By Mandy

Marketing

Income Tax Exemption in Malaysia and e-Filing for Assessment 2024

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia (LDHN) whereby taxpayers are allowed to deduct a certain amount of money from their income tax. Some types of assistance include life insurance, medical expenses for parents, individual education fees, the purchase of a laptop or smartphone. With tax relief, it allows you to reduce your taxable income which will affect the tax rate charged.

If you manage your taxes well, not only it can save you a huge amount of money but also help with your personal financial management. Whether you are new to work or need a refresh on this topic, this complete guide can teach you how to fill up e-Filing for 2025 and tax deduction, relief, and rebate that you can claim.

Table of contents

- Are You Eligible For Income Tax In Malaysia?

- When Can You Fill Out e-Filing 2025?

- How to Register MyTax LHDN e-Filing 2025

- How to Fill Out LHDN e-Filing for the Assessment Year 2024

- List of Individual Tax Reliefs for Assessment Year 2024 LHDN (e-Filing 2025)

- Income Tax ByrHASIL 2025 Payment Method

- Pay Tax And Avoid Debt

Are You Eligible For Income Tax In Malaysia?

Who Needs To Pay For Income Tax?

Every month, you will receive a pay slip if you are employed. If your monthly salary is around RM2,833.33 (or more than RM34,000 annually) after the Employees Provident Fund (EPF) deduction, you need to pay taxes.

If you work independently or as a freelancer receiving income from Malaysian companies or have your own business, you also need to pay taxes if your income reaches RM34,000 annually. Some companies also deduct taxes from your salary.

Please note, the calculation of the individual income threshold that is NOT TAXABLE takes into account the annual gross income minus the individual's basic relief and eligible tax rebates. The table shows the individual income threshold that is NOT TAXABLE according to the type of assessment.

| TYPE OF ASSESSMENT | ANNUAL INCOME (RM) | MONTHLY INCOME (RM) |

|

Individual (Single / widow / widower / divorcee / spouse with no income) |

37,333 | 3,111 |

| Separate | ||

| 1. Married + 0 Children | 37,333 | 3,111 |

| 2. Married + 1 Child | ||

| 3. Married + 2 Children | 41,333 | 3,444 |

| Joint | ||

| 1. Married + 0 Children | 48,000 | 4,000 |

| 2. Married + 1 Child | 50,000 | 4,167 |

| 3. Married + 2 Children | 52,000 | 4,333 |

Note:

- The total individual and dependent relative relief is RM9,000

- The total child relief for children under 18 years old is RM2,000/child

- The rebate eligibility amount (for self and spouse) is limited to individual taxable income up to RM35,000

Why Should We Pay Income Tax?

The taxes you pay will be used by the government for national development such as building infrastructures, paying government officials, scholarships, facilities such as public recreation parks, educational institutions, health initiatives, security, defense, pensions, and including scientific and medical studies.

Consequences Of Not Paying Income Tax

1. Charged with 10% penalty

If you do not pay taxes, you could be penalized 10% of your taxable income. Assuming you have exceeded a month of not paying your income tax, you can be charged another 5% penalty. This can potentially be a source of outstanding debt so it is best that you settle your tax payments as soon as possible. For the list of full offenses, refer to LHDN website.

2. Court action

If you still do not pay your taxes after a period of time, do note that court action can be taken. Your property and personal belongings can be confiscated by the government. You can also be jailed if the tax debt remains unresolved even after your property is confiscated.

3. Not allowed to leave the country

Travel restrictions can be imposed if you have overdue outstanding debts. This can happen even if you are a director of a Malaysian company who does not declare or pay income tax. This can impact both your business as well as the quality of your life.

When Can You Fill Out e-Filing 2025?

The start date to fill out the e-Filing form for the 2024 assessment year is 1 March 2025. Therefore, please ensure that you already have a MyTax LHDN account to facilitate the e-Filing process.

The deadline for submitting income tax returns are as follows:

- For individuals without business income (Form BE):

- Manual submission by 30 April 2025

- e-Filing submission by 15 May 2025

- For individuals with business income (Form B):

- Manual submission by 30 June 2025

- e-Filing submission by 15 July 2025

How to Register MyTax LHDN e-Filing 2025

1. Apply to get an income tax number

If this is your first time paying taxes, before you use e-Filing, you need to register to get an income tax number. There are 2 methods to get an income tax number: online (e-Daftar) or manually by filling out a form at an LHDN branch counter.

Fill Out Form at an LHDN Branch

You need to manually obtain an income tax number at the nearest Inland Revenue Board of Malaysia (HASiL) branch. The required supporting documents are:

- CP600 form (can be downloaded from Forms > Download > Registration)

- Identification card (new IC, military, police, or passport)

- Business Registration Certificate (for individuals running a business)

- Income statement/pay slip

Register Online (e-Daftar) at MyTax LHDN Portal

This MyTax portal is a platform that provides primary access to ezHASiL services online, involving the Inland Revenue Board (LHDN).

The MyTax portal is the official website for using LHDN e-Filing, LHDN e-Daftar, ByrHasil for income tax payments, e-Janji Temu for appointment applications for Taxation, Real Property Gains Tax (RPGT), and Stamp Duty, among others. This portal is introduced to facilitate taxpayers in paying taxes on time without having to visit an LHDN branch.

The required supporting documents include a passport for Non-Malaysian citizens and a Business Registration Certificate (for individuals running a business).

2. Register to get the MyTax LHDN PIN number

Once you have your income tax number, you need to request a PIN number to activate your account on the MyTax LHDN portal.

How to Log In to MyTax (Registered Users Without a Digital Certificate)

e-CP55D – Application form for PIN number for first-time online login

- Click the e-CP55D button and you will be directed to the information confirmation page

- Click the YES button, ensuring the registered email information is correct

- Click the NO button if the email information is incorrect

- A Successful Registration Notification will be displayed when the user successfully logs in for the first time

- An activation link will be sent to the email registered with LHDN

- To activate the Digital Certificate, users need to click the activation link (URL) sent via email

- The link is valid for only 2 days from the date the email is received

After clicking on the link sent to your email, you can continue the process to register the digital certificate.

3. Register MyTax Digital Certificate

- The PIN number will be displayed

- Select the type of identification

- Click the Submit button

- Basic information confirmation will be displayed

- Ensure all information is correct, and create your password

- Create a security phrase

- Click Agree, and Submit

- If there are any changes, click Again

- The system will display a Successful status for the registered digital certificate generation

- Next, click OK

- After that, you can log in to the MyTax portal

4. Log In to MyTax (Registered Users with Digital Certificate)

- Please select the type of identification (IC number, Passport number, Military number, Police number)

- Please select the type of identification, enter the IC number, and submit

- Ensure the security phrase, enter the correct password, and click the login button

- A successful status notification will be displayed if the taxpayer successfully logs in to the MyTax main page

If the display shows that you do not have a digital certificate, you need to obtain a new PIN first to log in to MyTax with the digital certificate that will be sent to your email.

How to Fill Out LHDN e-Filing for the Assessment Year 2024

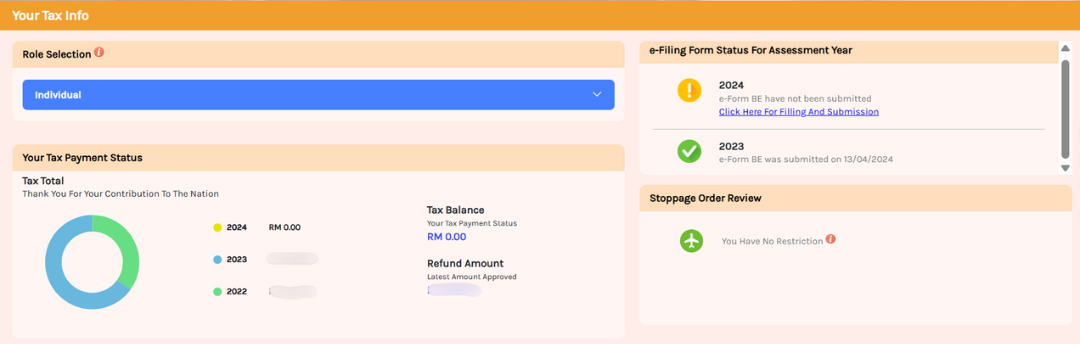

1. Go to MyTax portal for e-Filing 2025 login and click on "Click here for Filing & Submission" on the right menu.

2. Select the year of assessment for your status to fill out the form. (e-Borang BE for the assessment year 2024 will open from 01/03/2025)

Here is a list of LHDN e-Filing forms available on the MyTax portal for your reference:

Resident Individuals

- e-BE: No Business Income

- e-B: With Business Income

- e-BT: Knowledge Worker or Non-Citizen Holding Key Positions or Skilled Workers (Returning Expert Program) approved by the Minister – refer to P.U (A) 344/2010 or P.U.(A) 151/2012 on the Official LHDNM Portal

Tax Return Forms for Non-Resident Individuals

- e-M: Tax Return Form for Non-Resident Individuals

- e-MT: Knowledge Worker subject to approval by the Minister – refer to P.U. (A) 344/2010 on the Official LHDN Portal

Non-Individuals

- e-P: Partnership Tax Return Form

- e-E: Employer's Tax Return Form

The information on the e-Filing form is divided into 4 sections:

- Individual Information

- Statutory Income, Total Income, and Previous Years' Income Not Yet Reported

- Relief / Rebate / Tax Deductions / Tax Exemptions

- Summary

4. Please fill out all the required information completely to facilitate the calculation of your income tax and tax relief.

5. Finally, you need to verify the tax assessment form and then submit it to LHDN online.

6. If you are satisfied with the completed form, please click 'Sign & Submit'. Once you click, the Signature screen will be displayed. Enter your identification number and the correct password to submit the completed form.

List of Individual Tax Reliefs for Assessment Year 2024 LHDN (e-Filing 2025)

(updated on 13 March 2025)

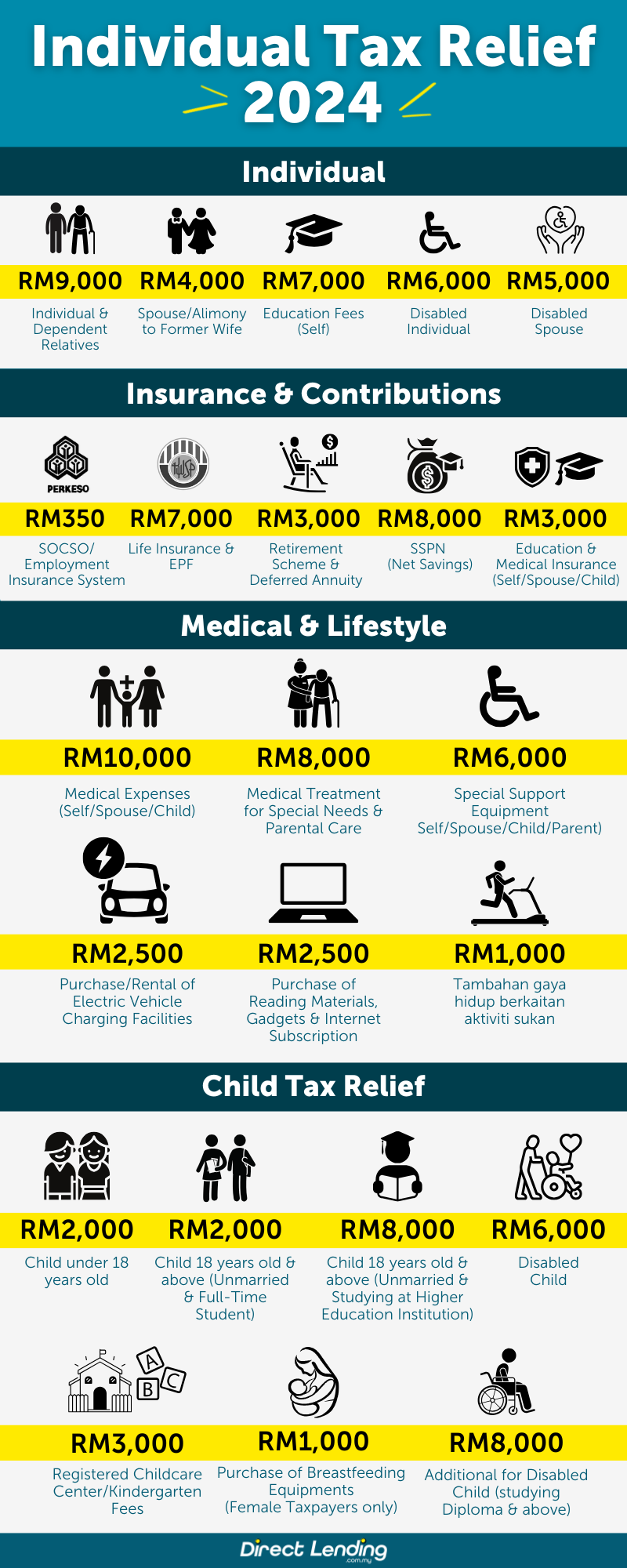

1. Individual Tax Relief

- Individual and dependent relatives: RM9,000

- Disabled individual: RM6,000

- Disabled spouse: RM5,000

- Spouse/alimony to former wife: RM4,000

- Self-education fees: RM7,000

2. Medical, Lifestyle & Related Equipment Tax Relief

- Medical expenses (self/spouse/child) with a total of RM10,000 for:

- Serious diseases

- Fertility treatments (self/spouse)

- Approved Vaccination (limited to RM1,000)

- Dental examination and treatment (limited to RM1,000)

- Limited to RM1,000 for these items: full medical check-up, COVID-19 detection tests, mental health check-ups or consultations

- Diagnosis/rehabilitation for Learning Disability Child (limited to RM4,000)

- Medical treatment for special needs and parental care: RM8,000

- Special support equipment (self/spouse/child/parent): RM6,000

- Installation/rental/purchase/facilities for electric vehicle charging for personal use: RM2,500

- Lifestyle: RM2,500

- Purchase or subscription of books or any reading materials

- Purchase of personal computer

- Purchase of smartphone/tablet

- Internet subscription fees (under own name)

- Any personal or skill development courses

- Additional lifestyle relief of RM1,000 related to sports activities (self/spouse/child)

- Purchase of sports equipment

- Gym membership fees or any sports training

- Rental/fees for any sports facility

- Registration fees for sports competitions

3. Child Tax Relief

- Child under 18 years old: RM2,000

- Child 18 years old and above:

- Unmarried/full-time student: RM2,000

- Unmarried/studying at higher education institution: RM8,000

- Registered childcare center/kindergarten fees for child 6 years old & below: RM3,000 (deduction only for either husband or wife)

- Disabled child: RM6,000

- Additional relief for disabled child RM8,000 (age 18, studying at higher education institution – Diploma/above)

- Purchase of breastfeeding equipment: RM1,000

- Only for female taxpayers

- Child under 2 years old only

- Claim made once every 2 years

4. Contributions/Donations Tax Relief

- Life insurance and EPF: RM7,000

- Life insurance premium/EPF (voluntary)/both: limited to RM3,000

- EPF (voluntary/compulsory)/approved scheme: limited to RM4,000

- PERKESO: RM350

- Retirement scheme and deferred annuity: RM3,000

- Medical and education insurance (self/spouse/child): RM3,000

- SSPN (net savings): RM8,000

Video: 5 Tax Relief that You Cannot Miss

@directlendingmy Top 5 Pelepasan Cukai e-Filling 2025, rugi kalau tak claim! ✅ Pemeriksaan & rawatan gigi ✅ Yuran penyertaan aktiviti sukan, gym membership & alatan sukan ✅ Insurans pendidikan & perubatan ✅ Telefon/laptop, bahan bacaan & bil internet ✅ Caruman KWSP #lhdn #pelepasancukai #pinjamanonline #pinjamanperibadi #directlending #PlatformPinjaman ♬ Tropical Haze - ALEKSANDAR KIPROV

Video: How to do e-Filing 2025 & Pay Income Tax LHDN via Online (1st Time)

Income Tax ByrHASIL 2025 Payment Method

There are 2 ways to make tax payments: FPX Payment Using Tax Identification Number or FPX Payment Using Bill Number. Both income tax payments can be made via FPX, credit card, debit card, LHDNM payment center counters, banks, post offices, and overseas money transfers. For income tax payments through FPX as a gateway for tax payments, users need to have an internet banking account with any bank that participates in FPX.

Pay Tax And Avoid Debt

Once you have filled and submitted the form for tax e-Filing, you will need to pay the amount listed as taxable income. Remember, you will be charged a 10% penalty in case of late payment and the next 5% would be charged if it is not paid after a month. If you want to avoid penalties and bad debt, it’s best to complete e-Filing and pay taxes as soon as possible. Be a responsible Malaysian so that your life, family, neighbors, and friends in this country can continue to remain peaceful and comfortable.

This article is written by Direct Lending – a personal loan platform from trustworthy bank & koperasi and licensed moneylender. Let us help you find, compare and apply for the personal loan that best suits you. Check your eligibility for free and receive affordable rates as low as 2.95% or as fast as 2 working days.

About the writer

Mandy

An ex-banker, digital marketer, and masters graduate from University of Coventry. Mandy enjoys filling in the gaps of financial literacy by transforming ‘dry’ financial topics into ‘digestible’ articles. She did a lot of ballet growing up and is always on the hunt for the best deals online.