By Yik Seong

Director

6 Effective Ways You Can Cut Your Petrol Cost

We can all agree that the cost of living in Malaysia has increased significantly. One of our daily necessities that have been increasing is the cost of petrol. A slight increase in petrol would impact almost everything around us from the cost of food to logistics to transportation and etc.

Table of contents

- 6 Effective Ways You Can Cut Your Petrol Cost

- 1. Don’t Keep the Engine on While Waiting

- 2. Service your Car

- 3. Clean Out Your Vehicle

- 4. Try Avoiding Traffic Jams

- 5. Make Use of Petrol Loyalty Card

- 6. Carpool More

- Video: Fuel Saving Tips and How To Calculate Your Car Fuel Consumption

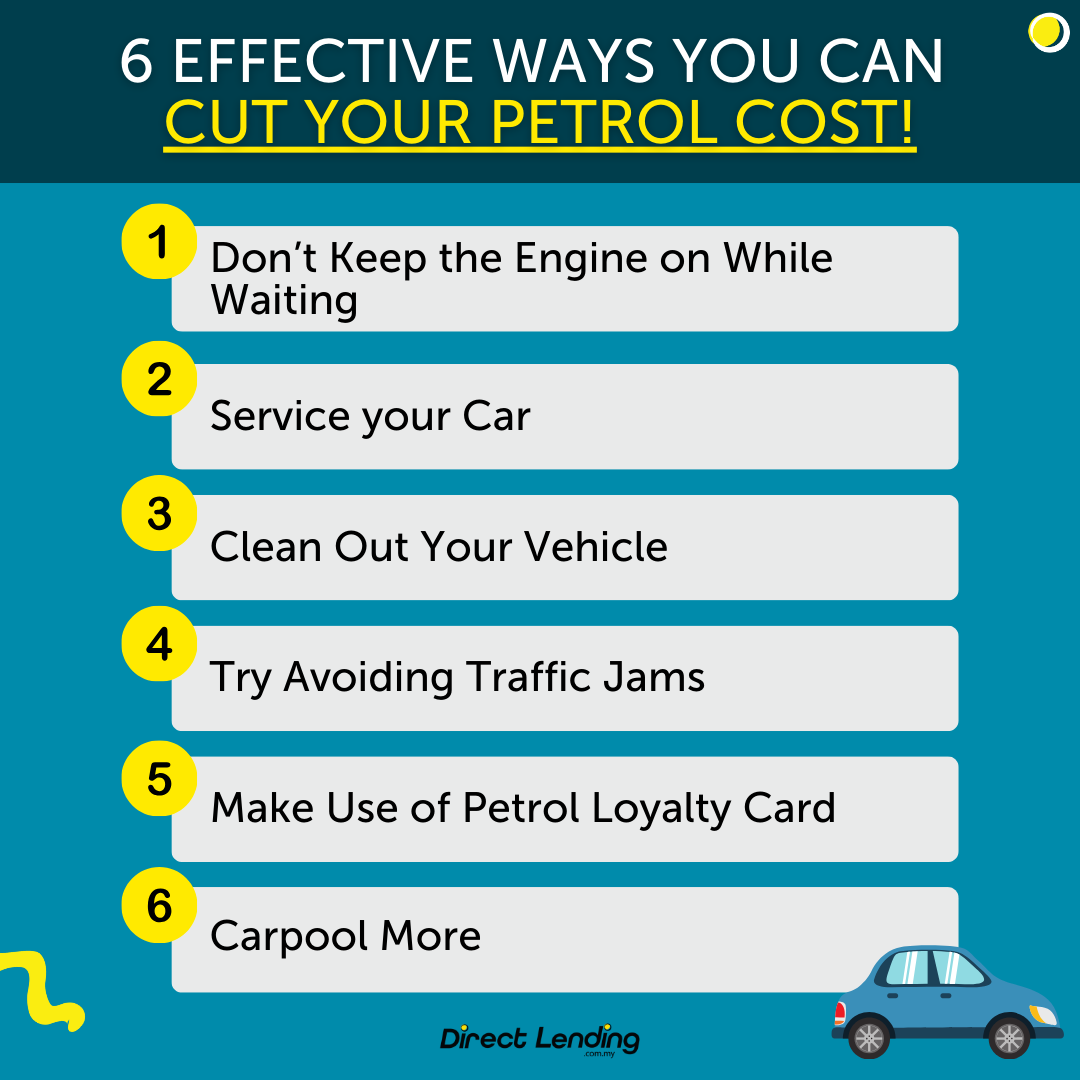

- Infographic: 6 Effective Ways You Can Cut Your Petrol Cost

- Fuel Subsidy for the B40 & M40

- To Be Mindful Of

6 Effective Ways You Can Cut Your Petrol Cost

Many of us Malaysians depend heavily on fuel to get around in our cars and motorcycles. Therefore, it is important to know some of the scientifically proven ways of saving petrol and thereby saving your monthly expenditures. Here are a few effective ways to cut your petrol cost!

1. Don’t Keep the Engine on While Waiting

If you have to stop for longer than 30 seconds for whatever reason, such as waiting to pick up your loved ones, or having to make a phone call, do try and turn the engine off. Keeping the engine idle for long consumes petrol that is not productive and does not keep your vehicle in motion.

Alternatively, if your car runs on ‘eco mode’, do activate it. Its start-stop feature would help to reduce fuel consumption when you put your foot on the brakes. This function is beneficial when you are stuck in a traffic jam.

2. Service your Car

Proper vehicle maintenance will not only sustain the health of your car but also improve fuel efficiency. Always set reminders for yourself on when is the next due service date. Moreover, another useful tip is to always ensure that your tyres are well-pumped! Inflated tyres are not only dangerous but also creates more traction which results in more petrol consumption.

3. Clean Out Your Vehicle

Carrying extra weight will put a strain on the car and will cause the car to require more energy and fuel to keep it moving. Clean out the back seat and storage of your vehicle to ensure that it is as light as possible, as this will minimise the drag effect.

4. Try Avoiding Traffic Jams

This may sound impossible to do, especially in urban areas and during peak hours, but minimising the time spent in traffic jams will go a long way in decreasing the amount of petrol consumed. This is due to the fact that constant stopping and acceleration burns up more oil than travelling in constant motion, preferably at a constant speed.

Tip: Plan ahead by checking Google Map or Waze before you begin your journey to find a faster route.

5. Make Use of Petrol Loyalty Card

Why not turn your petrol points into cash? Maximise the benefits offered by petrol providers. Ultimately, you may also want to prioritise your convenience first whereby you should find the nearest petrol station nearby your home or workplace. From there, then you may pick the petrol provider that offers the best benefits for you.

6. Carpool More

Although this step is not something you do directly to your vehicle, but it does help as you will have to bring out your vehicle less often. Even if you ride a motorbike, you can take turns with a colleague or friend and only take your bike out on alternate working days. This strategy may cut your fuel bill by up to 50% on a weekly basis.

Tip: Try apps like Droupr or Ryde for a cheaper fare and reducing carbon footprint too!

Watch this video for more fuel saving tips and how to calculate your car fuel consumption to help you save more when travelling.

Video: Fuel Saving Tips and How To Calculate Your Car Fuel Consumption

Infographic: 6 Effective Ways You Can Cut Your Petrol Cost

Fuel Subsidy for the B40 & M40

Recently, the government has announced some initiatives to help the underprivileged group B40 and M40. As highlighted in the Budget 2020, recipients under the initiative of Bantuan Sara Hidup (BSH) will receive RM30 monthly for car owners whereas motorcycle owners will receive RM12 starting from April 2020.

This fuel subsidy is only applicable for cars with engine capacity of 1600cc or over the usage of 10 years. The motorcycle subsidy is applicable for engine capacity below 150cc or over the usage of 7 years. This subsidy is applicable to one vehicle per individual. For individuals living in East Malaysia are not entitled to receive this fuel subsidy. Nevertheless, the price of RON95 is kept at ceiling rate which is RM2.08 (rate is accurate at the point when this article is written).

For motorists who are not BSH recipients will receive a Kad95 during first quarter of 2020. This special card subsidises their petrol with a discount of 30 cents per litre and limited to 100 litres per month for cars. As for motorcycles, its 40 litres per month.

To Be Mindful Of

In general, cutting petrol costs will definitely help you increase your monthly savings. However, for times when you need that extra money for an emergency repair, you can always consider taking a small personal loan from us. Know another way to keep petrol consumption down? Share your personal tips and tricks with us in the comments section below.

(This article was originally published on the 29th April 2017 and updated on the 18 June 2024).

About the writer

Yik Seong

Yik Seong is the founder of Direct Lending and Chartered Financial Analyst (CFA) Charterholder, with over 20 years of finance experience working in Malaysia, London, Singapore, and Hong Kong. Driven by his passion for finance, Yik Seong founded Direct Lending with a mission to provide safe and affordable financing to individuals with restricted access to credit channels. He enjoys long hikes during the weekend and never skips a morning coffee.