(This article is initially published on 3rd May 2021 and is updated on 23rd April 2024).

No upfront payment Direct Lending's service is 100% free

Tiada bayaran pendahuluan servis Direct Lending 100% percuma

By Ehsan Marisah

Content Creator and Business Journalist

7 Things About PTPTN Loan Repayment That You Should Know

General April 23, 2024

April 23, 2024 7 minutes read

7 minutes read

April 23, 2024

April 23, 2024 7 minutes read

7 minutes readBy Ehsan Marisah

Content Creator and Business Journalist

Related posts

Skim Pinjaman Pendidikan, Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) is a national student loan scheme that aims to provide financial aid to students undergoing higher education in local higher education institutions or IPTs (Institusi Pengajian Tinggi).

This scheme was founded in 1997 along with the National Higher Education Fund Act 1997 (Act 566) as a way to have a uniform and regulated means of financing for higher education in this country. Since it is a loan, graduates are responsible in making sure they are paid off accordingly after their studies.

Despite that, we often hear of people struggling to pay off their PTPTN loans even when they are in steady employment. Therefore, this article is a comprehensive guide to how you can plan your PTPTN loan repayment and eventually pay them all off.

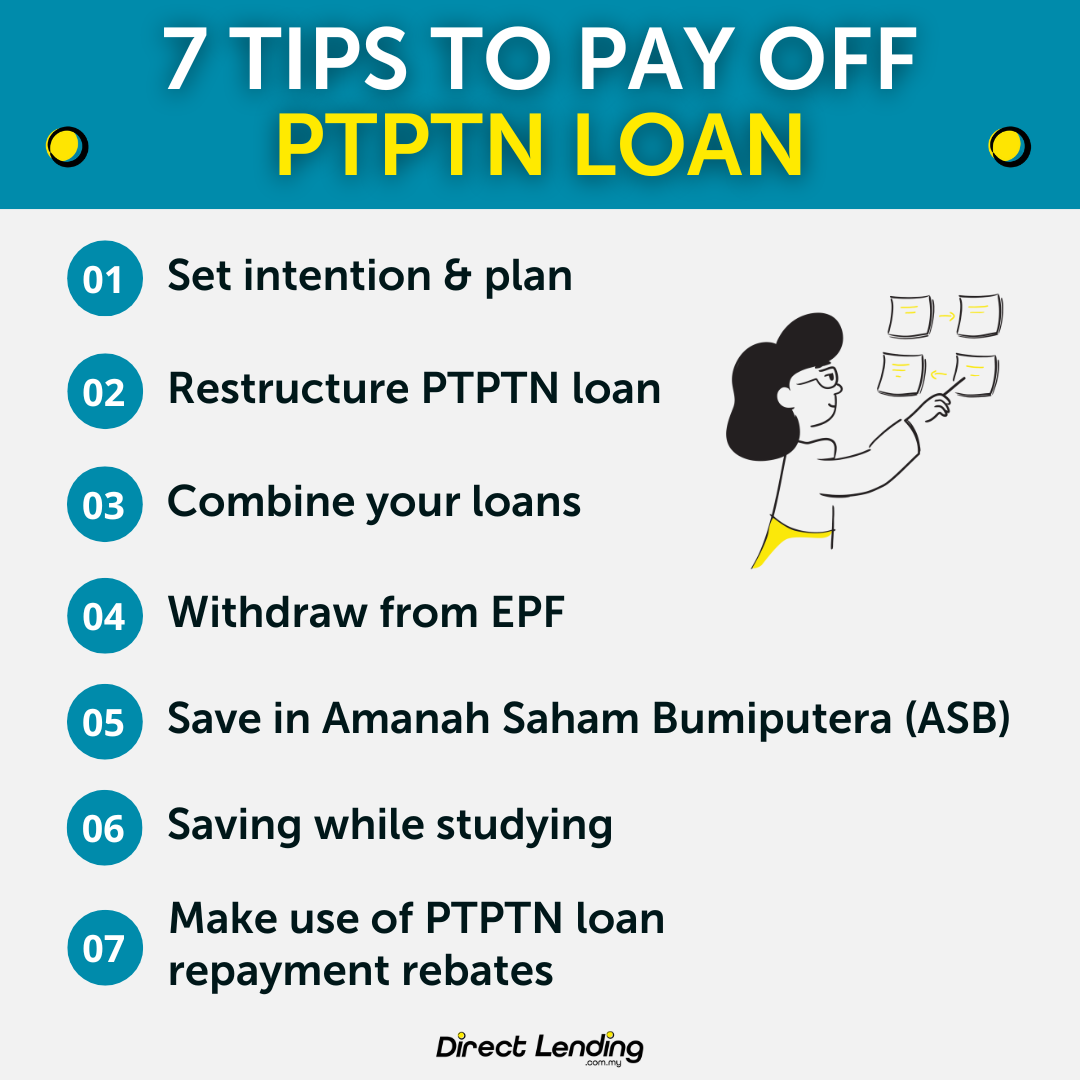

Tips To Pay Off PTPTN Loan

1. Set Intention & Plan

It can be helpful to plan when do you want to pay off the debt by. This can be a way for you to choose the correct repayment plan and channel that suit you.

2. Restructure PTPTN Loan

You are welcome to visit any PTPTN counters or call them on their customer service hotline to enquire about the restructuring of your PTPTN loan repayments.

One of the schemes that PTPTN may recommend to you is to convert your loan from a conventional scheme to an Ujrah scheme.

This scheme charges a service charge of as low as 1% p.a. as compared to the conventional scheme, which charges 3-5% service charge.

3. Combine Your Loans

Perhaps you have borrowed from PTPTN for several education levels, like diploma, undergraduate and postgraduate studies. You can actually combine all of these loans to enjoy only one management fee rate that will surely provide you some savings.

This combination will also be converted into the Ujrah scheme to further reduce the fees that will be borne by you.

4. Withdraw From Employees Provident Fund (EPF)

You can opt to withdraw the savings in the Account 2 of your EPF contributions to pay off PTPTN loans. This is one of the few purposes where this is allowed, as it is not necessarily a withdrawal that can plainly harm your retirement savings.

Some advantages to this include:

- Borrower can withdraw from their own EPF Account 2 or their parents’.

- No withdrawal limit as long as there is still balance left in the account.

- Zero processing fee.

- Borrowers can enjoy savings on service charge and shortened repayment term.

5. Save in Amanah Saham Bumiputera (ASB)

Saving in ASB takes some amount of determination and consistency. However, this method can give you dividends that can in turn be used to pay off your PTPTN loan.

This dividend surplus, added with perhaps monthly salary deductions to PTPTN, can accelerate your repayment process.

6. Saving While Studying

You do not necessarily have to wait until you start working to start paying off your student loans. While studying, you can also get additional income that can be used to support your expenses or to be saved for the future.

Some of the side hustles that students can try are signing up as product dropship agents, working part-time in retail, or take part in the gig economy by providing e-hailing services or working as food delivery riders.

7. Make Use of PTPTN Loan Repayment Rebates

PTPTN has introduced several initiatives to encourage borrowers to repay their loans, including:

- 15% discount for full PTPTN repayment

- 12% discount when borrowers pay off at least 50% of the total loan amount in a single payment

- 10% discount for scheduled salary deductions/direct debit

Ways To Repay PTPTN Loan

Borrowers are responsible to pay back the PTPTN loan amount as well as other costs including service charge, takaful insurance, stamp duty and other payments that are required as per the loan offer letter.

PTPTN Loan Repayment Duration

1. Borrowers are required to start repaying their loans 12 months after their study period ends WITHOUT having to wait for a Repayment Notice to be issued by PTPTN.

2. The monthly service charge (Ujrah) begins on the 13th month.

3. Borrowers that make repayments earlier than after the required 12 months will not be charged with the service charge during that period.

4. The repayment duration for borrowers who have converted to the Ujrah scheme will be based on the outstanding balance.

i. Physical counters

| Channel | Remarks | Charge (RM) | Processing Time (in business days) |

| PTPTN Counters (nationwide) | |||

| Cashless payments through Electronic Data Capture (EDC) Terminal using: a. Debit and ATM cards with MEPS logo b. Credit card (only Visa and Mastercard allowed) | – | 3 | |

| Agent Counters | Bank Islam | 1.00 | 3 |

| Bank Rakyat | 0.50 | 3 | |

| Pos Malaysia | 2.00 | 7 | |

| CIMB Bank | 2.00 | 3 | |

| Bank Simpanan Nasional | 0.50 | 3 | |

| Salary Deduction | Salary deduction through the Accountant General’s Department of Malaysia (JANM) or respective employer. The application for salary deduction can be done online. | – | – |

| Direct Debit | Scheduled deductions from borrower’s Savings/Current Account. Apply for Direct Debit here. |

– | – |

| PayQuik Kiosk | Loan repayment and cash deposit channel Payment guide PayQuik location |

1.00 | 1 |

| Razer Cash in 7-Eleven | Loan repayment and cash deposit channel Payment guide Check for Razer Cash in 7-Eleven | 1.00 | 3 |

| Digi Kiosk | Loan repayment and cash deposit channel Payment guide Digi Kiosk location | 1.00 | 3 |

| e-pay | Loan repayment and cash deposit channel For more information, click here. E-pay service can be accessed at places like Caltex, KK Mart, Mydin, myNEWS.com, PAK GROCER, Petron, etc. | 1.00 | 1 |

Note: Payments must be done latest by the 27th of each month to ensure the transaction gets recorded in the current month’s statement. Transactions made after this date will be recorded in the following month’s statement, except for transactions that are made at PTPTN counters/with PTPTN Marketing Executives.

ii. Online

| Channel | Remarks | Charge (RM) | Processing Time (in business days) |

| Online Banking | Bank | – | – |

| Bank Islam | 1.00 | 3 | |

| Bank Rakyat | 0.50 | 3 | |

| Maybank | 1.00 | 3 | |

| Public Bank | 1.00 | 3 | |

| RHB Bank | 1.00 | 3 | |

| Pos Online | – | – | |

| Affin Bank | 1.00 | 3 | |

| AmBank | 0.50 | 3 | |

| Agrobank | 0.50 | 3 | |

| CIMB Bank | 0.50 | 3 | |

| Bank Simpanan Nasional | 0.50 | 3 | |

| JomPAY |

|

– | 3 |

| MyPay |

|

0.50 | 3 |

| Shopee |

|

1.00 | 3 |

| kiplePay |

|

1.00 | 3 |

| BESTPay |

|

1.00 | 3 |

| KelantanPAY |

|

0.80 | 3 |

| PTPTN Official Portal FPX *Loan statement is also obtained here | List of banks:

|

– | 1 |

Note: Payments must be done latest by the 27th of each month to ensure the transaction gets recorded in the current month’s statement. Transactions made after this date will be recorded in the following month’s statement, except for transactions that are made at PTPTN counters/with PTPTN Marketing Executives.

Source: PTPTN

iii. Salary Deduction

- Starting September 2015, all PTPTN borrowers working in the civil sector are REQUIRED to sign up for repayment by salary deduction.

- Beginning 1st November 2015, matters regarding payment by salary deduction are handled by PTPTN instead of the Inland Revenue Board (LHDN). Click here for the procedure for payment by salary deduction.

- Salary deduction MUST be based on the Repayment Schedule (JBB) and any deduction less than what has been stated is NOT ALLOWED. Deductions above what has been stated must first be informed to PTPTN.

- Each deduction is only for the current month and any outstanding balance will need to be solved through a different channel.

- The minimum current balance to qualify for salary deduction is RM500.00, while the remaining repayment duration is 6 months.

- Click here to apply for salary deduction.

Cancellation of Salary Deduction Plan

- Borrowers are NOT PERMITTED to cancel their salary deduction plan while there is still outstanding balance to be paid.

- Cancellation is only permitted for the following cases:

- Borrower has paid off the entire loan amount;

- Borrower has been declared bankruptcy by the Department of Insolvency Malaysia; or

- PTPTN has received information from the borrower or their employer on termination of service or job change.

- Borrowers will need to submit a Borang Permohonan Pembatalan Potongan Gaji to PTPTN.

Failure to manage salary deductions by employers

Employers that fail to comply with managing their employees’ salary deductions will be subject to legal action. Once a written notice from PTPTN has been received, employers are required to arrange for monthly salary deductions for the employee in question. Failure to comply can be subjected to a fine of not more than RM20,000 or jailed not more than 1 year or both.

iv. Withdrawal from KWSP

- A borrower or their parents (whom are registered EPF contributors) are allowed to withdraw from the EPF Account 2 for the purpose of repaying PTPTN loans.

- The borrower can choose either partial or full Account 2 withdrawal for this purpose.

- Starting 1st April 2016, borrowers can apply for withdrawal for the purpose of repaying PTPTN loans online via Withdrawals.

Advantages of Pay PTPTN Through EPF Withdrawal

- Borrowers can use their own Account 2 or their parents’ accounts (subject to terms & conditions).

- No withdrawal limit.

- Withdrawals can be made more than once as long as there is still balance in Account 2.

- No processing fees charged.

- Borrowers can enjoy savings on service charge and shortened repayment term.

Terms and Conditions For EPF Withdrawal

- Open to all years of study, whether the EPF Member’s own studies, or Member’s child.

- The permitted level of studies are Diploma and higher.

Note: All rules and policies for EPF withdrawals for PTPTN repayments are subjected to EPF.

How to Apply for EPF Withdrawal

Online Withdrawals is an online withdrawal application submission through the EPF Website for members who have an i-Akaun. The application steps are as follows:

- Step 1: Login to the member’s i-Akaun, click the Withdrawal Tab, e-Withdrawal and click New Application to start the transaction.

- Step 2: Check the status of the application via SMS or Security Message Inbox in i-Akaun.

- Step 3: Visit any EPF branch for Thumbprint Identification (CIJ) together with the supporting documents that have been stated by EPF.

- The purpose of this identification is to determine the validity of the member’s identity as the applicant and to leave member’s thumbprint on the confirmation notice as proof of submitting the application.

Note: Members are given a period of fourteen (14) days to visit the EPF counter from the date the Security Message is sent to the i-Akaun inbox and the deadline for the Thumbprint Recognition (CIJ) process is also notified via SMS. If the member is not present within that period, the application will be canceled automatically.

Payment Period EPF will process the completed application within a period not exceeding 15 working days from the date the member visits the EPF Counter for Thumbprint Identification (CIJ) and submission of supporting documents.

i-Account Registration

1. obtain the i-Akaun Activation Code (6 digits) via: – EPF Call Center at 03-8922 6000 – EPF Kiosk – EPF counter

2. Activate the i-Akaun using the Activation Code within 30 days.

PTPTN Loan Repayment Exemption

Conditions for PTPTN loan repayment exemption

- Currently undergoing a full-time undergraduate study program;

- Received a First Class Bachelor’s Degree with Honours from an IPT;;

- Completed course of study within stipulated time as per the PTPTN loan offer letter;

- PTPTN loan does not overlap with any other forms of sponsorship/assistance;

- If a borrower undergoes a course/programme of study in a private higher education institution (IPTS), the course/programme has to be accredited by the Malaysian Qualifications Agency (MQA) during the loan duration;

- A borrower needs to present their repayment exemption application within 12 months after the convocation date; and

- PTPTN has expanded the Exemption Incentive for Loan Repayment to all graduating borrower categories starting from 2019, regardless of income limits.

How to apply for PTPTN loan repayment exemption

Borrowers need to submit their applications online through Portal PTPTN – First Class Degree Exemption at least 12 months after their respective convocation dates.

Required documents

| No. | Borrowers who have completed their studies before 1st of January 2019 | Borrowers who have completed their studies after 1st of January 2019 |

| 1 | A verified copy of First Class Bachelor’s Degree with Honours or equivalent (scroll). | A verified copy of First Class Bachelor’s Degree with Honours or equivalent (scroll). |

| 2 | A verified copy of academic transcript. | A verified copy of academic transcript. |

| 3 | A verified copy of MQA Accreditation Certificate (for IPTS borrowers). | A verified copy of MQA Accreditation Certificate (for IPTS borrowers). |

| 4 | First Class certification (if not already stated on the Degree). | First Class certification (if not already stated on the Degree). |

| 5 | Completion of study certificate (if not already stated on the Degree/transcript). | Completion of study certificate (if not already stated on the Degree/transcript). |

| 6 | – | Income statement at the time of applying for loan repayment exemption according to stated categories*.

|

Video: How To Apply PTPTN Discount Up To 15%

What Happened If You’re Not Paying Back Your PTPTN Loan

1. Affects your credit report

You can get blacklisted on CCRIS, and this will greatly affect the quality of your credit report. This will then make things difficult for future loan applications.

2. Blacklisted from leaving the country

Borrowers can get blacklisted by the Immigration Department if they miss payments or have unpaid outstanding payments.

As a result, you can be blocked from going overseas, unable to renew your passport or apply for a new one.

3. Have legal actions taken against you

PTPTN will issue two payment reminder notices and a claim notice if a borrower does not make repayments.

If these are left ignored or without any renegotiations, PTPTN will charge you in court.

PTPTN Loan Repayment Tips If Your PTPTN Outstanding Balance Are Too High

If you have too many commitments and too much of your monthly income goes to repaying debts, these are some of the measures you can take to ease your burden.

Debt consolidation

Debt consolidation is a method that conjoins all previously separate debts into a single new personal loan account, where the interest rate on the loan should be lower than the average of all the interest rates of the separate debts.

To simplify, you will use the money from the new personal loan to settle your existing debt. Debt consolidation can be done at any financial institution that offers the service.

Look for side income

There are increasingly more ways to earn side income, whether physical jobs or even online. If you are in need of extra funds to supplement your main source of income, some of the hustles that you can try are; ‘dropshipping’, food delivery, affiliates, online surveys, real estate agents, etc.

Build a special PTPTN fund

There are several easy ways to save money without taking too much away from your day-to-day spending. You can save your cash by colour, or you can also save gold instead of cash.

Summary

If you have the capacity to do so, please pay back your PTPTN student loan within time. It is a good loan that can massively aid an investment in yourself, i.e. obtaining higher education, and not paying it back can cause large repercussions. If you encounter any problem, do contact PTPTN to renegotiate your terms.

This article is written by Direct Lending – an online personal lending platform. Our smart eligibility checker will provide you with the best recommendations for bank and koperasi personal loans instantly. We can assist you to search, compare and apply for the lowest interest rate personal loan from 2.95% p.a. Receive funds as fast as 2 working days. As always, our service is 100% free, with no upfront payment or processing fees.

About the writer

Ehsan Marisah

Ehsan Marisah has been a branded content creator and business journalist since 2019 at Malaysia’s well-known television news channel. Originally from Kluang, Johor and graduated from University of Malaya. Known for his sharp eye for detail, multitasker, and ability to work in a fast pace environment.