By Q

6 Car Loan Approval Criteria In Malaysia

The term ‘car loan’ is a term that is familiar to most of us and it is very commonly talked as car is a necessary asset to have now. It is the best not to only rely on the public transport for our daily commute.

If you wanted to own and drive a brand new car or a used car, car loan is one of the method that you can try by applying for car loan from bank. Other than buying a car on full on cash, this method is widly use in Malaysia.

But to get you car loan approved, it is not as easy as you might think especially if the car that you wanted to buy cost over hundred thousand. With that being said, you can try these 4 affordable cars as you first option as it can help you save money for oil, expenses, and save you life.

In this article, we will share with the tips and guidance on how to make sure that you car loan is ‘car loan approval criteria malaysia’ friendly. This will help your car loan journey be as smooth as your new drive.

Table of contents

- Car Loan Terms That You Must Know

- How To Know If You Fits The Car Loan Approval Criteria Malaysia

- 1. Healthy Financial Record

- 2. Salary That Can Afford Car

- 3. DSR (Debt Service Ratio) Value Not Over The Maximum Limit

- 4. Own A Driving License

- 5. Complete Document To Buy Car

- 6. Types & Working Status

- Video: 5 Car Loan Approval Criteria Malaysia

- Infographic: 5 Tips to Settle Car Loan Quickly

- Conclusion

Car Loan Terms That You Must Know

Before applying for any car loan, you need to know the various kind of terms that are frequently used in car loan process. This will help you to easily familiarise yourself and be more aware with the process of your car loan to make sure that it will be an easy ride.

1. Margin of Financing

To those who is unfamiliar with the term margin of financing, the amount by which the value of collateral provided as security for a loan exceeds the amount of the loan agreed by the bank.

The average car loan in Malaysia offers margin up to 90%. In a simple word, you only have to pay 10% of the down-payment from the overall price of the car that you wanted.

For instance, Perodua Bezza 1.0 Standard G- Auto that cost RM 36,580, you only have to pay the sum of RM 3,658 as the down-payment to the car seller which total up to RM 32,922 the total amount of the car loan that you have to pay to the bank.

2. Interest Rates

Each bank institutions in Malaysia use their owns respective interest rates but in general, the interest rate of affordable cars is higher than the interest rates for luxury cars.

Commonly, the average interest rates of brand new cars starts from 2.3 up to 3.5 percent. As for the average interest rates for used cars starts from 3.5 to 4.2 percents. There are a few aspects such as the total sum of the loan, the loan period, your credit history as well as the age and condition of the car that will determine the interest rates.

As for the types of interest rates, there are 3 different type of rates that are used by specific bank according to the product or the loan package that is offered. Fixed rate, floating rate and flat rate are some of the examples. Generally, bank will use flat interest rate for personal loan or hire purchase (car loan).

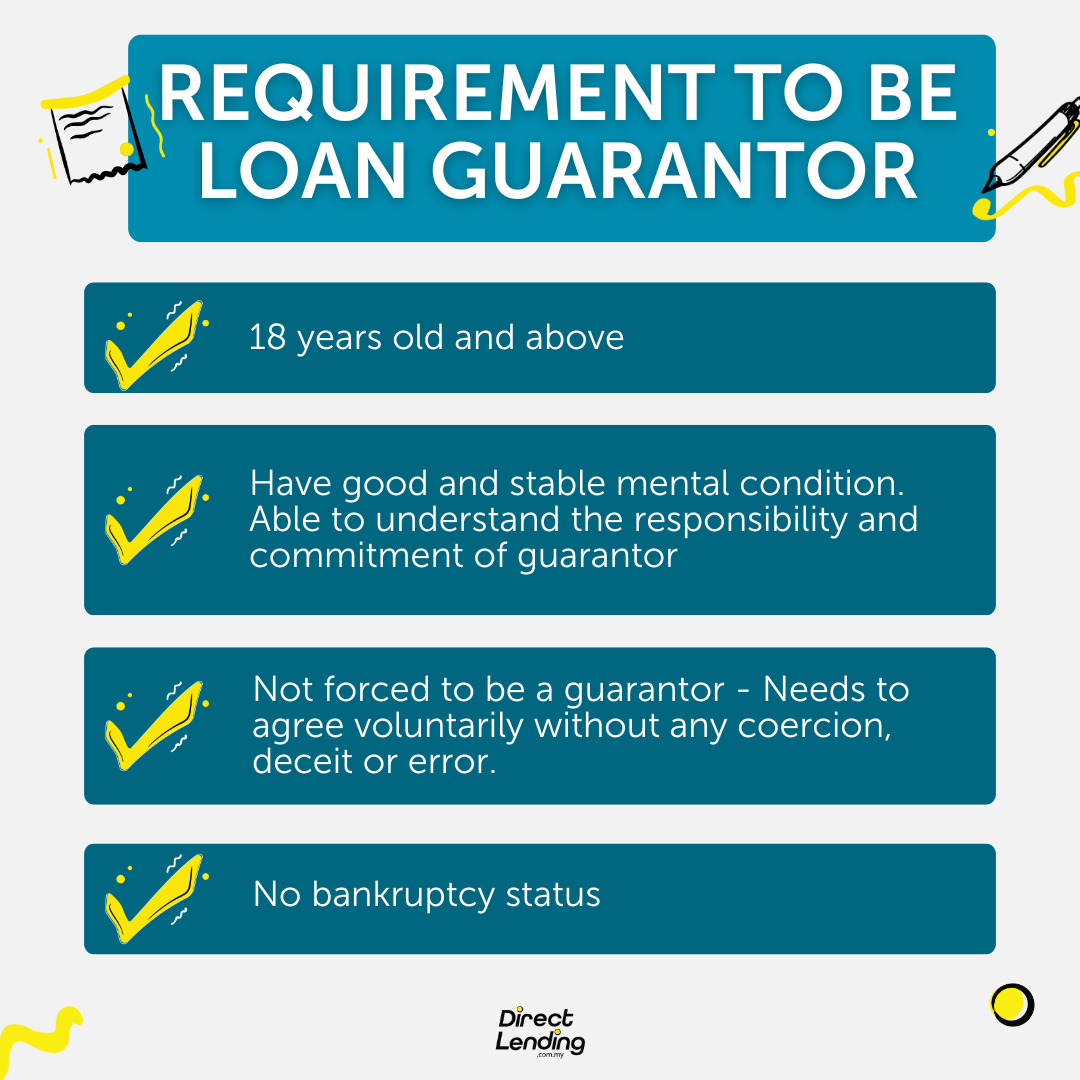

3. Car Guarantor

Car guarantor is a third party (usually close family or friends) that agreed to pay for your car loan if you were incapable to pay back the loan on any basis. A guarantor might be needed in the case of not having a stable income and a clean credit record or the current loan is higher than income percentage allowed by the applied bank.

The borrower and the guarantor have the same responsibility to pay off the car loan. If you were asked to be a guarantor, make sure you know the risk of being a loan guarantor before you sign any agreement with the bank.

Down here we have included the eligibility criteria of a car guarantor.

4. Repossession

Loan lender or specifically the bank, have the right to take away your car if you fail to pay the monthly instalment for two month in a row with the exception for borrower that have paid 75 percent from the total sum of loan.

5. Loan Period

The loan period for a brand new car loan in Malaysia is 9 years while for used car, the maximum loan period is only 7 years.

One basic thing that you need to knew is that the longer the loan period, the higher the interest rates that you need to pay to the bank. With that said, you are reminded not to be blinded by the low monthly installment.

What best to do is to be calculative and measure your budget ability. One wrong move and that could lead you to a grueling years ahead of scratching in the dirt to pay for your life commitments.

How To Know If You Fits The Car Loan Approval Criteria Malaysia

We also written down a list of tips and tricks that you can try to make your car loan journey easier and fits the car loan approval criteria Malaysia for an instant approval.

1. Healthy Financial Record

If you are planning to apply for a car loan, you need to know the condition of your credit score. One of the most important component that the bank is going to look for is what is your CCRIS and CTOS record.

Central Credit Reference Information System, in short CCRIS is credit information that is managed by Central Bank of Malaysia (BNM). Through this record, the bank can see if you have any arrears or if you made any late payments.

The bank will also look up if you are listed in the blacklisted borrowers. Read our article on how to clear up your CCRIS record to avoid your name from being blacklisted by the bank.

Next, the bank agency will also look through Credit Reporting Agency (CTOS) to see if there is any agency that reported you for failed payment or bill from company like Telco, a company that allows you to pay in installment like ‘buy now pay later’ and many more.

Your payment history for your personal loan, housing loan, credit card loan, student loan like PTPTN are all a part of the credit information that is managed by CCRIS and other credit reporting agency.

The main reason why your records are view is because the bank would like to analyse your history and tenure pattern. For best, avoid having any arrears or late loan payment as it will make your car loan process rough and does not fit the fast car loan approval criteria Malaysia

If you happen to have any arrears, make sure to settle the loan before applying for a car loan.

2. Salary That Can Afford Car

The minimum salary to apply for car loan differs according to the respective bank institutions. Commonly, banks in Malaysia put a benchmark where the borrower need to have the minimum of RM 1,500 and above for those who wanted to apply for a car loan.

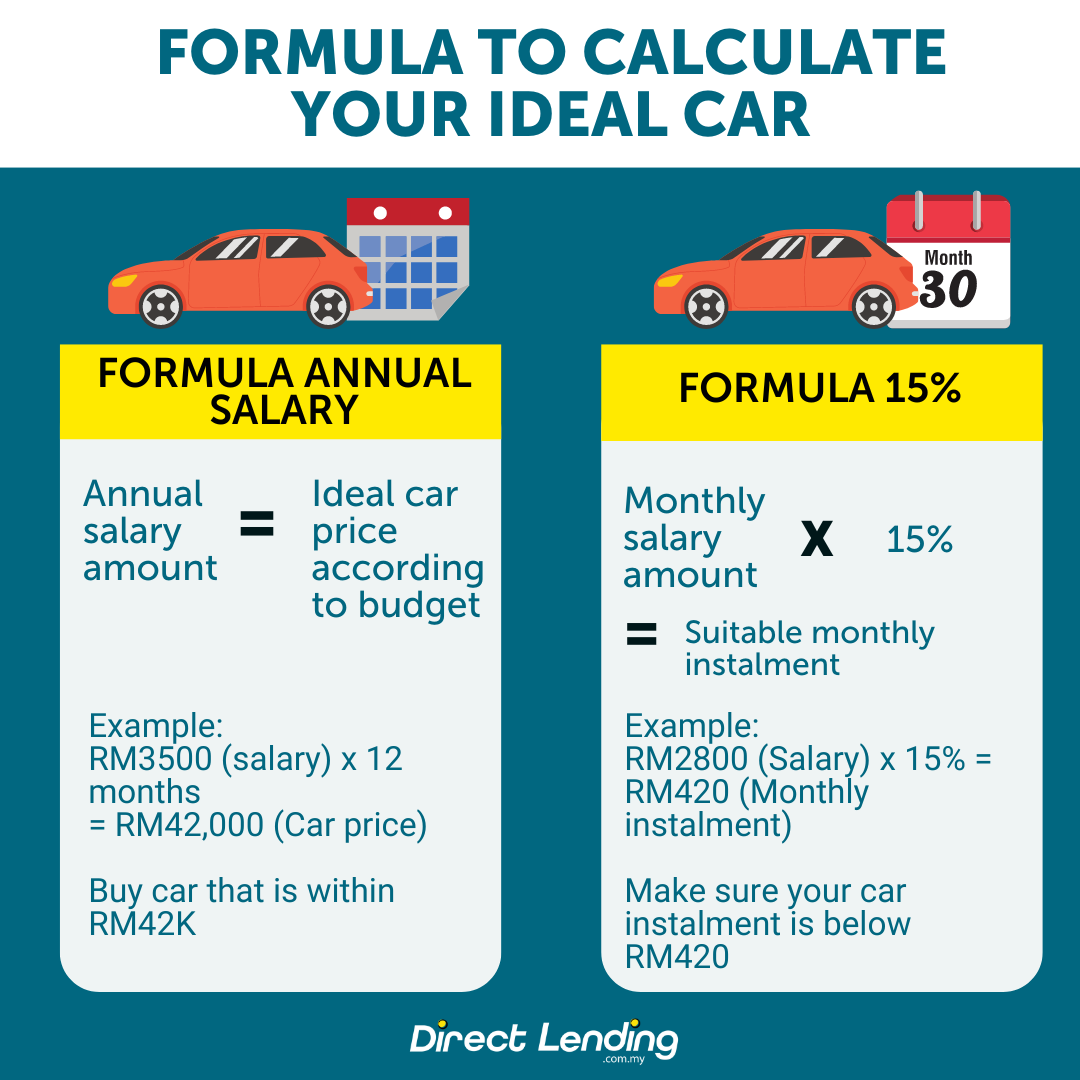

Even if you are someone who passes the eligibility criteria to make a care loan, you need to make sure that you really can afford to buy a car. Here we have attached a formula and easy calculation for you to use to identify if you can afford to buy and maintain a car.

How To Count Your Car Loan Ability

The Car Price Does Not Surpass The Annual Salary

The suggested price of car that you can be labeled as ‘affordable’ and should buy must not surpass your annual salary. The best example is, if you salary is RM 3,000, the car price that best suited you should be RM 36,000 and lower.

Monthly Installment Not More Than 15 Percent

As for the monthly payment, you are adviced to pick a car that the monthly fee is not more than 15 percent from your salary. This can be considered as the ‘safe amount’ that is suggested so that you wont be heavily burdened with monthly cost and other commitments that you need to pay every month.

Car: A Want or A Need

Think back the purpose of buying a car. If you wanted to buy a car to meet your daily need to make your life easier, then the purchase can be considered as a need. If you wanted to buy the car just for the fun of it or because of your interest or hobby, the purchase can be considered as a want. It is not a wrong thing to do but make sure that you are able to pay the cost involve to afford and maintain the car until the end of the loan period.

3. DSR (Debt Service Ratio) Value Not Over The Maximum Limit

One of the important component when you are applying for a car loan from the bank is the DSR value. DSR is a calculation or formula that is used by bank agency for them to identify the eligibility and ability of the borrower to pay back the amount applied.

In a simpler word, based on your net salary that you earn per month, how much you spend to pay loan and other commitments like PTPTN loan repayment, credit card loan, car loan, housing loan, ASB loan and others.

Higher the DSR value, harder it is for you to get a loan and fits into the car loan approval criteria malaysia. You can use DSR formula to count your eligibility for an easier car loan approval.

4. Own A Driving License

One of the minimum eligibility that you must have to apply for a car loan is to have an official driving license. Despite that, there are a certain bank intitution in Malaysia that allows the borrower to apply for a car loan without a driving license with a condition that the borrower must have a salary that is more than RM 3,000.

5. Complete Document To Buy Car

Uncomplete document is one of the most overlooked and easy mistake by the borrower which translate itself into a fatality which is getting your car loan rejected by the bank. That is why you need to make sure that every document that is requested by the bank is up to date and complete.

Other than that, inaccurate information and documents is one of the mistakes done when applying for a car loan. For instance, the amount that is transferred to your account is not similar to the amount of salary written on the salary slip. There is a case where the written pay slip is not the same as the amount that is cut off from your EPF statement.

This matter made the bank listed your bank statement as not convincing and make their own assumption that the pay slip was false. This is a very important as if the bank already rejected your car loan application once, it will be hard for you to make a new car loan application and the possibility of your car loan to be approved will be low.

Some of the supporting documents that you must present is a copy of your identification card, a copy of your driving license and others.

Down here, we have attached the document that you need in the process to apply for a car loan with the bank.

| Types of Borrowers | Documents Needed To Buy A Car |

| Civil Servants | 1. Copy of your self- identification card (MyKad) 2. Copy of your driving license 3. Bank statement 4. Copy of the latest 3 months payslip |

| Private Sector Worker | 1. Copy of your self- identification card (MyKad) 2. Copy of your driving license 3. Bank statement 4. Copy of the latest 3 months payslip 5. EPF statement |

| Self- Employed / Business | 1. Copy of your self- identification card (MyKad) 2. Copy of your driving license 3. Copy of the latest 6 months of company account statement 4. Copy of company registery (SSM) |

| Graduate Scheme | 1. Copy of self- identification card (MyKad) 2. Copy of driving license 3. Copy of offer letter (for borrower who just started working or less than 3 months) 4. Copy of verified diploma or degree transcript 5. The latest 3 months payslip 6. Copy of account statement |

| Student | 1. Copy of self- identification card (MyKad) 2. Copy of driving license 3. Student card 4. Guarantor documents – parents, working close relatives |

6. Types & Working Status

Your working status is also important in making sure that your car loan application are quickly approved. This is because the bank will look at your job sector or industry (ex: public sector or self-employed) and they will also look into your working status if it is contact or permanent working status.

For example, for those who is working or managing your own business with the condition the business is registered under SSM, you need to prepare at least the latest 6 months of company statement.

Other than that, your working period will also play a huge role in determining whether you car loan will be approved or not. This is because if someone does not have a stable monthly income, it will badly effect the monthly payment.

Watch our video on how to get a loan car approval for more details.

Video: 5 Car Loan Approval Criteria Malaysia

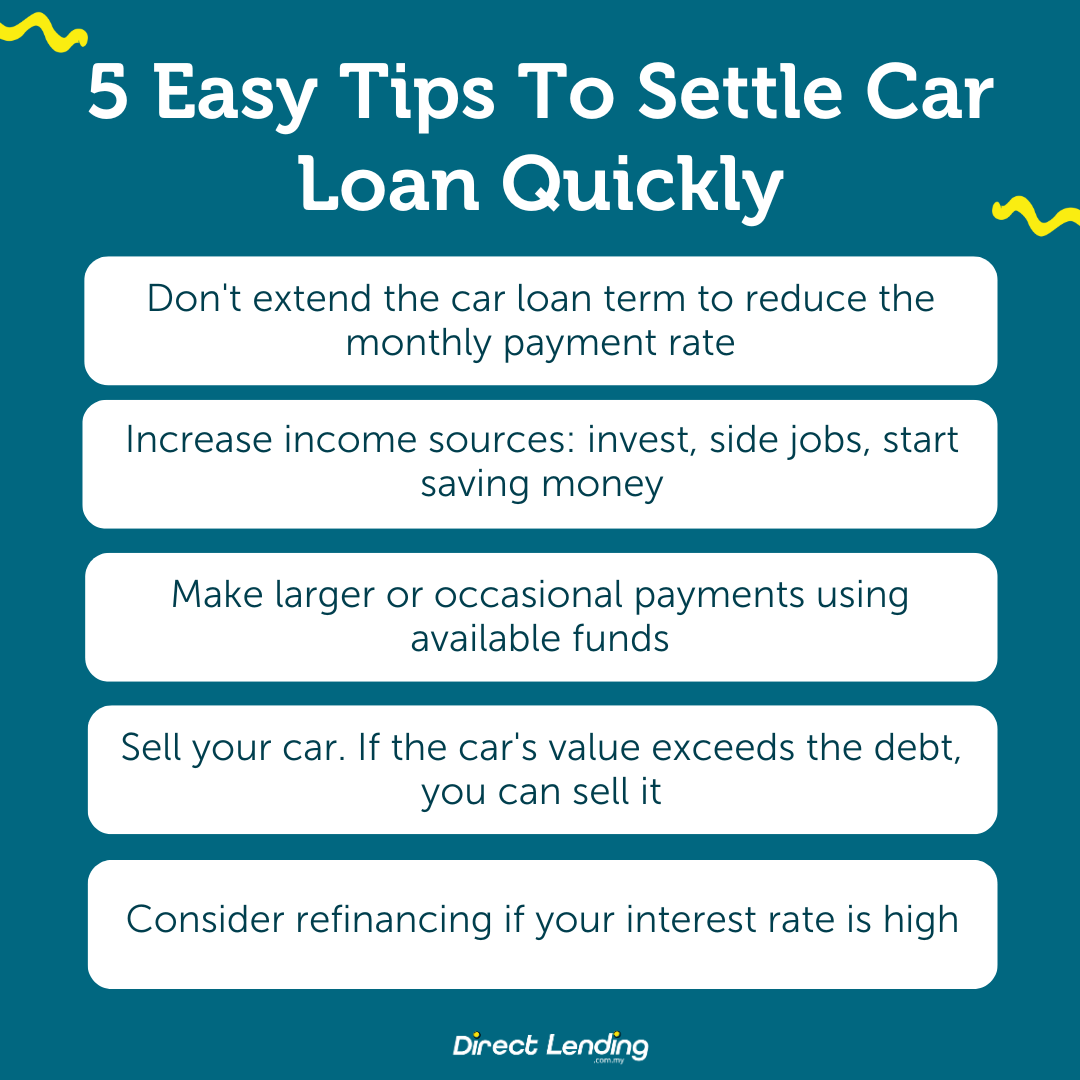

Infographic: 5 Tips to Settle Car Loan Quickly

Conclusion

Before applying for any car loan, make sure that you check and calculate your financial ability. Many people in Malaysia was declared bankrupt as the result of not being able to continue and finish their loan and car loan that they applied for.

Loan of any kind; be it car loan, housing loan, personal loan and others requires you to have a good background and monetary status. Hence why it is important for you to step up your financial management game and not to take the matter lightly.

If you are in need of personal loan or extra money to buy car, you can apply for bank and koperasi loan or personal loan from licensed moneylenders on the Direct Lending platform without guarantor.