By Sera

Marketing

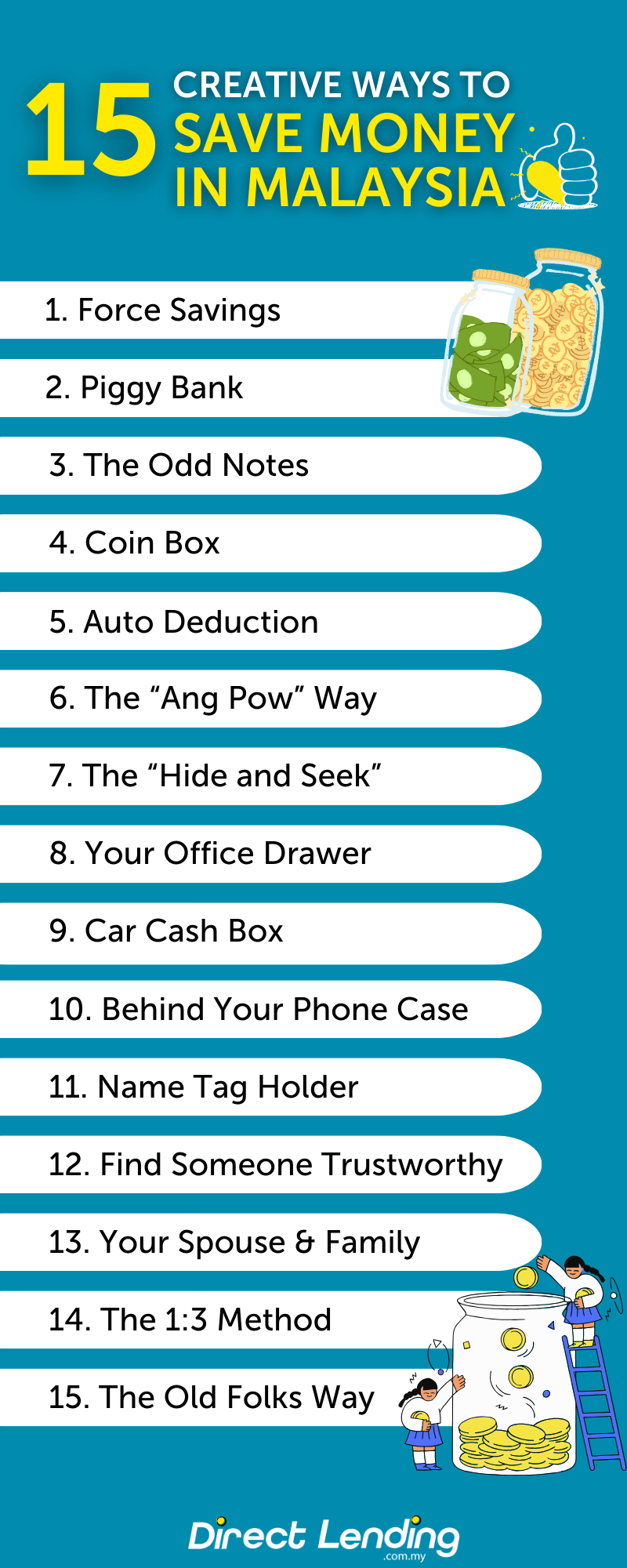

How To Save Money in Malaysia? 15 Creative Ways

There is no doubt that there are a handful of people whose salaries are always insufficient and worst, run out before the next one. So the question is, how to save money in Malaysia? According to the National Department of Statistics survey, as many as 63% who work within one to three years have savings that can last only less than a month.

It shows that many are still lost in translation to manage their expenses properly and if left unchecked, it’ll surely will impact and bring serious damages on the finances of Malaysians in the future. But the consequences above can be avoided and don’t panic, here are 15 easy ways to save money in Malaysia, even with a limited paycheck, you can still practice it according to your ability and financial situation.

Table of contents

- How To Save Money in Malaysia? 15 Creative Ways

- 1. Force Savings

- 2. Piggy Bank

- 3. The Odd Notes

- 4. Coin Box

- 5. Auto Deduction

- 6. The “Ang Pow” Way

- 7. The “Hide and Seek”

- 8. Your Office Drawer

- 9. Car Cash Box

- 10. Behind Your Phone Case

- 11. Name tag holder

- 12. Find Someone Trustworthy

- 13. Your Spouse & Family

- 14. The 1:3 Method

- 15. The Old Folks Way

- Infographic: 15 Creative Ways To Save Money In Malaysia

- Conclusion

How To Save Money in Malaysia? 15 Creative Ways

1. Force Savings

This is a suitable method for those who find it difficult to save or who are not disciplined. With this technique, you need to apply for a personal loan with a bank of your choice. For example, Amanah Saham Bumiputera (ASB) financing.

It is a form of savings and a great investment as well. Moreover, ASB itself can provide an average dividend between 5% to 7%.

So, you have no excuses for not being able to save money and having to set aside a portion of your salary to pay the monthly installments. But make sure to pay it consistently or to avoid the risk of skipping payment, you can create a hassle free automatic deduction from your bank.

Also, if you have a family and planning to save for your children, the National Higher Education Fund Corporation (PTPTN) has introduced a savings scheme in 2012 called SSPN-i Plus under ASB financing that comes with a Takaful Coverage.

2. Piggy Bank

Old but gold, this is the easiest and basic way to save up money and to spice it up, You can start focusing on saving from as low as the green note hiding in your wallet, yes RM5! The trick is that every time there is a RM5 note, set it aside and keep it in your piggy bank. So, why RM5?

We suggested a lower value so that you will feel more motivated when it works. Try to be strict on yourself such as the fund can only be opened after 6 months. In fact, you can choose to save RM10, RM20 or RM50, follow your ability and gradually increase it based on your stability.

3. The Odd Notes

With this technique, you can try to save money that’s easy to find such as RM1, RM5 or RM20 banknotes. Whenever these notes exist in your wallet, immediately separate them and put them in the fund. Give it a month period first and you’ll be surprise with the amount!

If you want a fixed amount of savings each month, this technique may not be suitable for you as each the amount may differ but it’s an easy way to nurture the savings habit in your routine.

4. Coin Box

Maybe many have started doing this technique since their early childhood days. You can always start saving up coins first if it’s harder to control the urge with bigger notes. This technique is ideal for those who do not like to put coins in their wallet. So you can save 10, 20, and 50 cents, and let’s be clear here it’s better to save it rather than having it scattered everywhere right?

You can set up a special storage of your choice to collect only 50 cent coins or collect all the coins into one place. It’s up to your own creativity.

5. Auto Deduction

This technique is also known as the Unconscious Technique. The way this technique works is that a portion of your salary will be deducted directly via an automatic deduction set up from your bank, and it’s also convenient because you can also set the date on which day you want to make transaction.

In addition, you can also open 2 savings accounts. One to receive your salary and the other as a savings account. So, when the salary comes in, you can make the auto deduction from A and move it to B for instance from your Maybank to your ASB account.

6. The “Ang Pow” Way

Yes, make use of your red, green or simply any envelope in your storage. Label each envelope according to its category.

Put the money in the envelope according to your expenses category each month and only use the money in each individual envelope for its purposes so it will train you to not overspend your money.

If you’re doing online businesses, you can use this method too. Divide your capital and profit. Your capital money shouldn’t be touched as it is used to keep the business pulse running. Make sure to be disciplined with this.

7. The “Hide and Seek”

Keep the amount you always use in the parts or compartments in your wallet. Insert RM20 or RM50 in the middle of your wallet or anywhere that you’ll find difficult to remove.

This method is effective to trigger the “Savings Nerve” in your mind as each time you realised the hiding notes inside your wallet, you will be aware that it’s hiding for you to save and not to splurge .

8. Your Office Drawer

Dedicate a special piggy bank in the office. You can buy a cheap one at the dollar store or use recycled items like a large cookie jar.

Follow your own creativity, decorate as you like if that inspires you. As long as the fund can give you the motivation to save. But, don’t forget to make sure that it’s hidden and locked in the drawer.

9. Car Cash Box

Inside your car, there are a few hidden components. Each car has a different design. So, try to explore a few small gaps where you can insert your ‘emergency’ money in.

But, make sure that you can also take out the money later on too. Or else it will get stuck in the components and that would be very troublesome for you.

10. Behind Your Phone Case

Many people use this technique on how to save money in Malaysia. Because maybe we’ll forget to take our wallet out, but our smartphone? It’s rare that will you forget, right? The amount is up to your choice. There are also many phone casing designs that have compartments to put your money called a ‘phone wallet’.

Various beautiful and cheap options are available on Shopee or any online stores. Just make sure your money is hidden and doesn’t attract unwanted attention.

11. Name tag holder

This technique is also common because many people save money in their name tags while working at the office. Similar to the mobile phone casing, this storage can also save you when you go out for our lunch because a in this modern days, who would want to carry around aa bulky wallet on the go?

12. Find Someone Trustworthy

Pick an individual, a loved one or someone you can fully trust. Why give money to others to save? Well because maybe that way you will feel hesitant to ask for the money back, or at least on a frequent basis. Without you realizing it, your money will slowly accumulate.

So, each month set aside the amount you want to save. It is better if the amount is 10-20% of your salary.

13. Your Spouse & Family

Make sure your partner can help to save instead of spending your money. Some may wonder why give money to others to save?

Well the reason is that again, you will be hesitant and reluctant to ask for the money back on every shopping weekend. So, soon the money will accumulate. The word of wisdom for this is that you may not be able to trust yourself once in a while but you can trust your mom always !

14. The 1:3 Method

When salaries or payments go into our accounts, we might find it difficult to monitor the ins and outs of the money. A simple method is the one to third method. This method will not burden you because the fraction of savings is quite low.

Suppose you earn a bonus, or salary from a side job. The amount obtained can be divided into three equal amounts. For example, if you earn RM900, transfer RM300 to a voluntary forced savings account, RM300 to a second savings account and the rest for personal use.

This is a smart and organized method because it allows you to track easily, allows you to build an emergency fund and of course to spend wisely.

15. The Old Folks Way

While the elderly do not have facilities like savings banks back then, they do have some unique ways and tips of saving that they actually practice. Some of the ways you might be familiar with, in case you saw your grandparents doing them such as inserting money in flower pots and in between books. This method may be less secure, but it is one of the unique additional ways for you to save your emergency money.

Infographic: 15 Creative Ways To Save Money In Malaysia

Conclusion

There are various way on how to save money in Malaysia, choose technique or way of saving that you feel best suit your individual needs. You can start saving with a small amount too!

Most importantly, you need to have the discipline and consistency to keep up. Start creating a ‘safety net’ because we don’t know what will happen in the future.

This article is written by Direct Lending – a licensed bank & cooperative personal loan platform and money lending. We can help you find, compare & apply for the loan that best suits you. Check your eligibility for free & get a loan as low as 2.95% or as fast as 2 working days.

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.