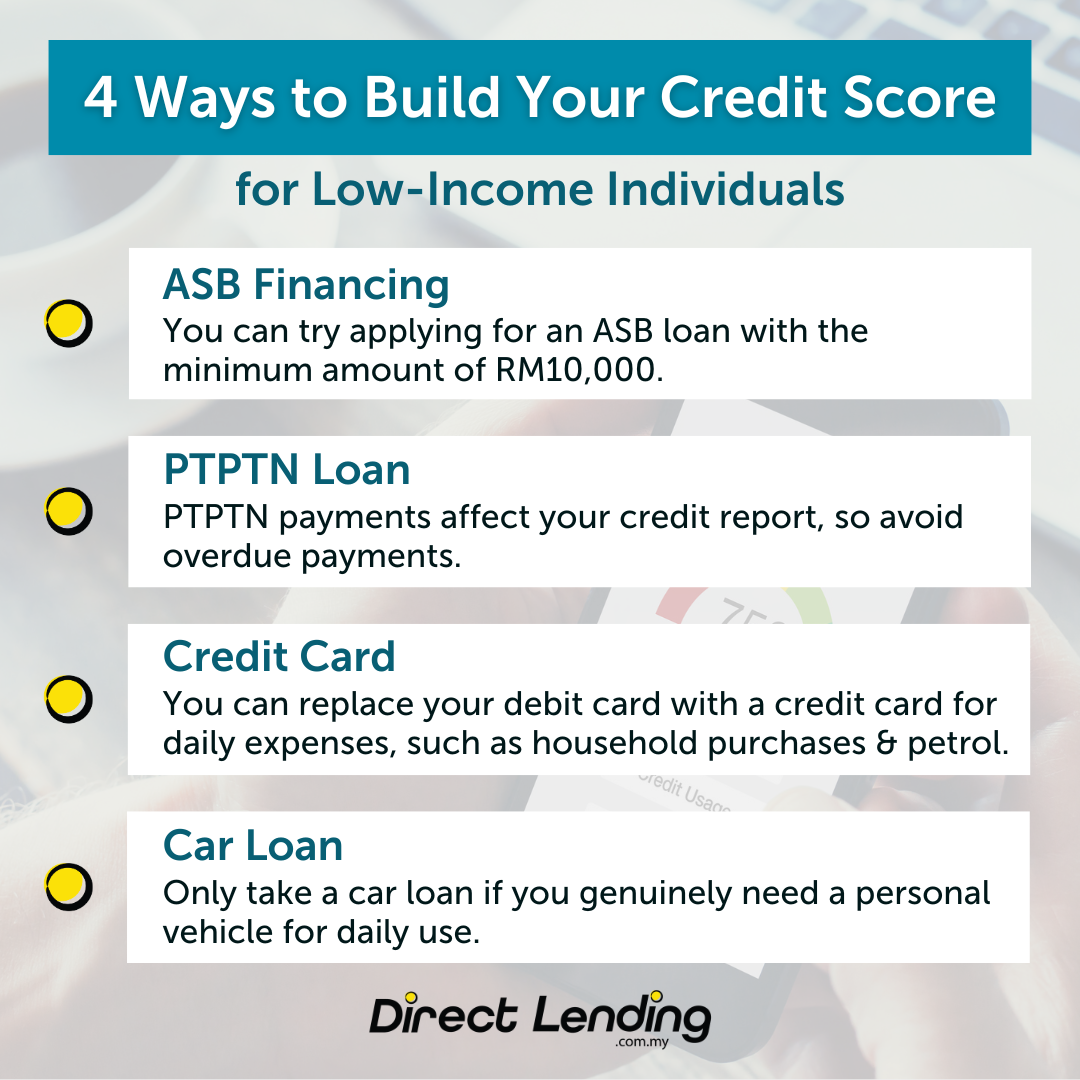

3. Maintain a Good Credit Score

Factors such as the debt-to-income (DTI) ratio and credit score are taken into account by the banks or any financial institutions to determine loan eligibility. Has your credit score status changed since you first took out your car loan? If your credit score has improved, it could help you secure a lower interest rate. Simply put, if your overall financial performance including your DTI ratio and credit score is in good condition, you have a higher chance of obtaining a more competitive refinancing rate.

4. Identify Your Key Financial Challenges

Refinancing your car is a practical choice if your income has been negatively impacted. A lower interest rate can reduce your monthly payments, helping you manage your budget more effectively. Alternatively, you can also consider extending your loan tenure to lower your monthly payments or consider a loan with a longer repayment period.

5. Reduce Monthly Financial Commitments

Refinancing helps lower your monthly commitments, even if interest rates fluctuate or your financial situation remains unchanged. If you receive a better refinancing offer for your car, be sure to evaluate all factors carefully. If the new car loan brings greater benefits and aligns with your financial goals, car refinancing may be a wise option for you.

Video: How to Reduce Monthly Commitment as Much as RM500

@directlendingmy Ini cara kami bantu untuk jimat komitmen bulanan hingga RM500 menggunakan teknik ⤵️ Penyatuan hutang ✅ Teknik mengumpulkan pelbagai hutang ke dalam satu pinjaman peribadi baru dengan kadar % yang lebih rendah. Nak tahu lebih lanjut - semak kelayakan PERCUMA di website Direct Lending! #penjawatawam #kakitangankerajaan #pinjamanperibadi #pinjamanonline #directlending #PlatformPinjaman ♬ Upbeat Energetic Indie Rock Pop Fun - SonicMusic

How to Refinance a Car Loan in Malaysia

What are the steps to apply for a car refinance? Different steps or documents might cater to different situations. However, overall, the steps below can be used as a reference if you are planning to make a car loan repayment.

1. Prepare all the required documents

If you want to refinance your car, it is mandatory to prepare information about yourself, your vehicle and your existing loan. Some of the essential documents required by the bank include identification documents such as your IC, your driver’s license, proof of income such as a pay slip, your employment confirmation letter and an income tax statement.

Important vehicle documents required include registration details such as the grant, insurance, VIN number and mileage. Next, you will also need to prepare documents on your existing loan that show information on the total loan amount and the balance, loan tenure and the existing interest rate. Make sure to prepare all the mentioned documents for a smooth car refinancing process.

2. Evaluate your credit score

Your credit score level plays an important role in the process of car refinance. You can get the best interest rates if your credit score is excellent. CCRIS and CTOS credit reports can be obtained from Bank Negara Malaysia, the Credit Counselling and Debt Management Agency and other relevant agencies without fees or charges.

Make sure to check and consider your credit score before applying for any car refinancing to avoid rejection. A good repayment record and consistently following the existing loan payment schedule for a year will improve your credit score and increase the possibility of banks approving your car loan refinancing.

3. Apply for a Car Refinancing

You can apply for car refinancing from a few banks and financial institutions so that you can compare their interest rates and benefits offered in the repayment package. With this method, you can have a more detailed analysis and get the most competitive offer with the lowest interest rate.

Besides that, one crucial thing to do while applying for a car refinance loan is to always ensure your credit score is not affected. It is advisable to apply all applications within the same period, ideally within 14 days. This indicates that all applications are part of a single request, helping to minimize any negative impact on your credit score.

4. Estimate Your Car’s Current Value

The estimated current value of your vehicle is one of the key factors to whether your car refinance loan is approved or not. Usually, if the current value is lower than the remaining loan balance, your application is less likely to be approved.

However, if the opposite situation happens where your vehicle’s current value is higher than the remaining loan balance, applying for car refinancing would be a wise decision.

5. Determine the Loan Term

Loan term is categorized into two: longer and shorter terms. If you choose a shorter loan term as you are accustomed to your previous loan payments, you can save money by benefiting from a lower interest rate and a shorter repayment period.

However, if you have any financial difficulties, you may opt for a longer loan term to reduce your monthly installments. This provides you the opportunity to rearrange your financial budget. Although this method has higher interest rates and longer loan periods, it is still the best alternative to maintain your payment record and good credit score despite your financial conditions.

6. Complete the whole process

If you have followed all the steps above, you may proceed to the final step which is to fill out all the necessary forms, submit all supporting documents, and complete the applications made with the choice of your bank or financial institution.

If your car refinancing application has been approved, your chosen bank or financial institution will work with you to clear the outstanding of your old loan and will do a new loan repayment method for you with lower interest as agreed in the new loan offer.

Benefits of Refinance Car Loan

1. Loan interest can be lowered

Two common terms in hire purchase loans through banks that we often come across are fixed rate and floating rate. As we all know, interest rates vary across banks and financial institutions. The amount of monthly installment is affected by changes in interest rates. If you are applying for a loan refinancing, you should choose a fixed and lower interest rate compared to your existing loan.

2. Monthly commitment can be reduced

For someone with relatively high monthly commitments, loan refinancing offers extra benefits to reduce existing financial obligations. A lower monthly payment and a longer repayment term allow individuals to have some extra cash on hand for more important expenses.

Your financing plan can be adjusted according to affordability

A financing plan that better suits your current financial situation can be chosen to align with your existing commitments. You can also select either a fixed or floating interest rate based on current economic changes.

Disadvantages of Refinance Car Loan

1. Increase in Debt

There is a risk in refinancing your car if the extra cash is not utilized wisely, as it can lead to increased debt due to higher long-term interest costs. To prevent this, loan repayment should be maximised to improve cash flow and enhance financial planning.

2. Increase in Liability Cost

Petrol prices, toll rates and car maintenance cost must be considered in a car loan repayment plan. All of these expenses significantly impact an individual’s cash flow, either directly or indirectly.

Video: 6 Ways to Refinance a Car Loan Before it is Fully Paid Off

Banks that Offer Car Refinancing Loan

You might not hear much about banks offering car refinancing loans, as most banks primarily provide refinancing options for home loans. However, in reality, you just need to find the right bank loan with suitable features to refinance your car.

Several factors can help you secure the best loan. Ensure the loan has a low interest rate, meets your eligibility criteria, or complies with Shariah law (for those who prefer non-conventional loans). For instance, you can consider applying for a personal loan from banks or cooperatives that offer lower interest rates and Shariah-compliant options for debt consolidation.

Apply Personal Loan for Debt Consolidation

Conclusion

All in all, car refinancing or car loan repayment has its pros and cons. If your answer to the question, “When should I refinance my loan?” is “in the near future,” you should carefully analyze all factors before committing to this new financial decision.

This article is prepared by Direct Lending, an online platform for personal loans from banks, cooperatives, and licensed money lenders. Our mission is to provide easy, safe, and affordable loans to hardworking individuals in Malaysia. We help you find, compare, and apply for personal loans that best suit your needs. Our service is 100% free with no hidden charges. We also offer an auto service installment plan, “Service Car Now, Pay Later,” which is Shariah-compliant for vehicle owners in need of financial assistance.