By Sera

Marketing

6 Tips To Start Save Money For A Wedding In Malaysia

Tying the knot between you and your loved one is a human nature and the ultimate goal in every relationship, but this modern century have brought us into the realization that save money for wedding in plan also means that it is not going to be sufficient with just the intention to, but also the amount of efforts needed to make it happen.

The usual dilemma in the planning is to go minimal or all the way, go big or go home. Moreover, the society and cultural expectations that revolves around us are playing a very significant role in most of the decisions along the process.

So what do you actually need to do to be able to solve this? So how to save money for wedding so it will be sufficient enough for your big day? In this article, rest assured as we’re going to summarize everything for you.

1. Set your goals, know your limit

The ultimate thing to save money for wedding is to discuss and negotiate the total amount of money you need for the occasion, deliberate this matter together with both your family and future in laws but remember to not get too swayed with the unimportant details but instead focus on the basic one instead. This is the time for you to be an analyst and stay honest to your own abilities.

Knowing your limit is the key in this process and avoid agreeing just to follow trends or comforting others feeling because you will sure bear the consequences of overspending and worst, debt in the long run. For instance, if you are going to get married two more years with a target of RM20,000, then every month you need to save about RM833.00. If the period is shorter, the amount of savings in a month will be even greater.

Also find several option and alternative for your checklist in this phase, always go for the cheaper solution with similar or almost quality, or even if you can DIY certain things then it could be a memorable thing to work on with your partner as well !

2. Add Motivation, Save Together!

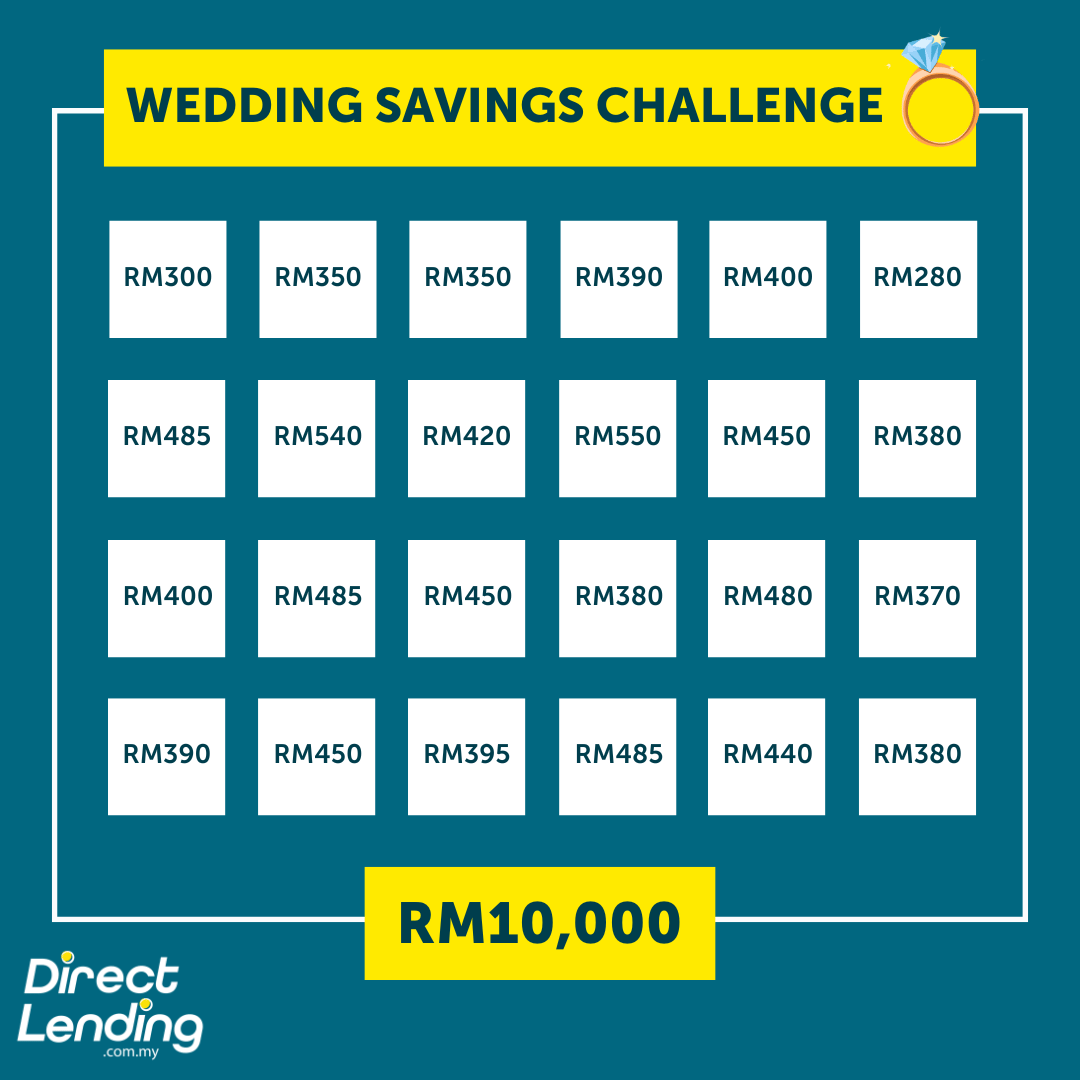

Try to set a timeline for example your wedding in 24 months, so both you and your partner will be responsible to save money and make it happen within the time frame. Via this method, you don’t need to have a dedicated account and amount but just trust between each other to make the dream day happen. If the target is RM20,000.00 for instance, each will be responsible to save up RM10,000.00. Subconsciously, within 24 months, you and your partner can collect RM20k in the savings. Make sure it is consistent and the tube does not leak !

And let’s debunk the myth that a wedding should only be bear by one party, it’s a joint love of two person for a reason. If you want to be a little more flexible, try to divide according to each other’s income. For example the person with higher incomes, can contribute more into the marriage fund.

From another perspectives, this method will also increase self -motivation because you are pursuing goals with your loved ones. This can also continue after the wedding with family and household finances plan.

Fun Even & Odd Techniques to Save Money with Your Partner ! :

a) Prepare pens, calendars & empty jars

b) Play rock paper scissors, wheel of luck or any method of your choice .

c) Then the winner can determine to pick even or odd numbers

Let’s say you choose an odd number, then your partner gets an even number. Therefore, on the 1st of each month, your partner needs to put RM1 into the jar and mark a ‘tick’ on the calendar dated the 1st.

The next day on the 2nd, you put RM2 into the jar and ‘tick-kan’ on the 2nd on the calendar. Then on the 3rd your partner enters RM3, the 4th you enter RM4, the 5th your partner enters RM5 and consistent until the end of the month.

d) The result

1+2+3+4+5+6+7+8+9+10+11+12+13+14+15+16+17+18+19+20+21+22+23+24+25+ 26+27+28+29+30 = RM465

If you consistently save for a year, RM465 X 12 months = RM 5,580 !

3. Save First, Shop Later

To save money for wedding, when you get your monthly salary, it is important to set aside the money for your savings first. Save at least 20% of your salary. The more, the better. We call this “Forced” but effective and no excuses method. No matter what, you can’t use that 20%. After deducting your expenses, the remaining balance can also be put into the fund. The calculation is this,

INCOME – EXPENSES = SAVINGS

Put it into a separate bank account to avoid confusion and unnecessary expenses . Amanah Saham, Tabung Haji and similar options is the best choice if you want to go this way, since it is difficult to withdraw and you will get the added dividend amount in your savings !

Some choose to keep it in a piggy bank every day. For example, as shared by Shaa Ismail who has collected almost RM12,000 with his fiancé by using this method :

RM1 on 1 day, RM2 on 2 days, RM3 on 3 days and so on up to 31 days. Eventually, you will be able to save almost RM500 a month.

If you’re not able to collect that amount, practice the habit of saving every day no matter how small the amount is . The important thing is to nurture the habit of saving in your routine, so that you can be more disciplined to save money for wedding.

4. Reduce expenses, Add savings

Among the examples of the “ want” is to buy clothes to follow the latest trends. Believe me, it will be a never ending cycle!

Also save on other expenses such as food and transportation. Maybe you can take public transportation or carpool where you can share the cost of fuel.

Before buying something, try to compare prices and find the best value , in most of cases you will find similar items at very different prices without the slightest reduction in quality.

Another way is to shop during bargain sales or during promotions. But be careful. Don’t over – buy anyway. Use a coupon if available. This really saves even if only a few bucks is the difference for one item.

5. No to Loan , No to Debt

Many people make mistake when they choose the short cut by making a personal loan instead of save money for wedding. As a result, there are many cases where they have to bear the burden of debt in the long run to the detriment of the marriage.

If you do not have funds in hand and need to apply for a loan only for the purpose of marriage. Maybe you need to reduce the cost of the wedding or in some cases postpone the wedding until you are sure everything is enough.

What’s important, don’t put yourself in risks that are actually avoidable because the worst thing in life is living with regrets , remember that ! The same applies if you have short-term debts such as credit cards, debts from licensed money lenders or other similar debts. This is also the best time to stop using credit cards, especially if you have a habit of spending beyond your means.

6. Find side income

Currently, 79% of Millennials want to generate ‘side money’ to cover the higher cost of living. So, many people sacrifice their time to supplement their monthly income. Examples of work that can be done in your spare time are as a food deliveryman, do a food review on YouTube, be a translator, and so many other things .. the possibilities can be explore just a fingertip away online !

This is not solely to save money for wedding, but for those who are planning on buying a first home, buying a car and other purposes. In addition to making savings from primary income, side income can help to speed up the process of achieving your savings goals. It does take time and energy but will be worth to do, especially at the young age .

Beautiful Wedding Dates in 2023

January

1.1.23 (Sunday)

21.1.23 (Saturday) School Holiday

23.1.23 (Monday) Chinese New Year

February

3.2.23 (Friday)

12.2.23 (Sunday)

23.2.23 (Thursday) School Holiday

March

3.3.23 (Friday) School Holiday

12.3.23 (Sunday)

23.3.23 (Thursday)

April

14.4.23 (Friday)

23.4.23 (Sunday) 2nd Syawal

24.4.23 (Monday)

May

4.5.23 (Thursday) Wesak Day

5.5.23 (Friday)

25.5.23 (Thursday)

June

3.6.23 (Saturday)

16.6.23 (Friday)

23.6.23 (Friday)

July

7.7.23 (Friday)

23.7.23 (Sunday)

27.7.23 (Thursday)

August

18.8.23 (Friday)

31.8.23 (Thursday) Independence Day

September

2.9.23 (Saturday)

3.9.23 (Sunday)

9.9.23 (Saturday)

23.9.23 (Saturday)

October

1.10.23 (Sunday)

21.10.23 (Saturday)

22.10.23 (Sunday)

November

3.11.23 (Friday)

11.11.23 (Saturday)

23.11.23 (Thursday)

December

2.12.23 (Saturday)

23.12.23 (Saturday)

31.12.23 (Sunday)

Video: How To Save Money For A Wedding In Malaysia

Conclusion

To save money for wedding is not an easy thing, but with high effort and discipline, it can be realized. A wedding is a special day, yet this does not mean it should be done lavishly. Enough with the union of two souls who promise to pursue mutual happiness in sorrow and in joy, in the good times, and in the bad .. till death do us apart .

This article is written by Direct Lending – a licensed bank & cooperative personal loan platform and money lending. We can help you find, compare & apply for the loan that best suits you. Check your eligibility for free & get a loan as low as 2.95% or as fast as 2 working days.

Get more money saving guides and financial tips on our Telegram channel!

About the writer

Sera

A UiTM graduate, digital marketer and content creator since 2018. Sera writes about anything, from career advice, lifestyles, and finance. A person who cannot live without coffee, and sometimes she spends too much time on Twitter and TikTok.